Red Hill Update

Red Hill share price has done pretty well since I wrote about it (and since I bought shares myself and exited yesterday +53.9%). I think there is still upside to shares, but I exited as I was looking to free up cash for other positions in my portfolio I find even more attractive. Let's revisit and see where it stands today.

TLDR

All $ in AUD unless otherwise noted.

Base case

| what | value |

|---|---|

| cash | $23.8m |

| payment | $200m |

| taxes | ($60m) |

| 35Mpta royalty | $376m |

| total | $639.8m |

| per share | $9.85 |

| premium to current | 50% |

While the base case seems like a good deal it really depends on if/when that discount closes. If it takes it 5 years that's like an 8% a year return, which is just OK.

Optimistic case

Sell Pannawonica projects and MinRes doubles production at Onslow. Maybe they make a big gold discovery.

| what | value |

|---|---|

| base | $639.8m |

| base/share | $9.85 |

| 70Mpta royalty (35Mtpa incremental) | $376m |

| 70Mpta per share | $5.78 |

| $3/t for gate projects | $200m |

| Pannawonica (*gate projects) per share | $4.61 |

| gold discovery | ? |

Bear Case

It takes awhile to ramp Onslow towards 35Mpta. Instead of returning cash to shareholders they pay management G&A and expand exploration program. Exploration program is largely unsuccessful. Taxes eat 1/3 of royalty revenue. They never sell Pannawonica but spend money developing the projects. Iron ore commodity prices fall out.

Valuing the Royalty

July 1 they receive $200,000,000 payment. 0.75% FOB royalty begins.

https://redhillminerals.com.au/assets/documents/reports/2732606.pdf

They have 63.9 million shares on issue, 1.06 million options. Top 20 shareholders hold 87.56%. Currently trading at $6.55 a share. Market cap $418,545,000 and fully diluted market cap (including options) $425,488,000.

Cash balance as of March 31, 2024 was $23.89m

https://redhillminerals.com.au/assets/documents/reports/2713795.pdf

Let's assume 30% tax rate on the $200,000,000, so net $140,000,000.

Enterprise value of $425,488,000 - $140,000,000 - $23,890,000 = $261,598,000

Let's revisit the value of the royalty from our previous article

Stage 1 targets 35Mpta and Red Hill has a 0.75% royalty. Mineral Resources of 820Mt and 537Mt in Ore Reserves, so that production level lasts quite awhile. That is 262,500 tons per year royalty. At USD$100/t (probably lower given low grade direct ship 5x% ore is below 62% reference price) that is USD$26m (AUD$38.4m) per year royalty.

... 23 years or so. If you do an NPV8 on that it works out to another AUD$376m.

So it's trading around 0.69x NPV on the royalty base case. With a long mine life and a large tenement such that they could add nearby tons MinRes could add a phase 2 and double production to 70Mtpa. That would lower the multiple to 0.345

If you belive that napkin math it is trading at a reasonable discount to the value of the royalty on stage 1 production and there is considerable upside if MinRes decided to expand production beyond 35Mpta.

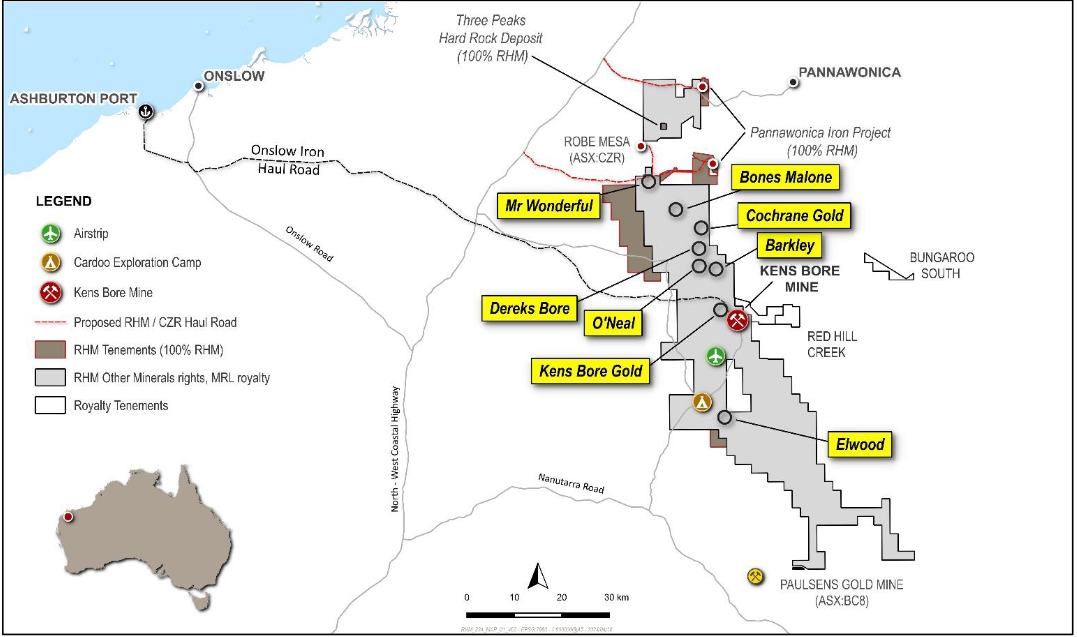

Gold

Red Hill continues to spend on the order of $2-4 million per year on exploration. They retained all the non-iron rights on the MinRes tenements and some 100% owned projects. They've got a good target pipeline. Hard to put a value on this now but the spending is resaonbly small and the upside potential is there for a postive return on that spend.

Pannawonica Haul Roads

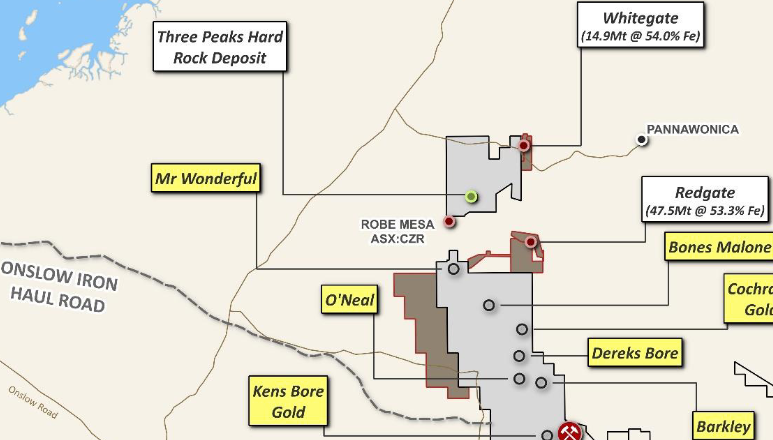

Whitegate has 14.9Mt @54% Fe, Redgate has 47.5Mt @53.3% Fe, both are 100% owned. Combined that is about 62.4Mt. Together they are referred to as the Pannawonica project, named after the closest town.

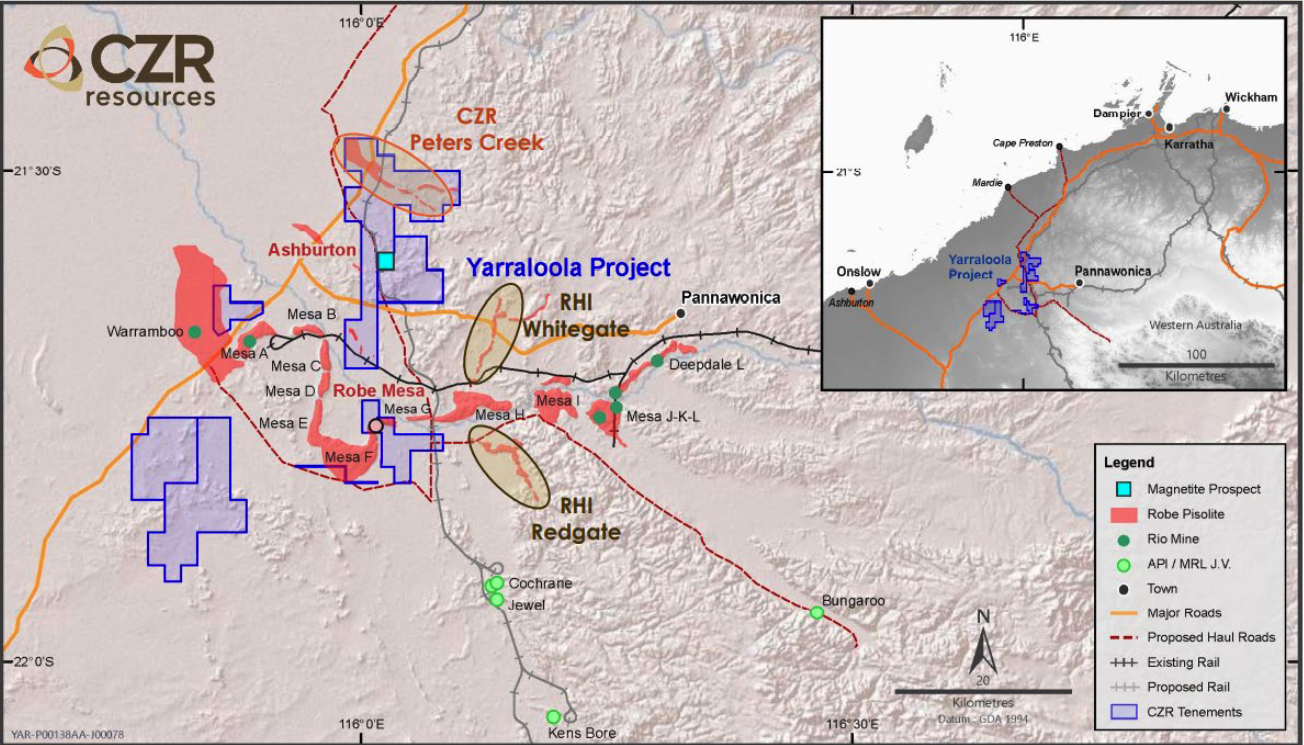

Pannawonica (Redgate & Whitegate) is being developed in coordination with CZR, it's basically at the stage of negotiating haul road link up routes. As of April the proposed haul roads would basically go west to the North West Coastal Highway.

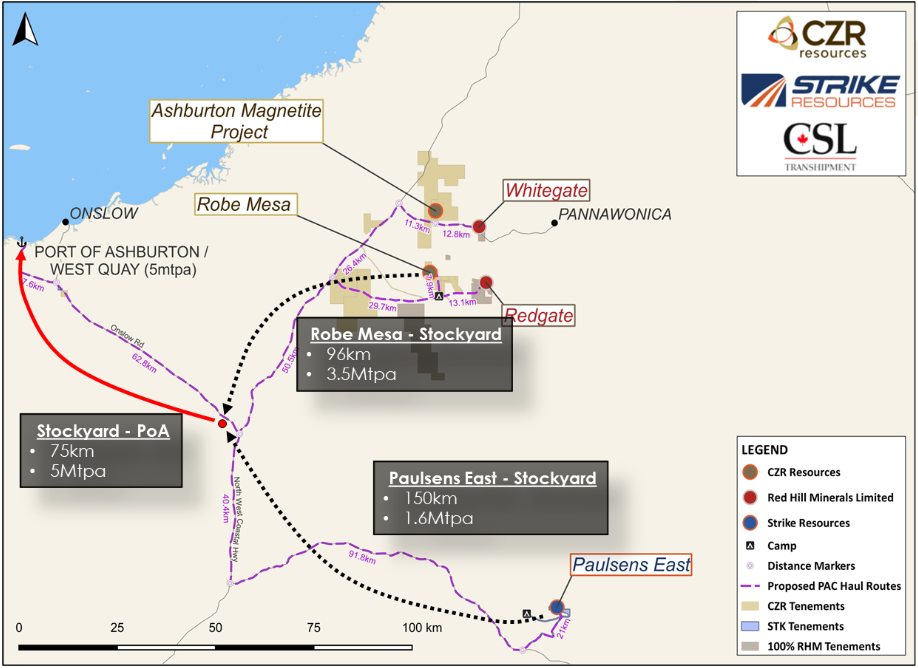

This is a pretty big change from the August 2022 map of proposed haul routes (likely already out of date then) that would have gone all the way up to Mardie and Cape Preston to the north. The DFS has them exporting through the Ashburton Port where they have a 50% shareholding in the port of Ashburton Cornsorium (PAC) and 67% of the export quota.

It's worth noting that CZR is waiting on FIRB approval to sell it's 85% stake in Robe Mesa project (33.4Mt @55.0% Fe) and assocaited 50% stake in the port consortium to Miracle Iron resrouces for $102,000,000 (about $3.05/t). Miracle Iron already closed on purchasing Paulesens East (9.62Mt @61.1% Fe) from Strike resources for $20,500,000 (about $2.13/t) with it's 25% ownership of the port consortium.

If we assume Paulsens East and Robe Mesa had some value in their port ownership and reduce their $2.13/t and $3.05/t to $2.00-$3.00/t then the 66.4Mt at Redgate and Whitegate might be worth $124,800,000-$199,200,000. The potential to share about 75km of the Onslow haul road mike add some value there. It's also likely that Paulsens east was discounted because it was farther from port (225km) while Robe Mesa was a shorter (171km) with the chance to possibly reduce further.

CZR's DFS presentation in October 2023 basically showed hault roads going out to the existing NorthWest Coastal Highway and Onslow Rd.

In the meantime MinRes has sold a 49% stake in the Onslow Iron Ore haul road to Morgan Stanley. That signals third parties will likely be able to use that haul road for a toll, use of that road would significantly shorten the haul distance to port for CZR's Robe Mesa and Red Hill's Whitegate and Redgate.

If you add up the distances without the Onslow haul road Whitegate would use the existing 24.1km of road to the highway (may need upgrading but seems already paved) and total distance to port would have been 171.4km. Redgate would have constructed a haul road of 42.8km, 29.7km of which would be shared with CZR's Robe Mesa and distance to port would have been 163.7km. I haven't see any proper studies but I estimate that accessing the Onslow Haul road would reduce that by 30km or so and avoid road trains on Onslow Rd.

Interesting to note MinRes will be running Kenworth C509 prime movers fitted with Hexagon autonomous driving. Each truck should be able to haul 300 tons of iron ore (3 trailers of 100 tons each) and eventualy be run without a driver. Others who use some portion of public roads would likely still need drivers for that portion, but could save quite a bit on labor costs. The negotiated toll to MinRes is $8.04/t (approx USD$5.31/t) for the full 150km route. It's possible that those using only the half of the toll road from the highway to port could negotiate a proportionately reduced rate.