Project Generators

This page compiles from previous blog articles on this well supported investment strategy, but those blog articles cover more depth than this page.

Project Generators Over Pure Explorers

Less Dilution

Pure explorers raise the vast majority of their funds by issuing stock that dilutes existing equity holders. Project generators often get cash from earn-in payments and management fees that can help cover their G&A and early stage exploration costs. So while they might from time to time also issue stock they are likely to do it less often. They also typically avoid the biggest exploration expense of drilling by having their partners directly fund drilling programs.

Benefit Weighted Spend

This is the single most important metric to evaluate the health of a pre-discovery project generator. It's a simple zero sum of who is spending the money on exploration and who is benefiting from that spending.

Benefit Weighted Spend from Exploration for $5m spend in a 70/30 Earn In

| Project Generator | OptionCo | |

|---|---|---|

| benefit | +$1,500,000 | +$3,500,000 |

| spend | $0 | -$5,000,000 |

| benefit weighted spend | +$1,500,000 | -$1,500,000 |

Many project generators will disclose partner spend, but without knowing how much the project generator contributed to the project spend or the split of benefit.

Royalty Is King

Many project generators will retain a royalty on their projects. This is incredibly important at the early stages are there is lots of spending and dilution that royalty avoids. There's also lots of chance of failure.

If we take the net profit margins for the top 40 miners over the 19 year period from 2002-2020 (because that's the data I found) you get an average profit margin of 13.1%. So in my view on average a 100% equity stake is equal to a 13.1% NSR.

Successful Mine Profit Equivalent = NSR / Mine Net Profit Margin

| NSR% | % of Profit |

|---|---|

| 0.5% | 3.8% |

| 1% | 7.6% |

| 2% | 15.2% |

| 2.5% | 19% |

| 3.93% | 30% |

| 4% | 30.5% |

But that's for an operating mine. For early stage royalties it's more like:

Diluted Mine Cashflow Equivalent = (NSR / Mine Net Profit Margin) / ((1 - chance of bankruptcy) * (1 - cashflow delay discount) * (1 - exploration dilution) * (1 - development dilution) * (1 - construction dilution) )

Plugging some default values gives a more typical value split.

| NSR | Equity Equivalent at Option Exercise |

|---|---|

| 0.5% | 20% |

| 1% | 40% |

| 2% | 80% |

| 2.5% | 100% |

| 4% | 160% |

The problem with the typical 70/30 or 75/25 JV earn in is that after the earn in the project generator has to start contributing their share of cash. Even carried JV partners have their share of spending taken out (with interest) from their eventual share of the profits.

Better Balance Sheets

One of the first things I like to do when evaluating a project generator is to make a spreadsheet with all their cash, shares of publicly traded companies, & shares of privately traded companies. I then add it up and compare it to their market cap. I consider this what I am really paying for their business and harder to value assets like JV stakes, projects, royalties, etc.

Debt - Pure prospect generators shouldn't carry debt. If a pure prospect generator has more debt than cash I would just stop and move on.

Cash - I'm old fashioned and lazy, a dollar is worth a dollar.

Stock - I'll just use the current publicly traded price of that stock. This isn't without it's downsides as it's not always possible to sell these illiquid positions and the stock price at this end of the market is very volatile. But unless the stock is worth a huge portion of the prospect generator's value the public market price is good enough. You may have to look at financial statements, press releases, and their website to figure out all or most of the positions. Google sheets will give you near real time market prices for publicly traded shares, even on the TSX-V.

Private Shares - I default to valuing private company stock at the per share value of the last funding round. However, since funding rounds in private companies are few and far between the value of the company may have dramatically changed since the last round. So you may want to make manual adjustments here.

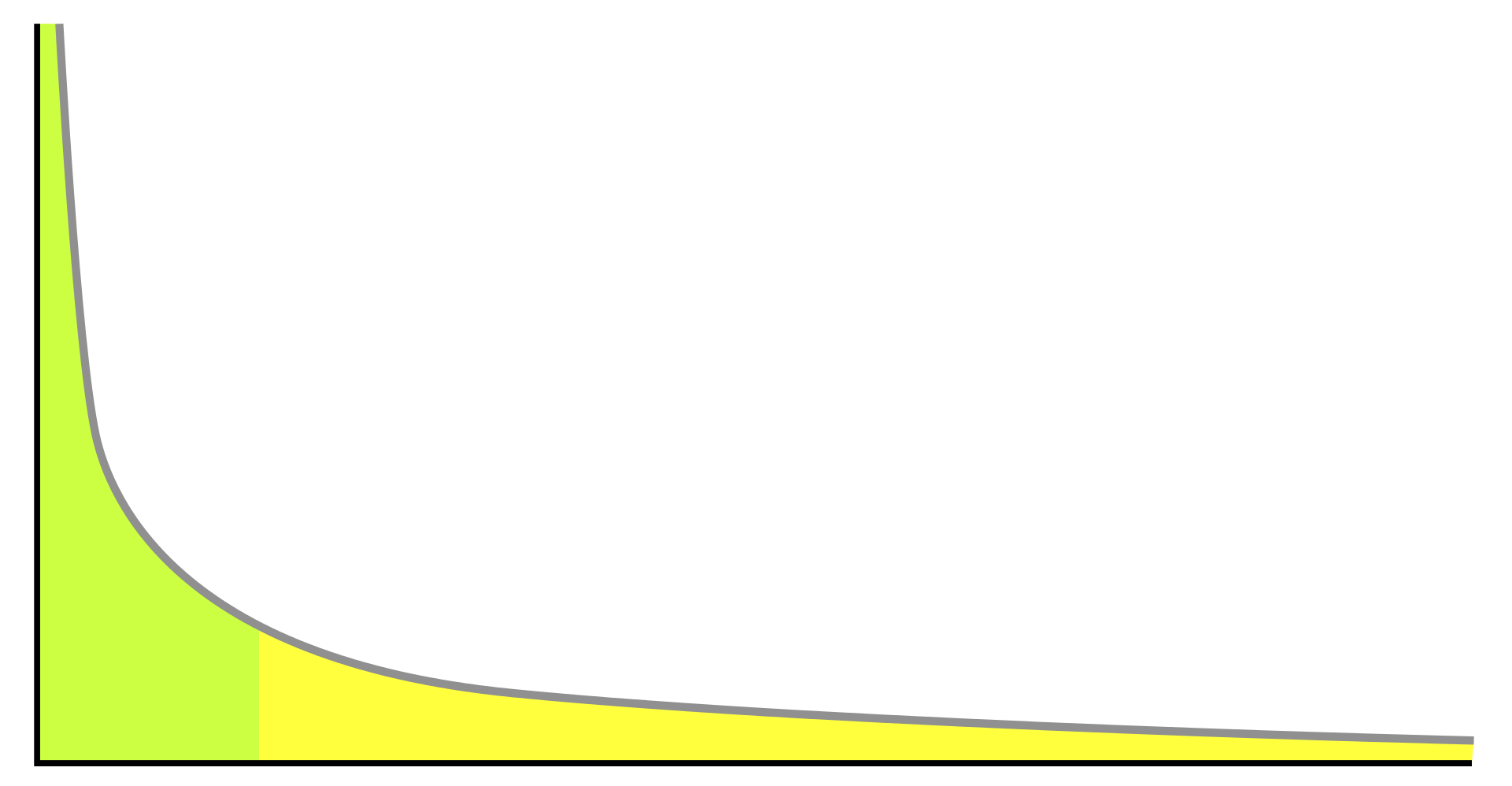

Power Laws

Mining exploration is not a Gauassian or normal distribution. It is a power law distribution. This means two things:

- All of your returns will come down to a very small number of wins and a huge number of losers

- To get those huge wins you are going to have a lot of losers

Post discovery you only need to look at a project generator's top assets, probably 5 or less, to figure out what their top 1 or 2 assets are. That will be where the value is.

Pre-discovery you want to look at are they effectively screening a large number of projects to generate a large enough number of losers necessary to find the big winners.

If they don't have a lot of value in their top 1 or 2 post-discovery assets and they aren't screening a large number of pre-discovery assets then they are a lifestyle company. Don't invest.

Copper

In 2021 there was 21,000 ktons of copper mined. 9,344 ktons, about 45% of the total, came from just 20 mines. 6,604 ktons, about 29% came from the top 10 mines. Over 7% came from a single mine (Escondida).

Gold

In Kenorland's Discussing Exploration Risk Video we see that for Canadian gold deposits there is roughly half as many for each doubling in size, at least for the three largest sizes looked at (10Moz, 5Moz, 2Moz). What I have informally observed is that the value per ounce of a deposit also increases as the deposit size increases. I believe these combine for an exponential increase in the value of larger deposits compared to smaller ones.

Others Talk About Project Generators

Rick Rule transcript starting at 2:22 in the following video:

I have done this with some very certain success over the last thirty years. I have been involved by my count in something like 55 prospect generators. I have participated in 22 economic discoveries and been the beneficiary of 15 takeovers. If you think about the concept of 15 major wins in 55 starts and compare that statistically with any other type of means of discriminating between exploration investments the payoff from prospect generator joint venture business model portfolio over any other kind is unassailably better.

Kenorland Minerals did a research study on exploration in Canada and what constitutes a discovery. It's just amazing and set the bar for what I consider good drill results.

Francis then Outdid himself and did a great talk on exploration risk and project generation.