A Hole in the Ground with a Liar at the Top

If you can't grow it you have to mine it. Electric cars, windmills, solar panels, computers, roads, bridges. Most of modern life relies on mining. There are hard working honest professionals building real companies that generate wealth. There are also charlatans that destroy wealth and try to dishonorably take the wealth of others for themselves. Part of the job of investors is to tell the two apart and put capital with people trying to improve the world and not just steal from it.

A gold mine is a hole in the ground with a liar standing on top of it.

The quote above is often attributed to Mark Twain. The true origin seems even more accurate in the brutality of the statement.

A mine is a hole in the ground. The discoverer of it is a natural liar. The hole in the ground and the liar combine and issue shares and trap fools.

—Detroit Free Press 1881

This morning I sat down fully clothed in my office in my house that is titled in my name and has no mortgage. It seems odd to start my day with a denial that I am sitting in my underwear in my mother's basement. I don't mind being on the receiving end of ad-hominem attacks, probably means some of the ideas I'm saying are on point. I read this article and was struck by the audacity of it.

Following is my response to this article and the author.

Anthony Milewski

I've never met Anthony, the author of that article. But I've seen this pattern before. I thought I'd share some of his history for the un-initiated. You can then decide for yourself who is the victim and who is the perpetrator.

DARVO

Deny, Attack, Reverse Victim and Offender.

From the Wikipedia article

... I have observed that actual abusers threaten, bully and make a nightmare for anyone who holds them accountable or asks them to change their abusive behavior. This attack, intended to chill and terrify, typically includes threats of law suits, overt and covert attacks on the whistle-blower's credibility, and so on. The attack will often take the form of focusing on ridiculing the person who attempts to hold the offender accountable.[...] [T]he offender rapidly creates the impression that the abuser is the wronged one, while the victim or concerned observer is the offender. Figure and ground are completely reversed.[...] The offender is on the offense and the person attempting to hold the offender accountable is put on the defense.

While Peter Clausi and Chris Parry were publicly writing about Giga Metals insider dumping of shares (more on that below) Anthony Milewski was implying he could sue anonymous Twitter accounts.

Screenshotted because my account is blocked.

The reply to the implied threat is classic, and echos my basic sentiment.

If you're coming, you better come strong, Anthony.https://t.co/np5M5BDXsx

— 🆒 Chris Parry (@ChrisParry) September 20, 2020

Giga Metals

Start off by just reading Chris Parry's article.

Do read the whole thing, but here's an excerpt of some of the undisputed facts without speculation.

Milewski’s timing was impeccable. Desai’s story was posted on September 11 and it took the GIGA market cap from $38 million to over $150 million.

The day after the story, with the stock hitting $2.40 early, Milewski dropped the hammer and dumped 3 million shares at an average of $1.86, for $5.57 million, with the stock going as low as $1.40 during his sell-off.

Two days later he sold another 450,000 shares for an average of $1.61, bringing him another $724,000.

Wikipedia has a nice definition of Pump and Dump. You can decide for yourself if that term applies to what happened with Giga Metals.

Pump and dump (P&D) is a form of securities fraud that involves artificially inflating the price of an owned stock through false and misleading positive statements (pump), in order to sell the cheaply purchased stock at a higher price (dump). Once the operators of the scheme "dump" (sell) their overvalued shares, the price falls and investors lose their money. This is most common with small-cap cryptocurrencies[1] and very small corporations/companies, i.e. "microcaps".

Here's some more on the topic

and the CEO of Giga Metals interview is pretty damning as well (starting at 32:32)

Nickel 28

Fired "for cause" and "serious misconduct"

https://www.bloomberg.com/news/articles/2024-05-06/nickel-28-fires-founders-on-serious-misconduct-that-they-deny

Anthony had to return shares for nil consideration as part of the settlement. He was willing to give up all the shares and compensation for a release of claims.

https://www.nickel28.com/investors/news-releases/nickel-28-announces-settlement-with-former-chief-executive-officer

Nickel 28 and the Milewski Parties have entered into the Settlement which includes a full and final mutual release of any claims between the parties, as well as a customary two-year standstill by the Milewski Parties. Pursuant to the Settlement, the Milewski Parties will return to the Company 4,965,222 common shares of Nickel 28 for nil consideration; no compensation or other amounts will be paid by the Company to the Milewski Parties.

Board didn't mince words while firing

Toronto, Ontario--(Newsfile Corp. - May 6, 2024) - Nickel 28 Capital Corp. (TSXV: NKL) (FSE: 3JC0) ("Nickel 28" or the "Company") today announced that Mr. Anthony Milewski, former Chief Executive Officer of the Company, Mr. Justin Cochrane, former President of the Company, and Mr. Conor Kearns, former Chief Financial Officer of the Company, have been terminated for cause with immediate effect after the Company found evidence of serious misconduct, breach of duties and obligations, repeated lack of judgment, care and diligence and non-compliance with various of Nickel 28's policies and procedures. None of the Company's findings have been proven in court.

Messrs. Milewski, Cochrane and Kearns' employment and/or consulting arrangements with the Company have been terminated for cause with immediate effect following the close of business on May 3, 2024 after the Company's board of directors (the "Board") received and considered the findings and recommendations made by an independent special committee of the Board (the "Special Committee"). The Special Committee was formed in early December 2023 to conduct an independent investigation, in consultation with independent legal counsel and professional advisors, into, among other things, historical compensation arrangements, including grants made under the Company's Omnibus Long-Term Incentive Plan, compliance with the Company's various internal policies and procedures (including its Insider Trading Policy, Expense Policy and Code of Business Conduct and Ethics), as well as a review of policies and practices relating to actual or potential conflicts of interest and related party and similar transactions involving the Company's insiders and key employees. Following its review, the Special Committee reported its findings to the Board and unanimously recommended to the Board, and the Board approved, the termination for cause of each of Messrs. Milewski, Cochrane and Kearns. The Special Committee members have asked Mr. Milewski to resign from the Board. The Company has reserved all of its rights against the aforementioned individuals and intends to take such steps or initiate such proceedings as may be available and appropriate to recover from the terminated individuals the losses it alleges the Company has suffered, and may continue to suffer, and recover the gains the Company alleges they may have benefited from, due to the serious misconduct found by the Special Committee. The Special Committee's findings are currently not expected to materially change or impact the Company's prior financial statements and associated reportings.

Pelham also went hard with this, adding a lot more detail.

https://cdn-ceo-ca.s3.amazonaws.com/1i6s19j-NKL%20Pelham%20News%2024.5.23.pdf

Cobalt 27

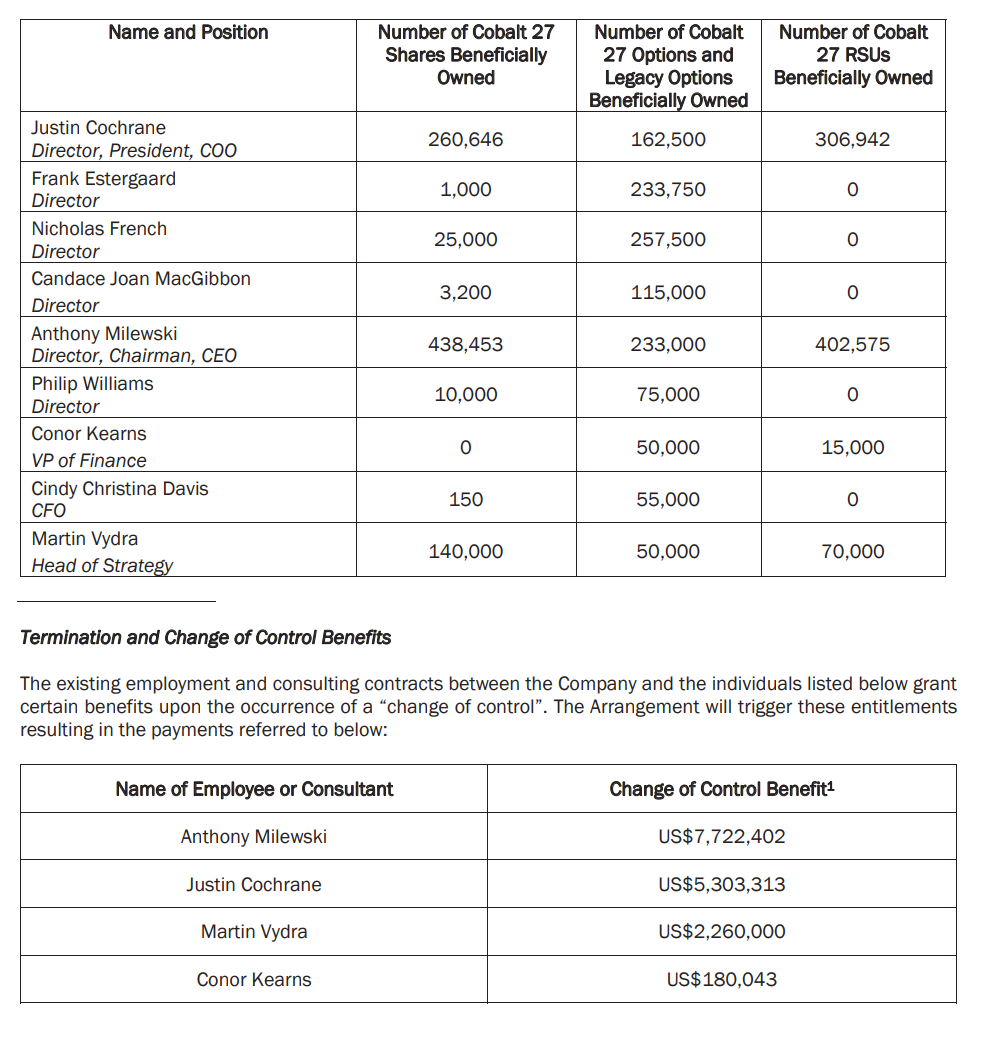

One red flag to look out for in junior mining is large change of control bonuses combined with trying to make deals that would trigger change of control and where those deals are bad for minority shareholders. We saw that in Cobalt 27.

The financial post wrote a pretty constrained article.

Anson Funds was an investor in Cobalt 27, where Anthony Mikewski was CEO. They issued a couple press releases opposing the deal. Here's one.

Anson believes that the only beneficiaries of the Transaction are: (i) Pala, who is acquiring a high-quality royalty stream with significant upside for a distressed price, (ii) management, who benefit from change of control payments and who will continue to manage Nickel 28, and (iii) the financial advisors who continue to earn unnecessary transaction fees in respect of the Transaction. As a result, and for reasons set out below, Anson believes that minority shareholders will see this Transaction for what it is – a fire sale of the Company without the payment of control premium – and vote against the Transaction and the Company will fail to obtain the “Majority of Minority” shareholder approval required under the Transaction. Pala and management are simply seeking to accrue benefits to themselves at the expense of the Company’s minority shareholders.

What was the change of control benefit to Anthony Milewski? US$7,722,402.00

Summary

At this point if you invest here you are the frog.

A scorpion wants to cross a river but cannot swim, so it asks a frog to carry it across. The frog hesitates, afraid that the scorpion might sting it, but the scorpion promises not to, pointing out that it would drown if it killed the frog in the middle of the river. The frog considers this argument sensible and agrees to transport the scorpion. Midway across the river, the scorpion stings the frog anyway, dooming them both. The dying frog asks the scorpion why it stung despite knowing the consequence, to which the scorpion replies: "I am sorry, but I couldn't help myself. It's my character."

There are a lot of other questionable things with Anthony at a lot of other companies that I am not writing about here because they would either compromise the source of the information or are still at the level of rumor that is probably just mostly true.