Vicuña 2.0 Royalty

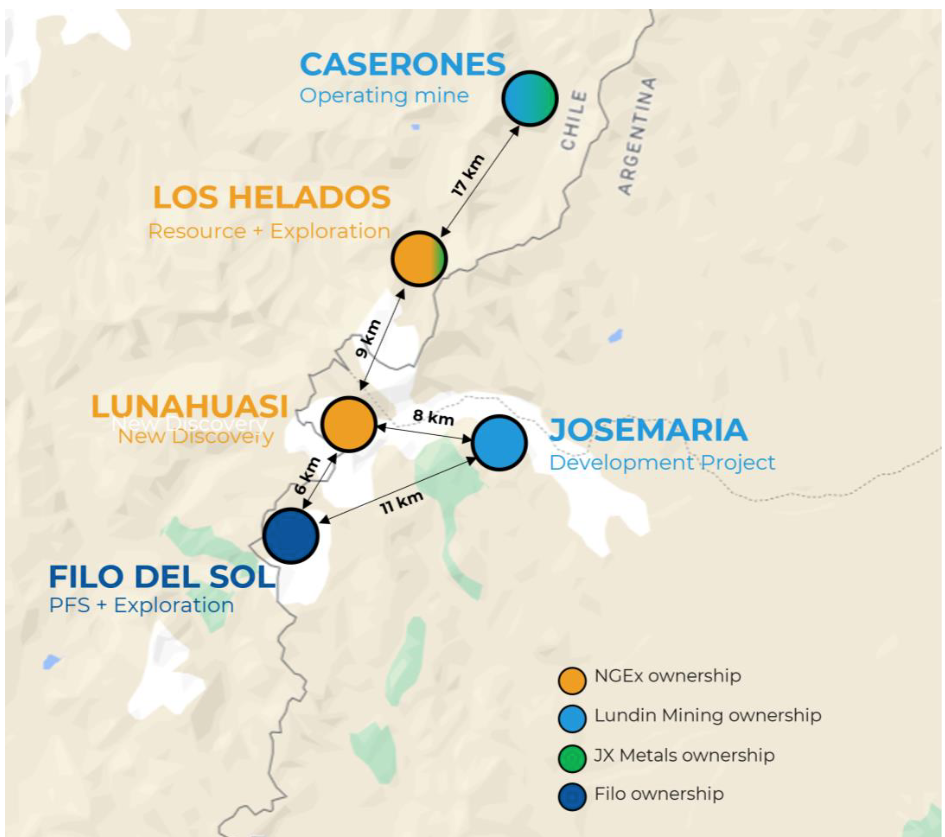

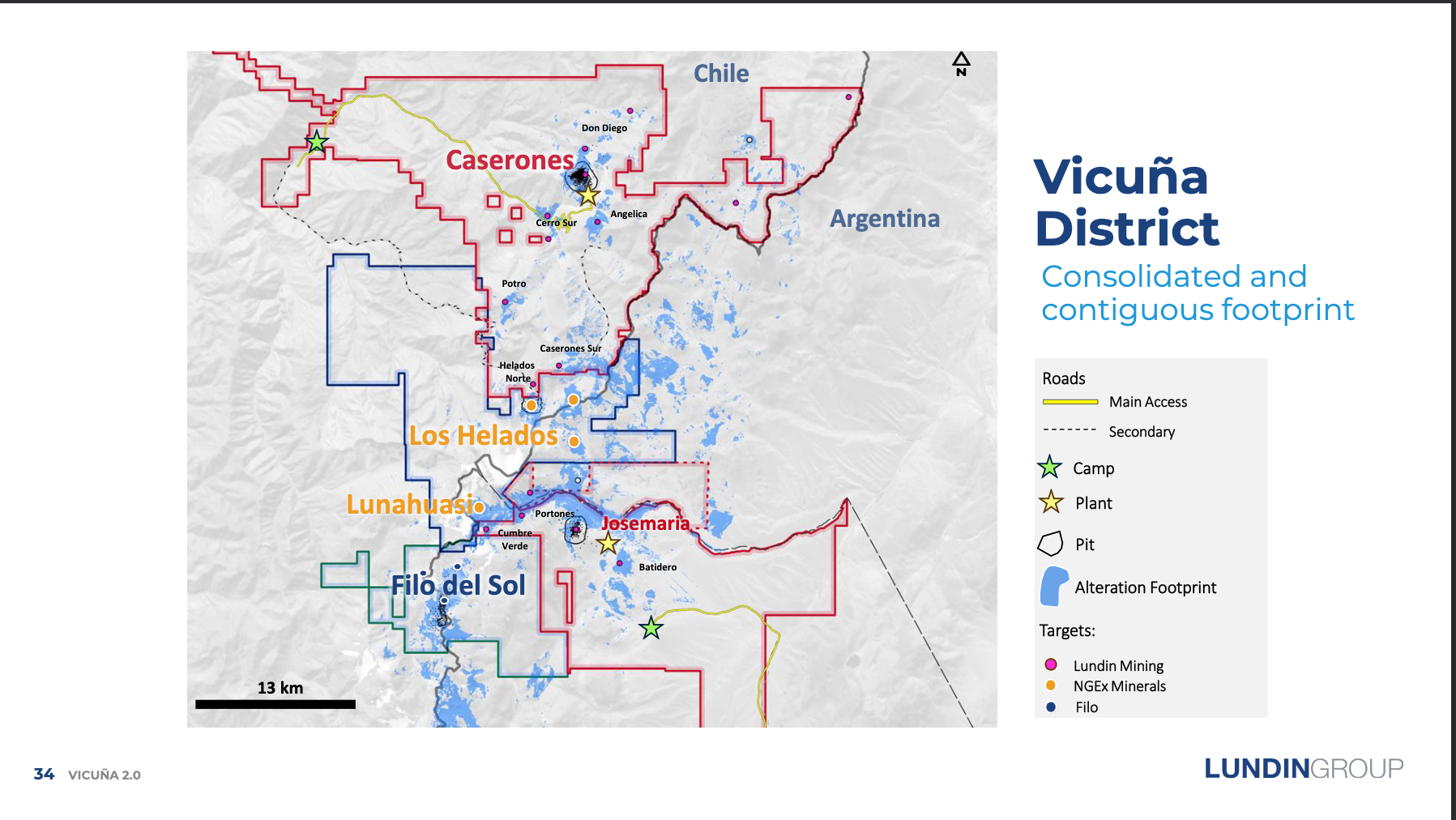

Vicuña 2.0 is a theme that much of mintwit is invested in, myself included. The Lundin group is developing the region through several publicly traded vehicles like Lunding Mining, Filo, and NGEX.

Today I want to talk about the impact to the royalty companies: Elemental Altus, Sandstorm (by way of the Nomad acquistion), EMX, Franco Nevada, and Nova (soon to be Metalla).

Caserones

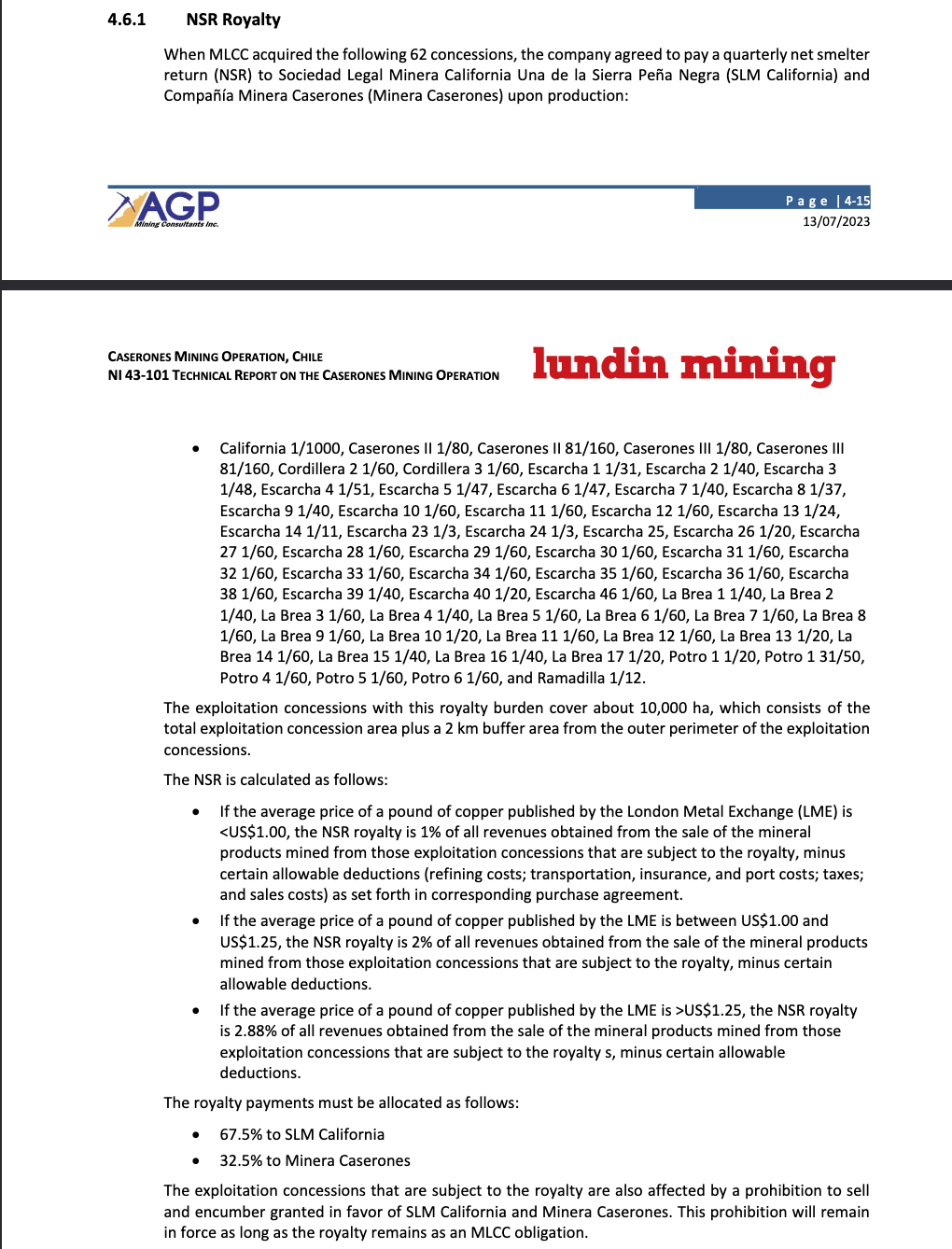

Given inflation we would hope copper never goes below US$1.25/lb again, so let's consider this a 2.88% NSR royalty. The royalty companies have bought shares in SLM and Compania Minera Caserones (CMC).

0.63% Sandstorm (by way of Nomad acquision of CMC shares)

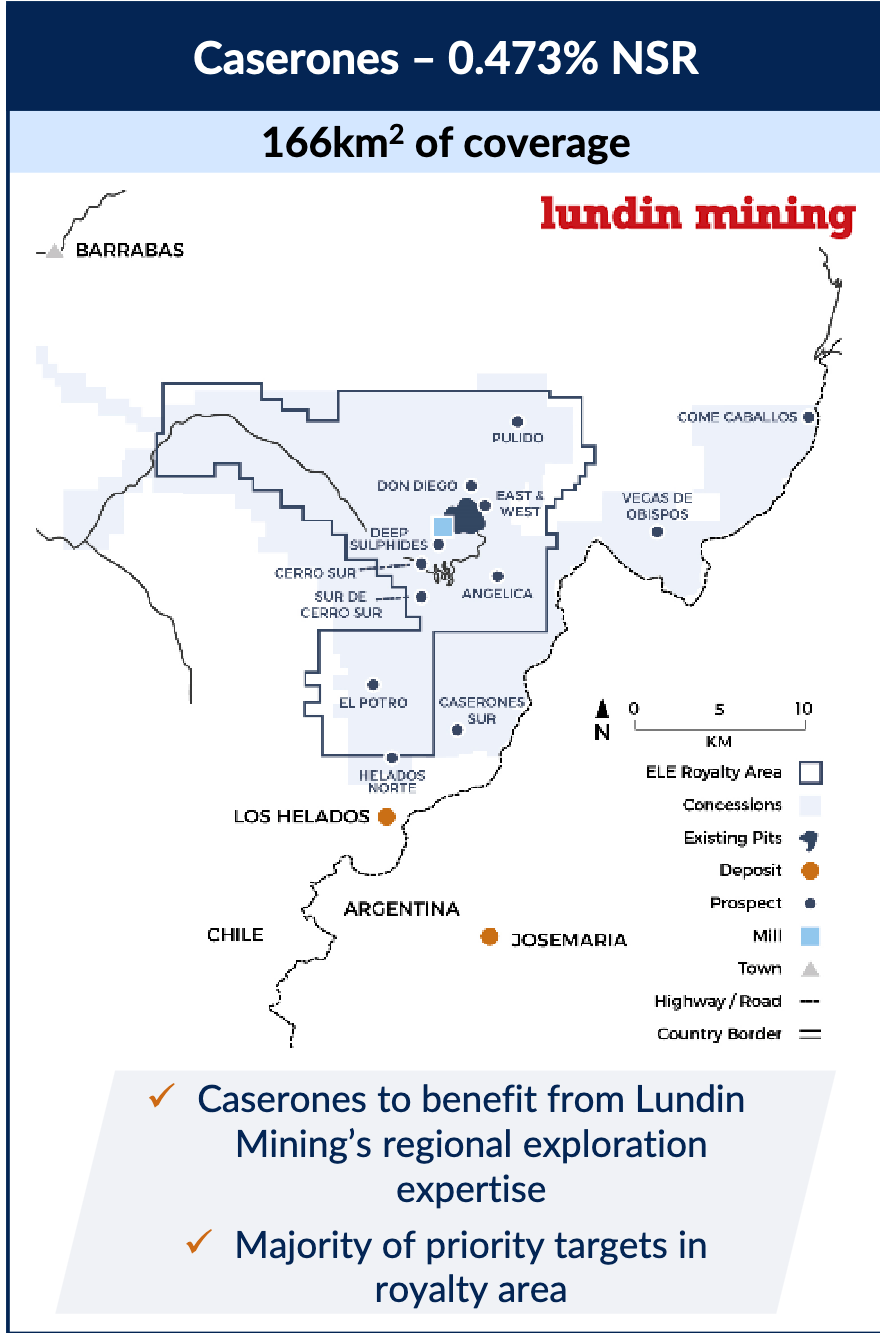

0.473% Elemental (by way of SLM shares)

0.7775% EMX (by way of SLM shares)

0.57% Franco Nevada (split between SLM and CMC shares unclear)

----

2.4505% between the 4 companies

0.4295% unaccounted for (other shareholders of SLM and CMC)

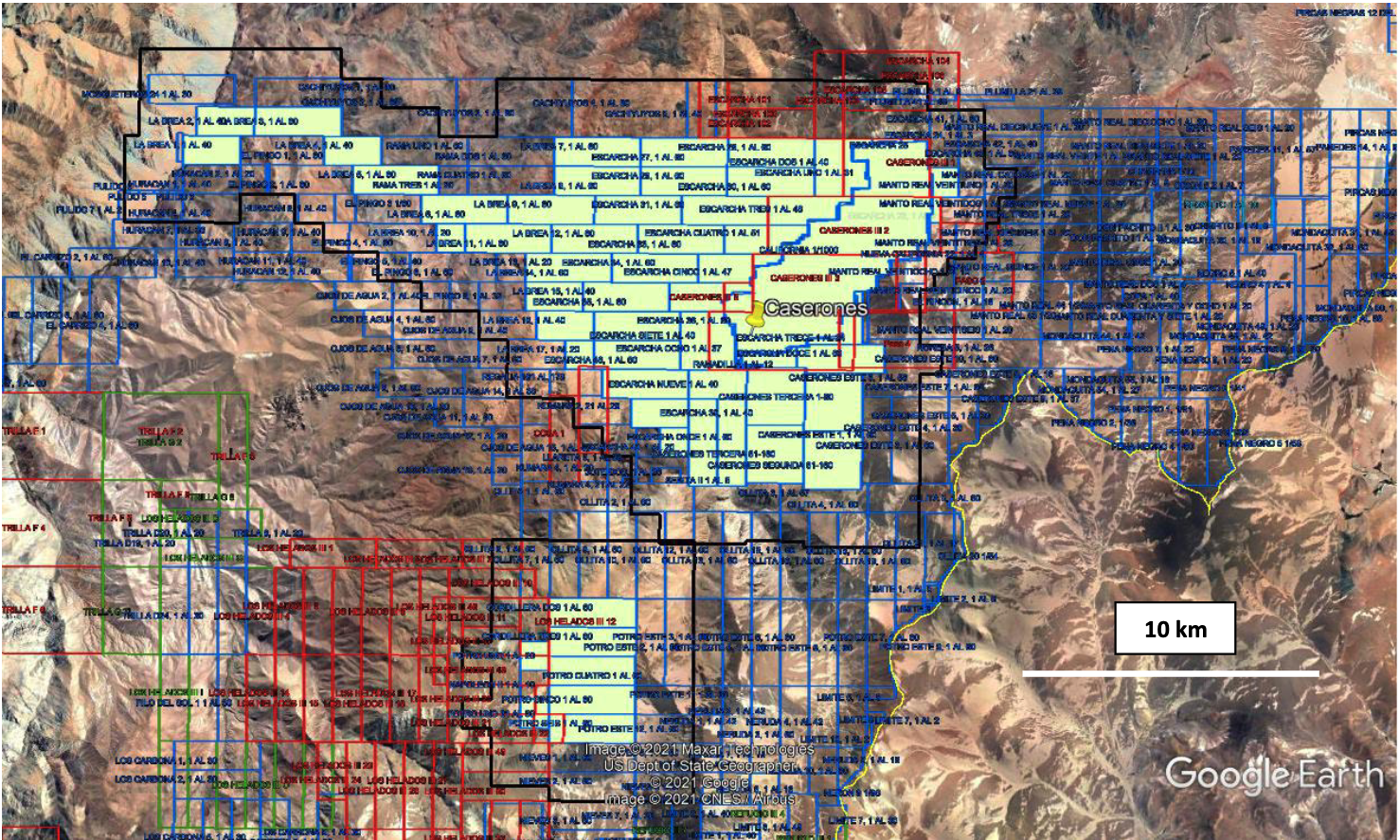

Royalty area is the black lines showing a 2km interest around the yellow original claims.

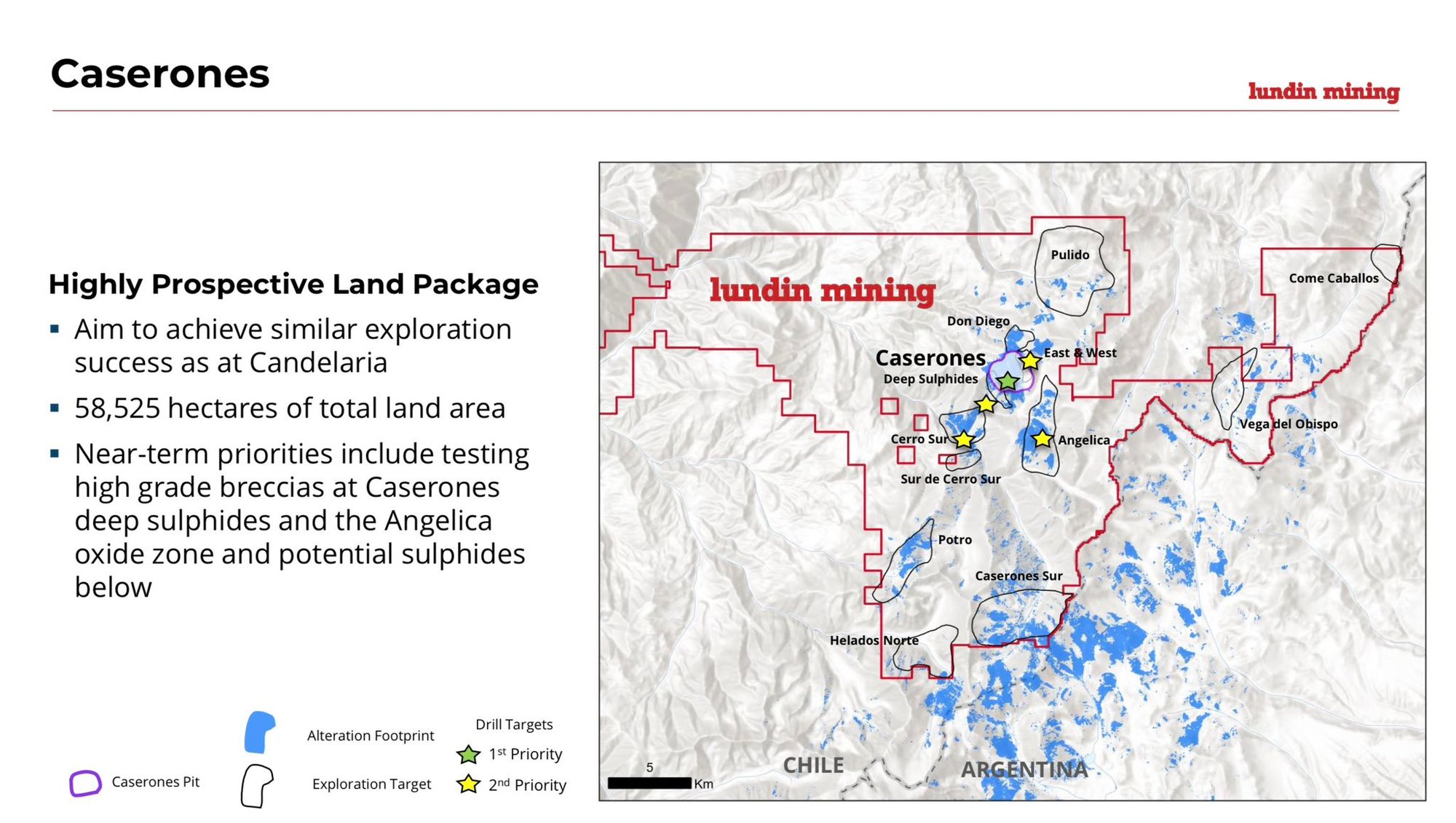

All the 1st and 2nd priority drill targets (Deep Sulfides, Cerro Sur, Angelica, and East & West) are within the royalty area. As are exploration targets Potro, Sur de Cerro Sur, Don Diego, & Pulido. So there's a lot of exploration upside happening that will benefit the royalty companies.

Helados Norte exploration target seems right on the edge of the royalty area.

The Alicanto northern extension on the Caserones property is likely south of the royalty area. Caserones Sur, Vega Del Osbisbo, and Come Caballos are outside the royalty area.

Josemaria

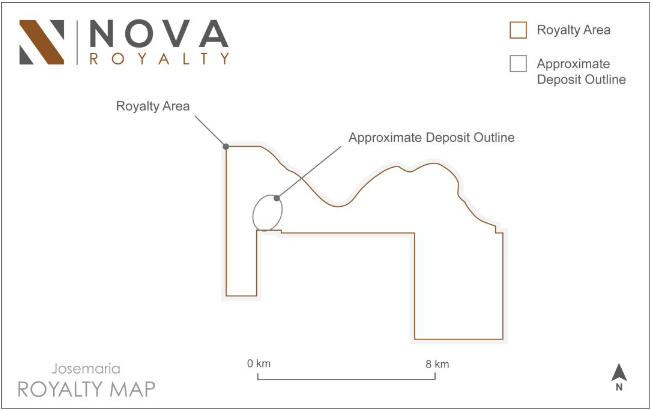

Nova has a very strange 0.08325% Net PROFIT Interest (NPI) on a good chunk of Josemaria, and at least some of NGEX exploration area. They also have the right of first refusal over an additional 0.08325% NPI. The profit interest is only for a 10 year period from years 3-13 of production. Because the percentage is so low, and it's a percentage of profits not revenue, and it's limited to 10 years it seems like a missed opportunity.

The original royalty Nova bought a sliver of is referred to as the Lirio DPMA Royalty in the 43-101 docs.

My consipiracy theory is that this acqusition was done for marketing purposes to say they hve a royalty on a very large well recognized project.

The Lirio agreement this is based off of covers the Cateo, Rio Blanco 1, Josemaria 1, Josemaria 2, & Josemaria 3 concessions.

0.08325% NPI is roughly equivalent to a 0.0052% NSR. It's not a lot.

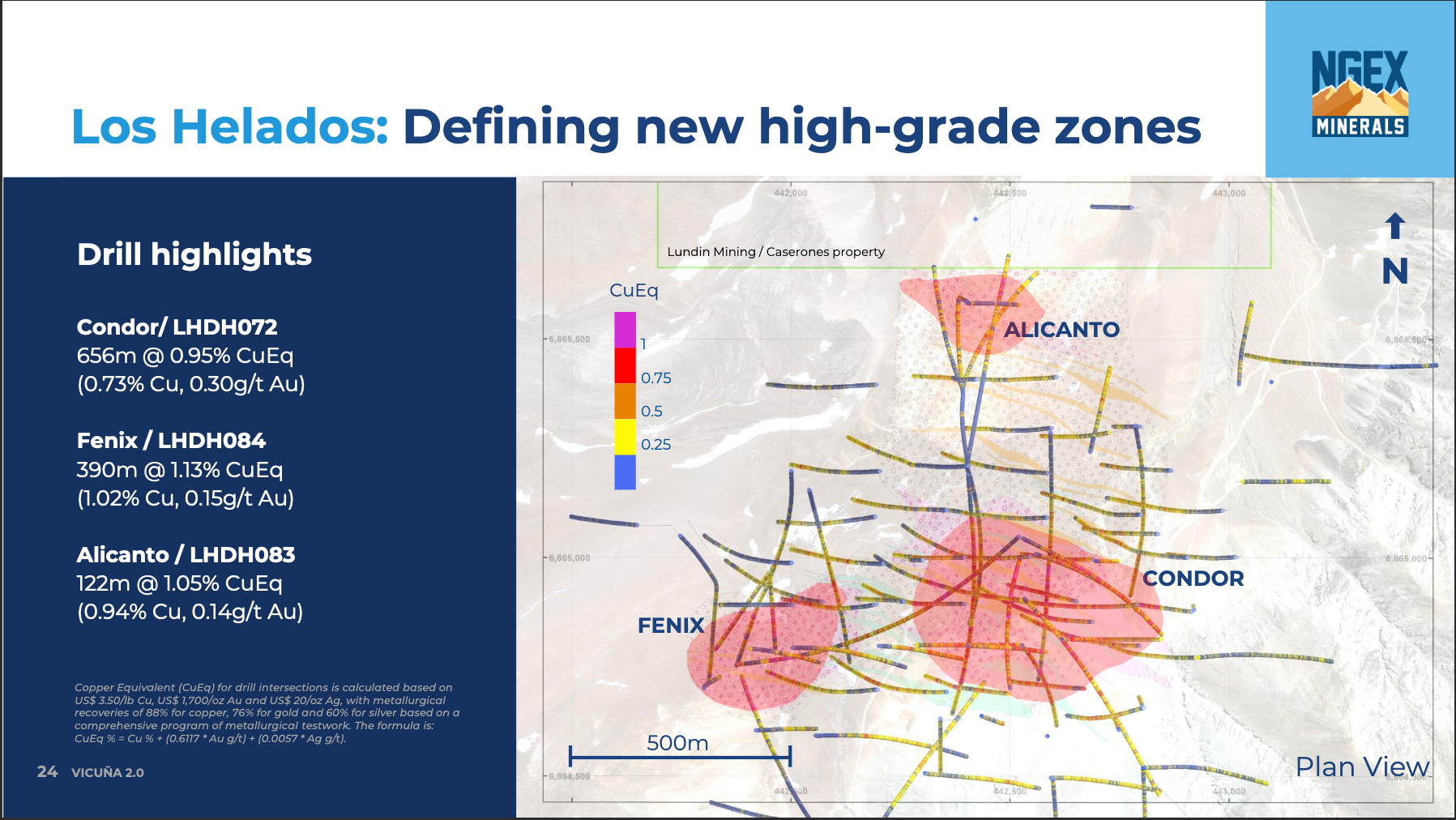

NGEX

Los Helados has a 0.6% Net Profits Interest (NPI) with the local community.

Nacimientos I, Potro I, Potro II, and Potro III are subject to the Lirio DPMA royalty of 0.6% NPI for years 3-13 of production. Though it is likely that Josemaria will go into production first ahead of Lunahuasi and cover the initial several years of payments. El Potro was the previous name of the Lunahuasi discovery.

Filo

There's a private 1.5% NSR royalty, but it's not clear who owns it. Compañía

Minera Tamberías SCM got the royalty as part of the option to Filo's child company.

Investment Discussion

Franco Nevada

Franco is the GOAT but at a market cap of US$23b this royalty isn't that material for them compared to say their Cobre Panama royalty. So invest in them if you like and take this as another example of their portfolio having upside.

Nova/Metalla

This is a good example of how not to structure a royalty, though it was the property owner and not Nova that did the structure. Ideal royalties are in perpatuity and are a percentage of revenue not profits. I'll leave evaluation of the rest of the company as an exercise to the reader.

EMX

With a market cap of US$189m this is VERY material. Back in February 2022 I did some quick napkin math that looked like:

0.418% NSR. In November 2020 JX Nippon announced plans for "stepping up exploration efforts in areas around the mine". It's a big copper/moly porphyry mine originally with resources through 2040. Current payable production should average 148k tons of Copper Equivalent. With copper at $9,678/ton we end up with:

148,000 tons peryear * $9,678 per ton * 0.00418 * 18 years = $107m

There's obviously no discounting, but that same kind of calculation with the additional royalty acquired since:

148,000 tons peryear * $9,678 per ton *0.007775 * 18 years = $200m

If you gave that an 8% discount rate $200m * 0.92^9 = $94m

Now obvsiouly you'd want to discount that with an actual DCF model. But that also doesn't assume any upside from increased production rates or increased life of mine from exploration. It also ignores all their other assets like Timok (which has a renegotiated lower royalty rate since I wrote about it), Balya North, Gediktepe, etc.

I think EMX is very interesting here.

Elemental

Market cap CAD$225m or around US$163m.

Do the same math as EMX...

148,000 tons peryear * $9,678 per ton *0.00473 * 18 years = $121m

$121m * 0.92^9 = $57m at at 8% discount rate.

So call it 1/3 of the market cap with a lot of exploration and expansion upside.

I think Elemental is very interesting here. I put a rough value of around $98m on the Karlwinda and Wahgnion royalties together, so the top 3 royalties of Karlawinda, Caserones, & Wahgnion probably justify their current market cap on their own with the rest of the portfolio giving some upside.

Full Disclosure

I own shares in $ELE.V, $EMX, and $NGEX.V. I have owned shares in $FNV on and off over the years.