Valuing Royalty Optionality

Introduction

I thought I'd ramble awhile about valuing optionality for royalty companies.

I've done it three times where we bought something for $2 million worth a billion dollars. -Pierre Lassonde, Co-Founder of Franco Nevada

That is a 500x return, not 500%, 50,000%. Once is a fluke, twice is lucky. Three times, that's a pattern. There's a reason why we have a Pierre Lassonde page in our required reading section and why Franco Nevada is the GOAT (greatest of all time).

When we came back public in 2008 we had 20 million ounce of reserves and 30 million ounce of resource royalty to Franco Nevada. Ten years later all those ounces have been mined; 20 million ounces have been mined. We got the cash flow, we paid a billion dollars of dividends and guess what the reserves are? 20 million ounce of reserve and 30 million ounce of resource without Franco Nevada spending one penny. Why? Optionality! The mining companies kept drilling they found more and we have the same and that is the power of the business model of Franco. -Pierre Lassonde

I'll put my own twist on this and say there are three ways that production royalties increase in value. They either add more metal, they earn the discount rate, or they accelerate the delivery of that metal from farther in the future to less far in the future. Pre-production royalties add value the same three ways and add another dimension of decreasing risk.

- Royalties add more metal by drilling

- Royalties Earn the discount rate through the passage of time

- Royalties accelerate the discount rate by expanding production

- Pre-Production Royalties also can decrease risk

That's it. That's the value creation game. Everything else is just earning NAV.

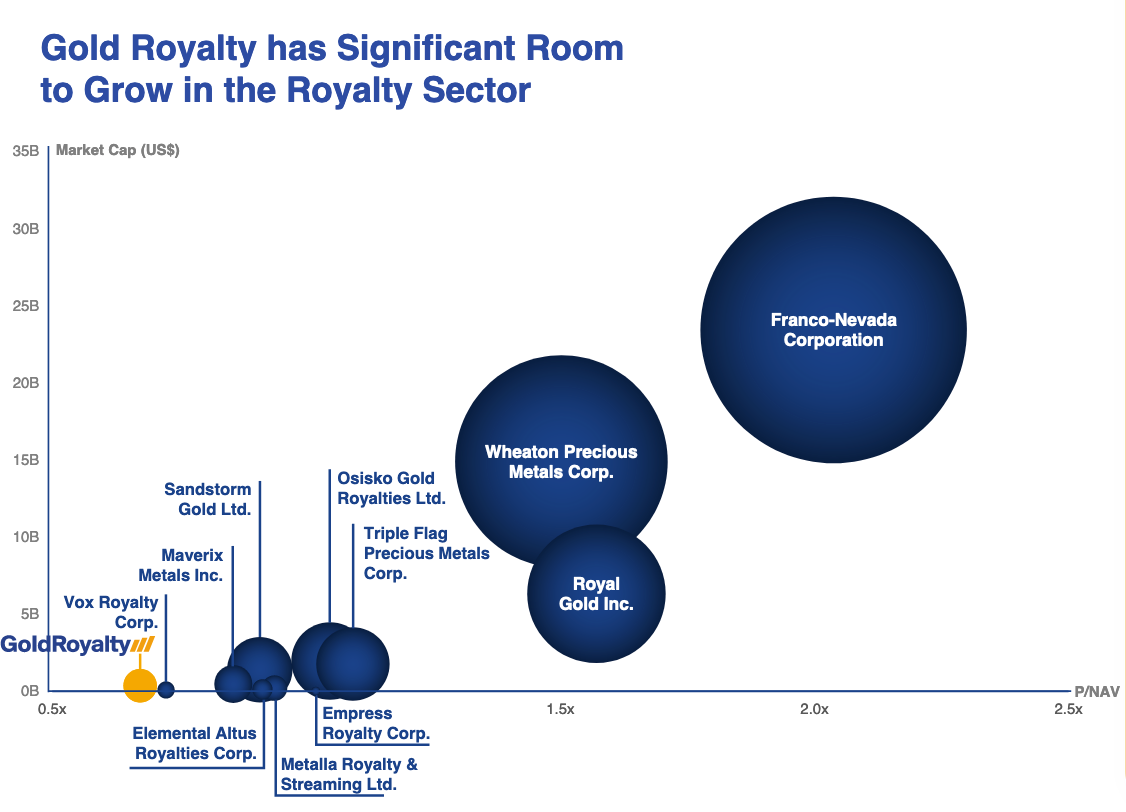

Royalty NAV Broken

If something trades at a significant premium to NAV and NAV actually was a sane way to value the company we'd expect negative returns going forward from Franco, Wheaton, & Royal. What I believe instead is that NAV systematically underestimates the value of royalties.

Let me change Pierre's quote a bit.

I've done it three times where we bought something [with a $2 million NAV based on a discounted cash flow table and the Net Present Value (NPV) of cash we actually received and expect to receive based on updated NAV] turned out to be $1 billion.

I have seen over and over again royalty companies explicitly or implicitly state that the reason Franco, Wheaton, & Royal trade at a significant multiple to NAV because they have large market caps that make them more attractive to institutional investors, ETFs, and other large pools of capital. NO! It's because they keep turning $2m into $1b. NAV is garbage.

Adding More Metal By Drilling

In today's world miners don't just start digging up rocks and hope they have gold in them. Instead they use a drill and computer models to make a reasoned estimate of how much gold the rocks have in them. This is true for other metals like copper, lead, zinc, silver, lithium, etc as well.

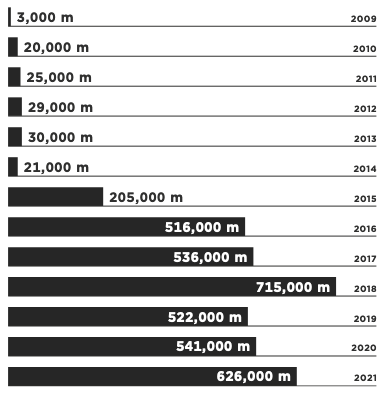

I'd like to give a shout out to Sandstorm Gold for being one of the few royalty companies to disclose how much drilling was done on properties they have royalties on.

Let's dig in. 500,000m of drilling at a typical cost of $250/m = $125,000,000 of partner spending on exploration. Let's say that on average exploration costs $25/oz. That would mean 500,000m of drilling would add 5Moz of Au on Sandstorm royalties. I don't know what Sandstorm's average royalty rate is, but let's say it is 1.25%. 5Moz * $1,767/oz * 0.0125 = $110m. Based on their current market cap that would be a 6.9% yield. Sandstorm has exceeded that number of meters drilled every year for the last 6 years. None of that is accounted for in their current analyst NAV. Eventually this does start to show up in NAV as mine plans get updated, but it is often lost as NAV can be grown through acquisitions and it's hard to separate how much of the NAV growth was organic vs acquired.

Drilling costs aren't the same everywhere, discovery cost per meter drilled aren't the same everywhere. Ounces discovered don't have the same value on every project. Your results may vary. I'm saying all this to caveat this next paragraph.

At a 1.25% NSR a royalty company's partners exploration budget can be basically generating value for the royalty company on a dollar per dollar basis (in the above napkin math it was $125m spend generating $110m value). At a 2.5% NSR the royalty company could be getting value of almost $2 for every $1 spent on exploration.

Discount Rates

If you offer to pay me a dollar in 30 years, what is that worth to me today? How much would I pay you for it? Let's assume you are good for it. Well, I might figure out what other things I could invest that dollar in today. Maybe the stock market or bonds. Or what would it cost me in interest to go borrow a dollar today from someone else to give to you. We can kind of munge together what my dollar could earn elsewhere and what it costs to get a dollar and add some for the risk of any of that and call that a discount rate.

If we use an 8% discount rate and you offer to pay me a dollar in 30 years the math says that (1 - 0.08)^30 = 0.0819. So a dollar 30 years from now is worth about 8 cents today. A dollar 15 years from now would be 28 cents, a dollar 5 years from now is worth 65 cents.

Mining a resource is a lot like having dollars in the ground that you dig up on a schedule.

One of the interesting thing about discount rates is that they are a moving target, this will be more relevant in a later example.

Accelerating Delivery By Expanding Production

When a mining company increases production they essentially turn some of those longer dated dollars closer to the present and increase their value. It costs the mining company to increase production, they have to go buy equipment and hire more people and such. A royalty company pays none of that, they get 100% of the increase in the value of the dollars being closer to now.

Hypothetical 10 year Gold Mine

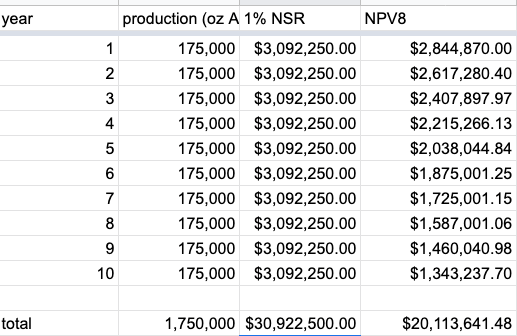

Let's imagine a hypothetical mine we'll refer to as Mahguiou, this is a simplified version of an actual mine and an actual royalty I was looking at recently. It has 1.75Moz+- Au and a mine life plan of 175,000+- oz per year for 10 years. A royalty company has a 1% NSR on all gold produced from the mine.

If you would rather skip making spreadsheets a shortcut is to take resource oz * spot price of gold per oz * 0.92^(life of mine /2) and you'll get awfully close to the NPV8 number that the spreadsheet does with a lot less work. But I digress.

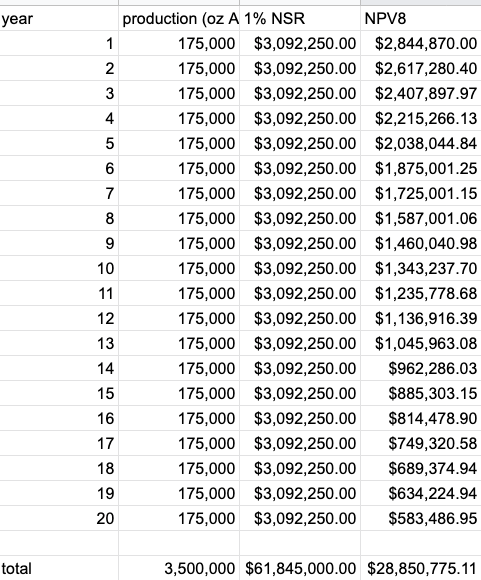

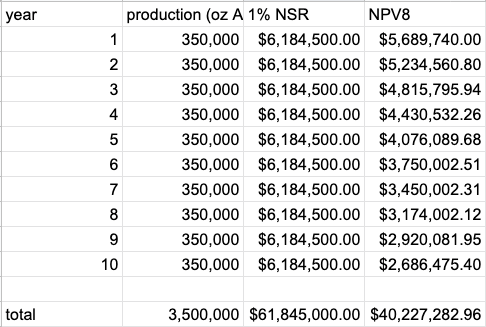

Let's imagine that the mining company has a stated goal of doubling the resource during the next 5 years. So they go from 1.75Moz to 3.25Moz. Let's first assume the production levels stay the same. What does that look like for the royalty company and the value of their asset?

The ounces of gold doubled and the actual dollars doubled. But the present value of those dollars only went up 43%. Those 20 year out dollars are worth less than $0.19 today. I'm not adding 20 years of inflation to the price of gold or making other adjustments, discounting the risk of nationalization, or other useful things that would make this illustration adequately complex. It's just to illustrate the principle.

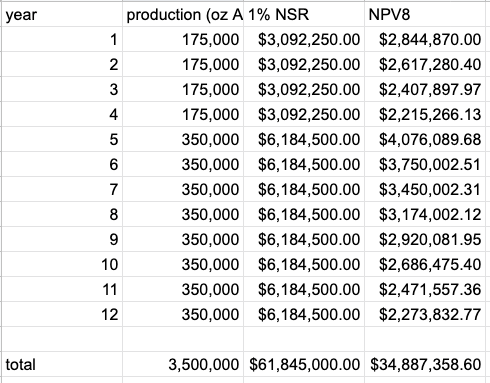

Let's see what happens if we double the production rate on a 20 year mine life halving the production life to 10 years. The NPV8 goes up 39%, and due to the magic of rounding and compounding 43% + 39% = 100%. Little math joke, it's actually 1 * 1.43 * 1.39 = 1.99.

There's a few ways to think about this. Doubling your resource combined with doubling your production doubles your NPVx. These aren't independent variables. Often companies will add resource through exploration in order to backfill mine life ahead of a production expansion.

It's also the case that short mine life resources aren't likely to expand production. A project with a 5 year mine life isn't likely to increase production, even if they add resource. However a project with a 5 year mine life gains a lot of value by adding ounces and hence years on the end of their mine life. A project with a 30 year mine life doesn't get much benefit adding ounces to extend mine life to 40 years, but a project with that much mine life is way more likely to expand production.

Here's a more realistic model of what a mine like "Mahguiou" might do, they might explore while mining for 4 years, and then in year 5 double production based on the increased resource. In this model we see the same total life of mine production but the NPV kind of splits the middle of leaving production as is and doubling production right away.

A bank analyst would value NAV of Mahguiou at the NPV8 of the current mine plan $20m.

My rule of thumb of M+I at spot would value Mahguiou at $30m.

There's a decent chance they earn the NPV8 of expanded production in year 5 and are worth $34m.

Hypothetical 30 year Porphyry

Pierre Lassonde says the best asset to own is a long life copper gold porphyry. Who am I to argue?

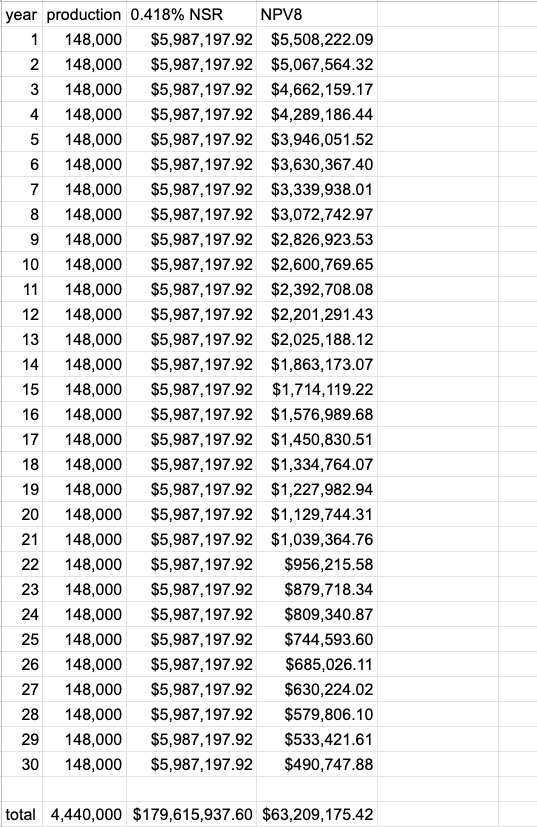

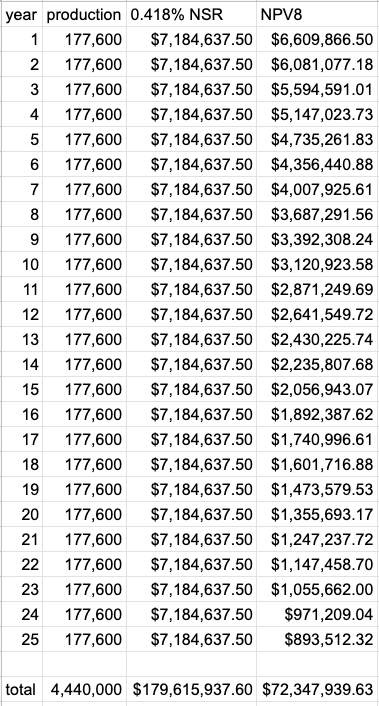

Let's take another hypothetical mine. Let's call this one Cashcarones, which is a portmanteau of cash and Cascarones. Cascarones are hollowed out eggs filled with confetti typically smashed on other people's heads around Easter, a tradition from Mexico that my family has adopted. I've extended the mine life from the real world example this was stolen from to illustrate my point better.

OK, great. Our NPV8 is $63,209,175.42.

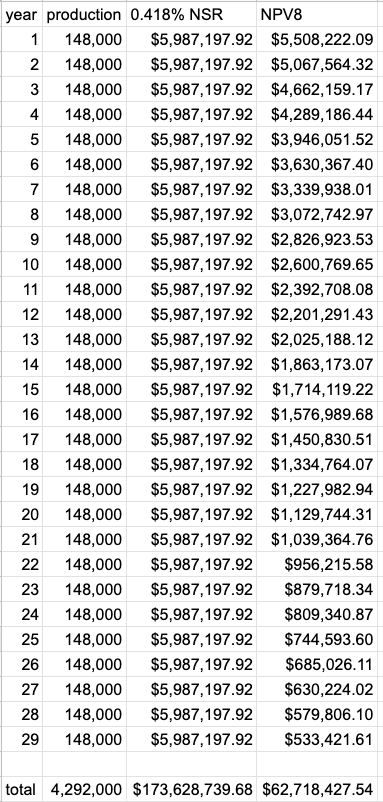

A year goes by, we get paid $5,987,197.92. So far so good.

Our remaining NPV8 is $62,718,427.54. That's a bit fun.

$63,209,175.42 (previous NPV) - $5,987,197.92 (cash we got paid) = $57,221,977.50 (what some people would wrongly thing the remaing value was)

$62,718,427.54 (new NPV) - $57,221,977.50 (what some people would wrongly thing the remaing value was) = $5,496,450.04 (the NPV gain from time passing)

OK, so the $5.9m is pretty easy to understand. The royalty company gets a check or a wire transfer or whatever. They can pay dividends with it and you can take those dividends and buy Christmas presents to put under the tree.

The $5.4m gain in NPV was an unexpected bonus. That's you moving through time with the 8th wonder of the world compound interest at your back. The quote is true even if Einstein didn't say it. As you move through time, the gap between the total undiscounted cashflow and the NPV8 closes. In this case the remaining 29 years all gained 8%. Pretty nifty.

Also, if I were to ask you to guess what the price of copper or gold would be in 30 years how would you do it? One way might be to look at their current prices and a guess at the expected inflation rate. Say copper was $3.50 a pound today and you expected inflation to average 3% a year over the next 30 years. Well, in 30 years copper would be $8.50 a pound. The mining company would have increased costs, but the royalty company wouldn't, all that commodity inflation drops straight to the bottom line.

What happens if no time passes but our theoritecial Cashcarones increases the plant capacity 20% to increase production 20%?

NPV8 just increased by $9.1 million, which is a 14.4% increase in NPV8. Not bad for a 20% mill upgrade.

Of course real mines are more complicated. Escondida, the largest copper mine in the world went through a multi-phase ramp up that saw increasing metal production for 15 years. Then in the last 15 years metal production has been roughly flat to down despite expansions as grade declines.

Imagine if a royalty company had royalty on Copper Mountain when earlier this year they announced a huge increase in reserves & resources and an updated life of mine plan that adds a production expansion in 2028. The new life of mine plan has 32 years based only on proven & probable and including the production upgrade. It would probably be closer to 60 years if M&I+I were all included.

Because long life mines have more of their value discounted royalty companies benefit more from plant upgrades than royalties on short mine life mines do.

Cost Curves

We typically think of wanting royalties low on the cost curve so that the mine can continue operating through downturns in metal prices. A mine that closes early is no good to anyone. There's some truth to that, but it's not the main reason you want a low cost mine.

For to everyone who has, more will be given, and he will have abundance; but from him who does not have, even what he has will be taken away.

In both our 10 year gold mine and our 30 year copper porphyry the royalty company wants plant expansion and exploration drilling at the mine. Both of those things cost money and need a payback. High margin (low cost) mines can afford to do exploration and plant expansions because they generate positive cash flow.

The main reason royalty companies benefit from royalties low on the cost curve is the increased likelyhood of plant expansions and exploration drilling being funded by the operator from operating cashflow.

Pre-Production

This has all the risks and value growth of a production mine, because any value it has comes from it becoming a production mine. Added to that is risk. Does it become a mine at all?

There are lots of aspects of risk. Is your government stable? Are there endangered animals living at the potential mine site? Are the local inhabitants grumpy or happily employed in other industries?

The biggest risk however, is there an economic orebody? The bigger a deposit gets the more likely it becomes a mine. How many 10Moz gold deposits fail to make it into production? The answer is not a lot. Here's my equation for pre-production royalty success:

More meters drilled == more ounces in a resource == higher chance of becoming a mine

How many meters have been drilled in the last 12 months? That question is a good place to start. The next question is how many meters are exptected to be drilled in the next 12 months?

Summary

Royalties benefit from exploration drilling. "Short" mine life (10 years or less) projects benefit more than long mine life projects from exploration drilling. Pre-production projects doubly benefit from drilling because of the increase in the size and the decrease in the risk size brings. Exploration drilling can be estimated based on exploration budget and estimated drill costs.

Royalties benefit from production rate increases. "Long" mine life (more than 10 years, ideally 20 or more years) benefit most from production increases.

Full Disclosure

We are all grownups here right? If you lose a bunch of money investing in something based on what I wrote then welcome to the world of taking responsibility for your own actions. The only reason I mention which companies discussed that I own is that I want to make my inherit bias clear. This is for educational and/or entertainment purposes only and not investment advice.

I explicitly mentioned Franco Nevada, which I have had a long position in in the past but have no position in at the time of this writing.

I explicitly mentioned Copper Mountain, which I have a long position in, purchased in the public market.

I kind of based two of my hypothetical examples on a couple of real royalties. I have a long position in one of those royalty companies and at the time of this writing do not have a position in the other.