Gold Bull Markets

In the last 12 months gold, as measured by the $GLDM ETF, is +38.57%. I thought I'd take a quick look at a few questions from past gold bulls.

What does silver do relative to gold in these markets?

How do the majors and juniors respond?

How does royalty do?

Here's a list of gold bull markets where gold went up more than 30%.

| rank | time | percentage |

|---|---|---|

| 1 | November 1978 to January 1980 | +329.0% |

| 2 | August 1971 to July 1973 | +205.4% |

| 3 | 2008 to August 2011 | +159.9% |

| 4 | August 1976 to October 1978 | +125.3% |

| 5 | November 1973 to December 1974 | +115.7% |

| 6 | June 1982 to February 1983 | +65.1% |

| 7 | August 2005 to May 2006 | +63.8% |

| 8 | March 2020 to July 2024 | +59.1% |

| 9 | June 2007 to March 2008 | +53.1% |

| 10 | February 1986 to September 1986 | +31.8% |

| 11 | April 2019 to March 2020 | +31.3% |

| 12 | March 2003 to January 2004 | +31.0% |

| Now | Oct 23 2022 to now | +101.23% |

I'm going to do a series going through each of these, but let's see where we are in today's run, which is already up to 6th best all time and doesn't seem over yet.

Current Bull Run

Roughly from October 23, 2022 - today (April 17, 2025)

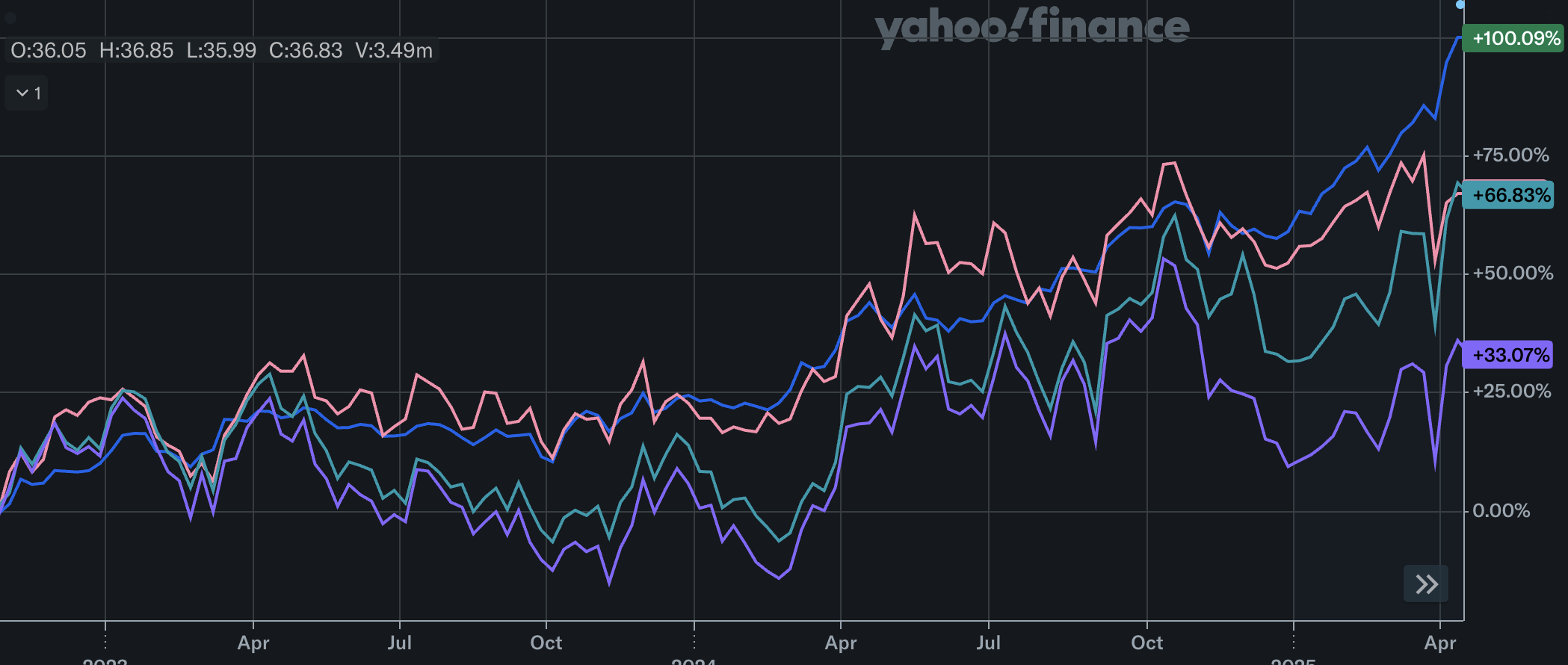

Gold and Silver

There is an undeniable relationship between gold and silver. Both have historically been used as money. Both have a lot of use in jewelry today.

If we were to zoom out a bit historically there has been a long term trend where the price ratio in dollars of gold to silver has gone up over time. It was 20 in 1970 and is 102 as I write this. It is interesting that the ratio in crustal abundance is about 19:1, which is close to the 1970 ratio, making the long term trend interesting.

There are differences of course, silver is often produced as a by-product of base metal mining and has industrial uses largely due to it's being a better conductor of electricity than copper. I think the by-product production is why silver price tends to be more volatile, to increase production the primary silver mines are much more price sensitive. I also think the by-product nature of production is why the ratio has been increasing over time.

Silver has largely kept up until December after which it has wildly underperformed. I have started a long position in $SIVR as I think odds are the ratio goes back closer to 80:1 instead of 100:1. That could happen with silver going down but gold going down more, or the ratio could continue to expand. Nobody knows the future. But I like the odds here.

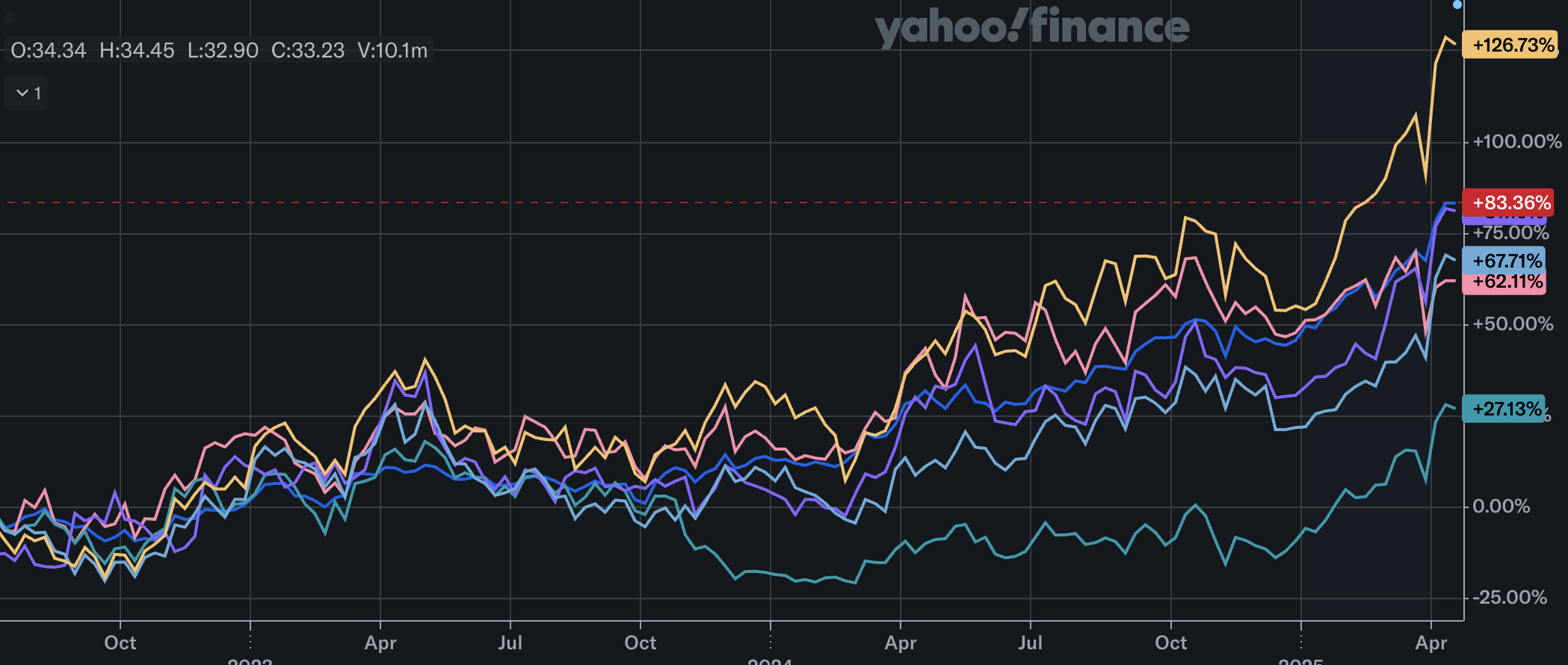

Miners

The $GDXJ in purple at +114.84% and $GDX at +109.49% have outperformed the physical in this bull run. Some of that is justified as the price of energy inputs (oil, gas, electricity) hasn't really gone up. Labor costs haven't gone up much either. Other major costs like equipment, steel, etc haven't had enough time to move.

Over a long enough time period I expect the miners to underperform, and I don't think they are a good investment here on average, though some individual names could be interesting. The real question is how long miners will have high price in gold and low costs in production inputs.

Silver miners as measured by $SIL have perfromed largely in-line with silver metal, though that's biased quite a bit by Silver Wheaton the royalty company having an outsized representation. $SILJ has lagged silver metal prices. While I think $SILJ is usually just for shorting it could have some leverage if it catches up to the change in silver metal prices, and even more leverage if simultaneously silver metal prices catch up to the change in gold prices. Any investment in $SILJ is a short term trade and not a long term investment, but it looks interesting as a trade here. It also means silver miners might be a good place to go looking for individual names.

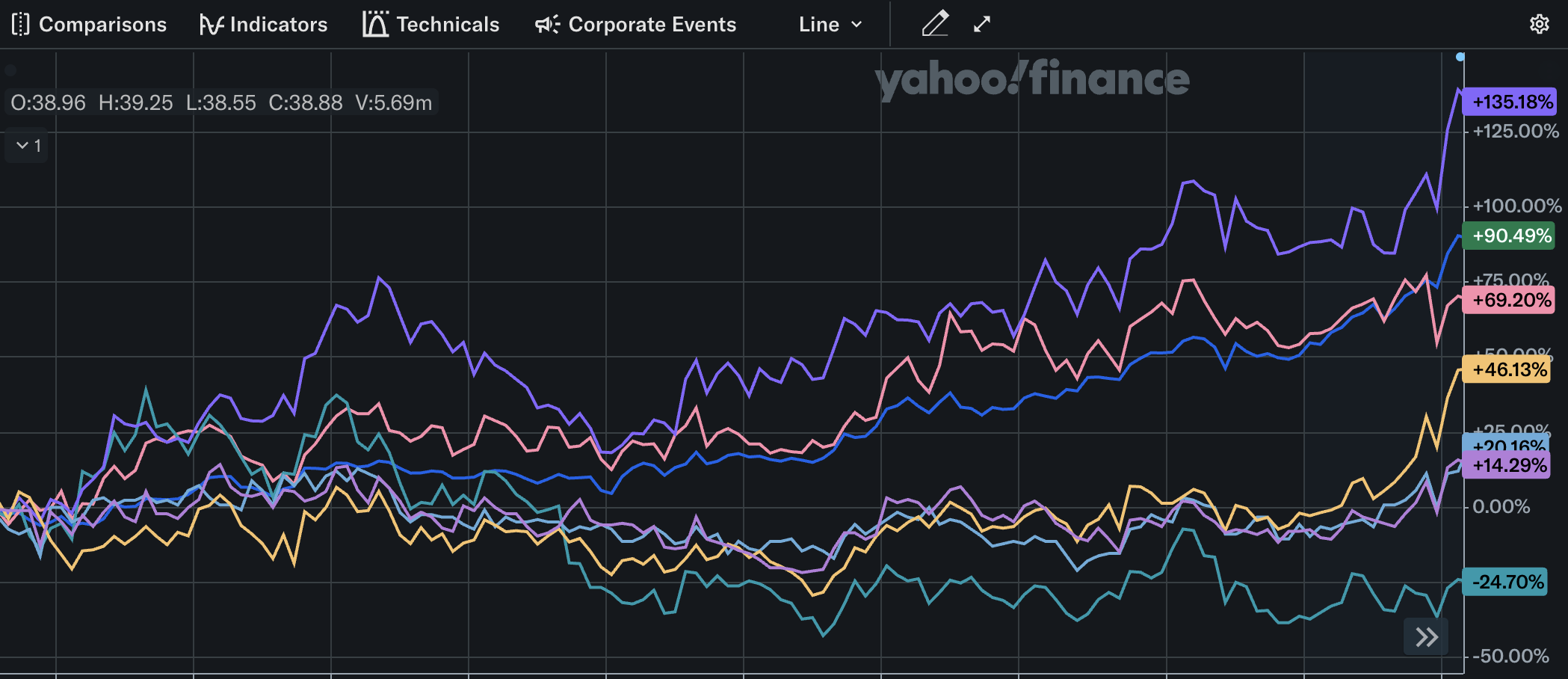

Major Royalty

If we add the performance of the 4 together and divide by 4 we get almost exactly the performance of physical gold. That's kind of nice.

Franco Nevada (the GOAT) has underperformed since Cobre Panama got shut down and has never recovered the stock price. It's started catchup up a little since rumors of resolution to re-opening Cobre Panama seem to be progressing, but has plenty of room to run if it actually re-opens. Probably a good deal here.

Royal has basically matched gold.

Triple Flag has outperformed gold a little, largely due to it being relatively new near the beginning of the period and now being valued more in-line with the other major royalty companies.

Wheaton has largely outperformed Gold and while it's a great company I wonder if the stock price has gotten a bit ahead of the business performance.

Mid-Tier Royalty

Osisko Royalty went from having a board unaligned with shareholders to being run for the benefit of shareholders. It's hard to say it's undervalued anymore, though it still may be a good acquisition target.

Osiskso is the only mid-tier royalty company to outperform the commodity this bull market. The others may have underperformed due to higher cost of capital, more exposure to non-gold commodities like copper, or less stellar management. I'll offer an alternative, investors have overlooked them a bit. I think there is tremendous value in Elemental Altus $ELE.V, Sandstorm $SAND, EMX $EMX, and even Metalla $MTA. Vox $VOXR has similarly underperformed though I personally don't see as much value there.

Pre-Production Sweet Spot

For fun I looked at the performance of the three pre-production sweet spot companies I own that are in construction on gold mines. They all completely crushed gold during this period. They have done well for me, but I would be a lot wealthier if I had held them the entire gold bull market and not just after they were permitted and financed.

I think this will be a topic to revisit. The traditional wisdom that the development phase is not worth owning wasn't true for these 3 that went into construction during a commodity bull. It's worth looking at what separates the development winners from the development losers.