Hugging On A Life Raft

Let's talk about Equinox Gold and Calibre Mining and what it means for the mining industry. First, here's a quick rundown of what happened: the two companies announced a no-premium merger and concurrently Calibre announced US$75 million of convertible debt ahead of the merger to fund their already fully funded Valentine project.

This is a merger with no operational synergy. None of their mines can share costs or coordinate in any way.

Managment Thinking

Note this is what management thinks, not what I think.

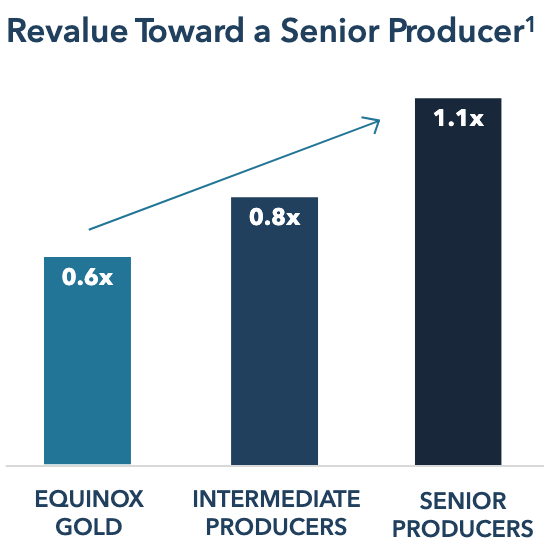

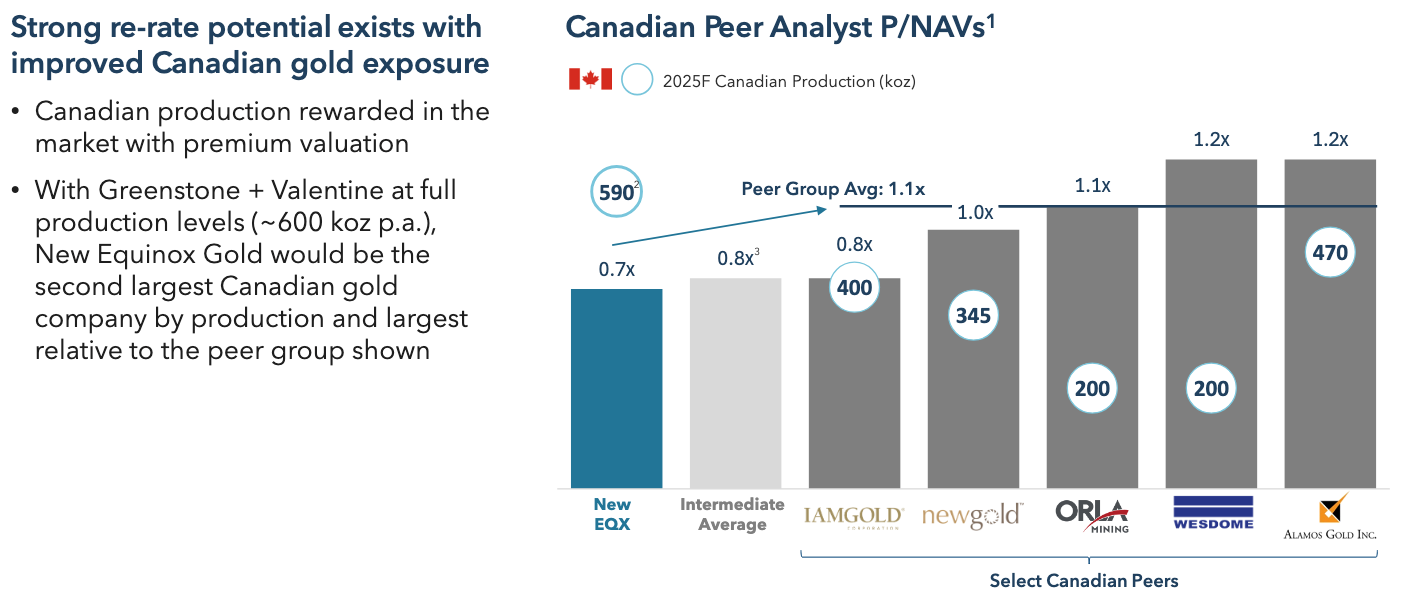

Senior Producers Get Higher Multiple

Let's look at Equinox's pre-merger deck to see Management's assertions. We'll then dive in and see what we think and if this can affect our investment strategy.

Management clearly thinks that there is a multiple re-rating for larger companies. Ross Beaty has said this before, for example here's him 2 months ago:

have some intermediate producer like like Equinox is going from one tier to another because as it grows and goes from one tier to another the valuations get better the price to net asset value gets better so so getting bigger is wealth creating by itself right so a senior producer trades for one times net asset value a junior producer 0.8 or 0.6 and a small producer 0.4 or 0.3 and as you get bigger you get you get that value Bump by itself so it's a strategy that works.

And from the merger deck we again see get bigger re-rate price to NAV ratio:

Higher Multiple is the Result of Passive

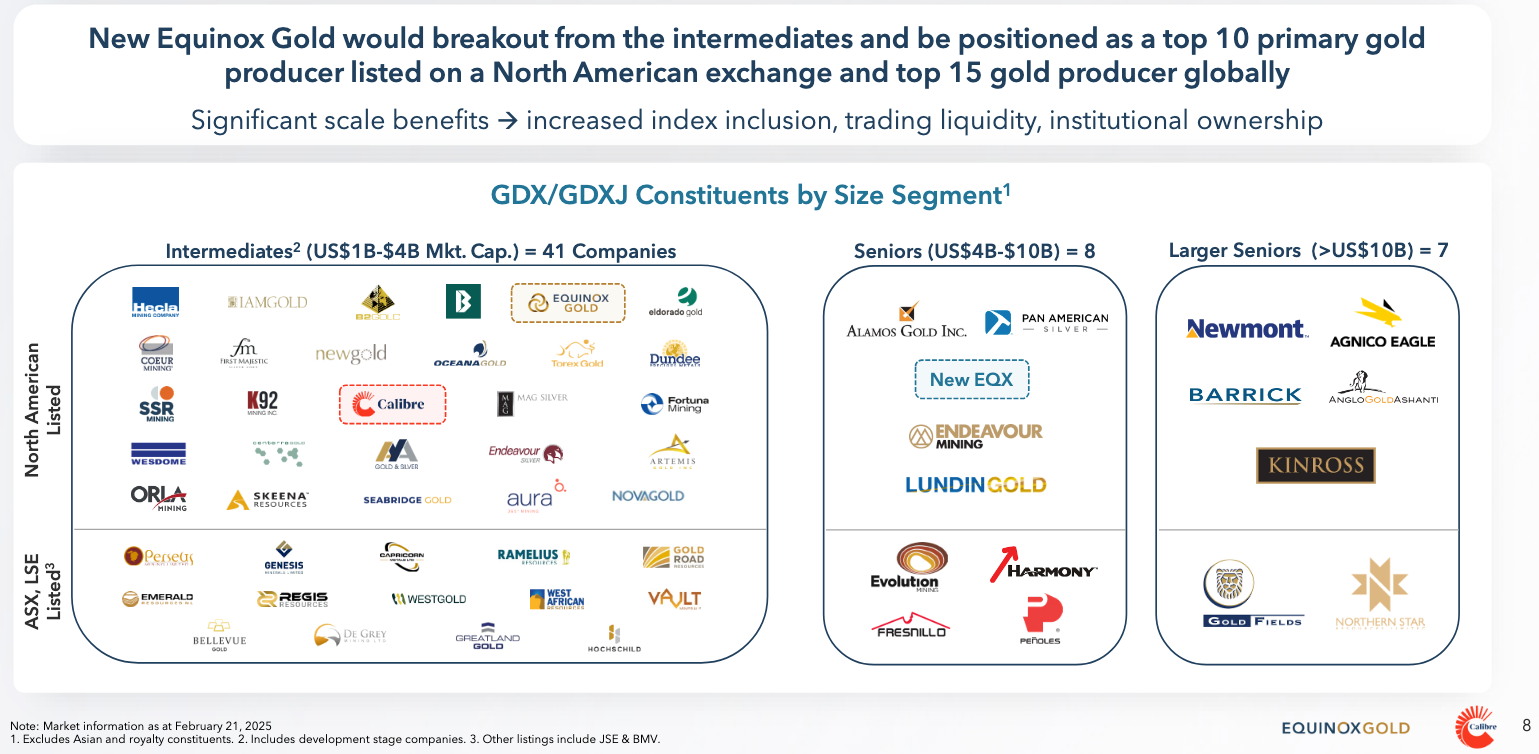

From the merger deck:

$GDXJ inclusion can start at US$150m market cap if you meet all the liquidity requirements. Alamos is the largest company on the $GDXJ at US$9.5b market cap. Calibre and Equinox were already in this club.

$GDX inclusion can start at US$750m market cap. Equinox was already in this club and so was Calibre. So there isn't any new forced buying. They were already the 24th and 35th largest companies in that index.

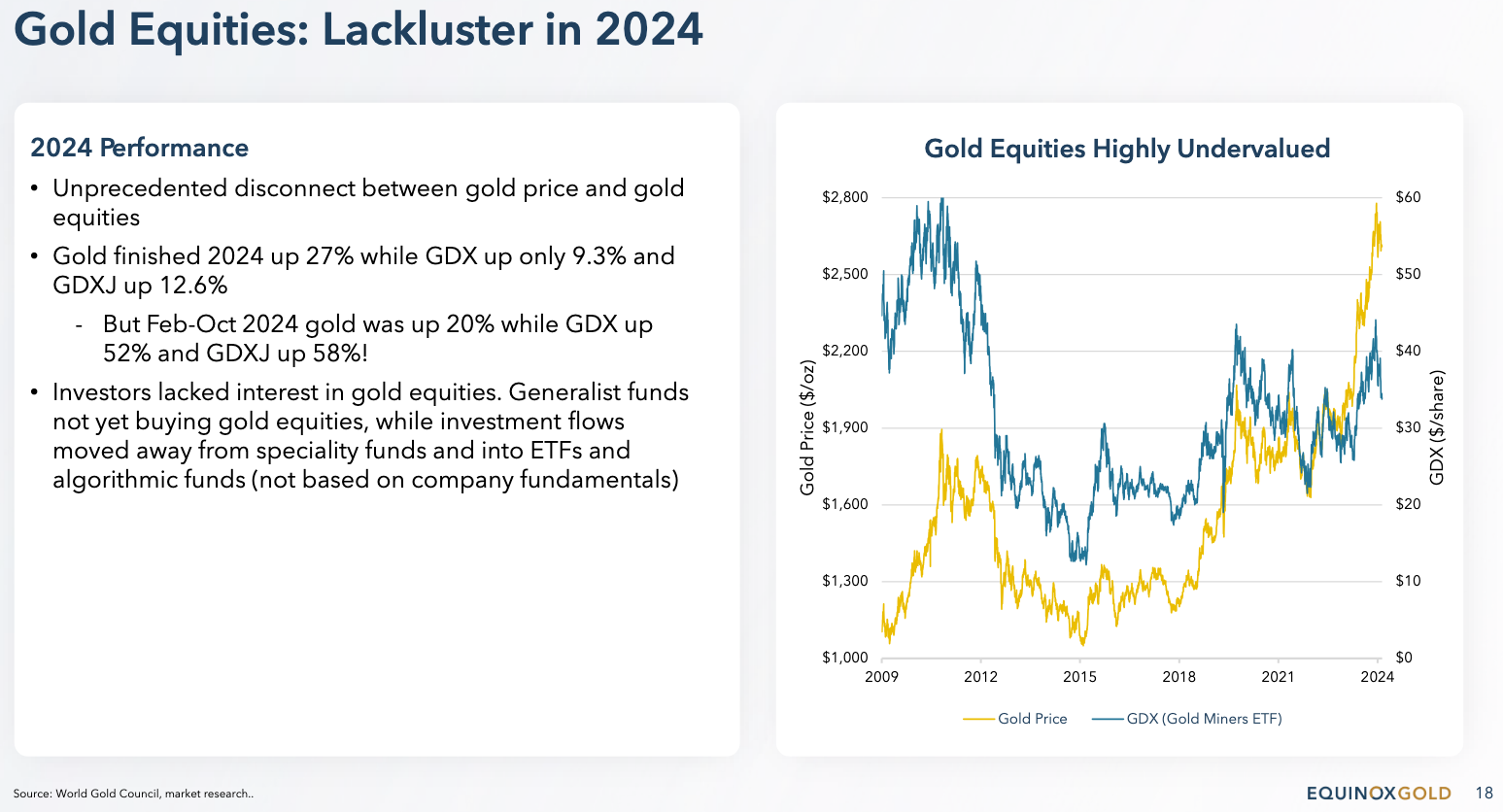

Gold Equities Will Catch Up To Gold

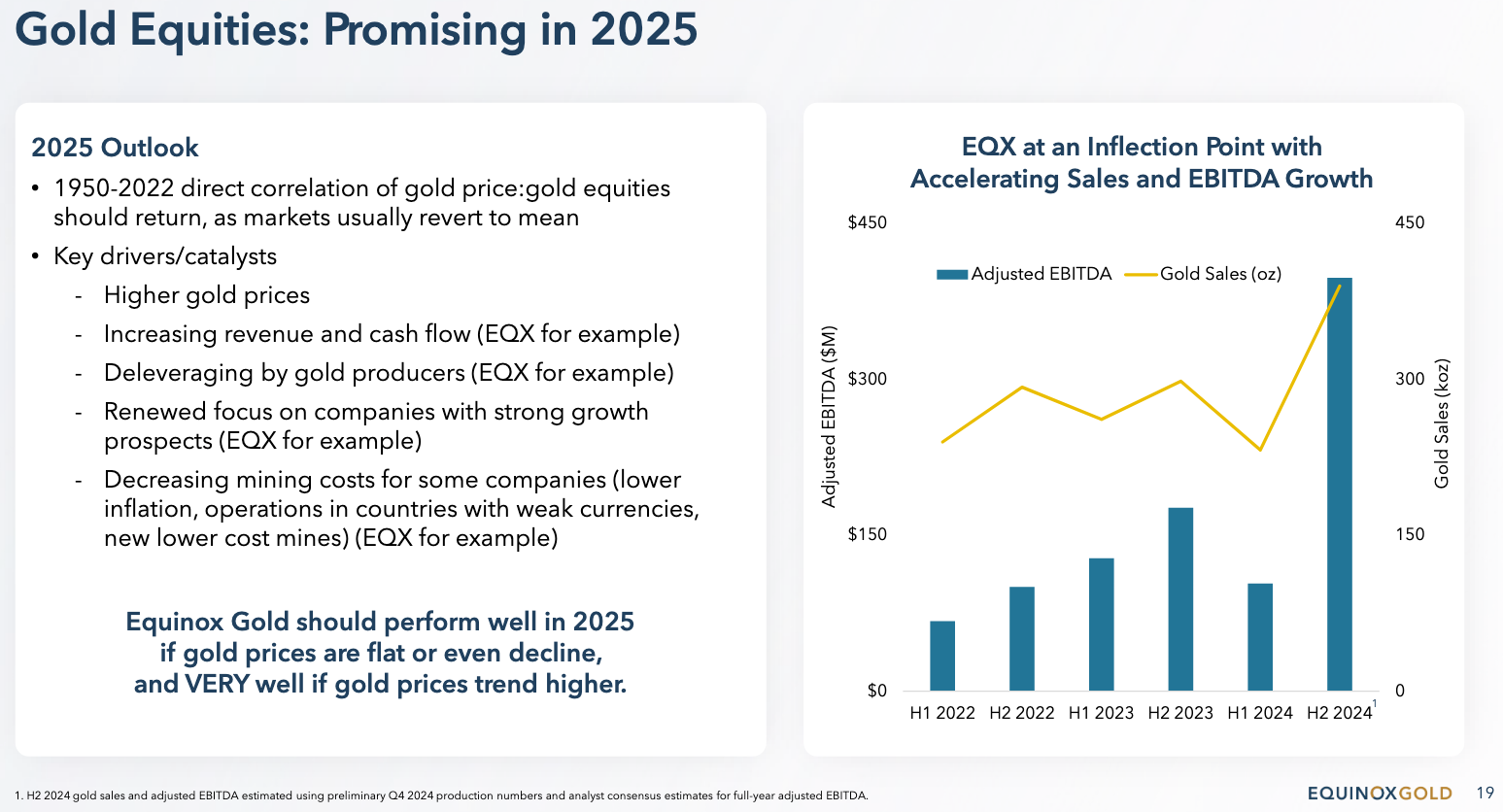

Again, from Equinox's pre merger deck:

and

My Take- What I Agree With

Like any good fable, there's some truth there.

Liquidity Premium is Real To A Point

I do think there is a re-rating uplift for increased liquidity up to a point.

Getting included in the GDXJ and GDX gives you access to passive investors both directly and through shadow investments (GDX and GDXJ charge a 0.5% fee so some larger institutions would directly mirror or slant their weightings with factor overlays).

Having a dual listing gives access to more capital. Uplisting from the TSX-V to the TSX increases the number of institutions that can consider you. Adding a ASX or US listing really opens it up.

Projects Re-Rate As They Advance

The P/NAV of a PEA stage project is lower than the P/NAV of a producing mine. This goes without saying for most of the readers of this blog. That as projects advance and de-risk they close the gap between potential and reality.

Two of my main investing strategies in mining are built on this. Pre-production sweet spot captures the de-risking re-rate of a in construction mine to a producing mine. Producer expanding production captures a similar re-rate as new mines and increased revenue/profit comes online.

Diversification De-Risks

A company with no revenue is risker than a company with a producing mine. A company with two producing mines is less risky than a company with one producing mine. A company with 10 mines is less risky than a company with 2 mines. Mines sometimes get disrupted so it's nice to have other cashflow to fall back on.

My Take - What I Don't Agree With

Correlation is not Causation. The thing that comes out of the back of a horse isn't gold.

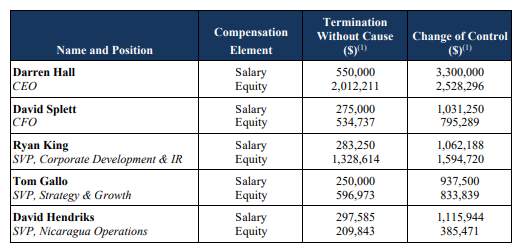

Change Of Control

Show me the incentives and I'll show you the outcome - Charlie Munger

Sometimes management's incentives and shareholder incentives aren't aligned. Shareholders get paid on a good takeover deal, management gets paid for any takeover deal.

Gold Can (Has) Outperform(ed) Gold Miners Forever

All the data basically says that in the gold space royalty companies outperform physical which outperforms large miners which outperform small miners. Yet, despite the overwhelming amount of data supporting this I again and again see miners saying that oh gold has outperformed them and they are due for a catchup. Reversion to the mean.

Here's me with some backtesting of some data, open source code.

I'm just going to copy/paste this from my Pierre Lassone page.

11:20 If you look at 2004 to 2011 when the gold price went from essentially $350 [per ounce] to $950 dollars [per ounce] a lot of people went into gold stocks. The Newmont of this world and whatnot thinking they are doing $100 [per ounce] margin at $350 [per ounce gold price]. They are going to be doing $700 [per ounce] margin at $900 [per ounce gold price] but that's not what happened. Instead energy costs went from $30 a barrel to $150. Twenty-five percent of the mining cost is energy. The reality is that the margin did not change and the equities did not move at all. The price of the Newmont shares were the same in 2011 as they were in 2004 and yet the gold price had gone from $300 [per ounce] to a thousand dollars [per ounce].

The point is amazing. Traditional wisdom says own the miners in a gold bull market. If miners have costs of $250/oz at $350/oz gold prices and gold prices go to $950/oz they should be making $700/oz. That's 7x or 700% of what they were making, so if their profits go up 700% then the stock should go up 700%. But they don't!

$100/$250 = 40% profit margins.

$380/$950 = 40% profit margins.

So even if their profit per ounce improve A LOT (3.8x in this example) their profit margins can stay pretty flat. And that's with profit per ounce almost quadrupling.

Over the long term the growth of the stock price will converge towards their return on capital minus their cost of capital. Those relative margins matter more than the absolute margins.

Now imagine a royalty company had the same initial margin, they paid $150 per ounce and sold them at $250 per ounce. But then the price of gold goes up. Their costs stay at what they initially paid, $150 per ounce.

$100/$250 = 40% profit margin

$850/$950 = 89% profit margin

Liquidity Premium Isn't Infinite

Equinox and Calibre are already in the GDX and GDXJ. By combining there's no incremental index buying. All the big investors can already invest in them through the index or individually. They are plenty liquid and aren't more liquid together than separately.

Higher Multiples Go To Better Companies Not Bigger Companies

What we have here is a case of selection bias. In this recent post I backtested the companies in the GDXJ looking at a particular thing, but the interesting bit for this is that the companies in the GDXJ way outperformed the GDXJ itself.

Many of the senior gold miners got their market caps by executing well, investing capital at high rates of return and running mines profitably.

I've seen this in the royalty space. Small royalty companies see Franco's valuation multiple and instead of thinking they need to replicate Franco's history of turning a million dollars into a billion dollars several times think they can get the valuation by turning a billion dollars into a billion dollars several times.

We have a reversed causation here. Being bigger didn't cause companies to be better, being better caused them to get bigger. We just see that they are both bigger and better, but not which came first.

Raise Your P/NAV by Going Into Production

Equinox P/NAV was going to go up if they successfully ramped Greenstone and delivered their debt. It's not rocket science to think that a profitable producing mine gets a higher multiple than a development project. It's not rocket science to say that a company with less debt is valued higher than the same company with more debt. No merger necessary.

Same with Calibre. Want a P/NAV re-rate, put the NAV of Valentine into profitable production on time and on budget.

A lot of the P/NAV multiple differences can be explained by the percentage of NAV in production versus earlier stages.

Do Better

In the last 5 years Gold is +85.59%. What a run for physical gold.

The royalty companies are:

Wheaton: +142.61%

Royal: +56.74%

Franco: +30.47%

Average: +76.60%

Franco got their biggest asset Cobre Panama stolen by the government, but overall royalty did pretty well, almost keeping up with physical. Certainly the slight under-performance versus physical doesn't do anything to counter the narrative that it's the best through-cycle gold investment class.

Equinox: -0.67%

GDXJ: +40.74%

GDX: +56.39%

Lundin Gold: +292.69%

We have to take a hard look in the mirror and ask why do we keep doing what doesn't work? The big and small miners underpeformed gold. The poster child of creating a big liquidity vehicle lost investors money over the period (but look at the market cap growth!).

Meanwhile a gold company with a single mine in a shaky jurisdiction trounced everything else I've talked about. They didn't focus on stable jurisdictions like Canada, they didn't grow to be a major, they didn't diversify. As I go through a deck like Equinox's I like to think of Lundin Gold and how each slide would apply to them. I then went through Lundin Gold's deck. The main difference I see is that one is positioned as a market vehicle and one is positioned as a real business. Food for thought.

edit: maybe I should run spell check before hitting publish instead of after