Investing Strategies for 2024

I'm flexible and adjust my strategies to where I find opportunity in the market. All I know about 2024 is that I will be wrong a lot and don't know anything yet. But here's my prognostication for investing strategies for 2024.

Royalty Space Consolidation

Royalties were one of the 3 proven strategies to invest in mining, but I'm always looking for an extra edge, so within royalties who wins in 2024?

In 2024 I'm predicting more consolidation. In my own portfolio I'm positioning to have more of the potential acquirees than acquirers.

Potential Acquirers

FNV, WPM, RGLD, TFPM. These are what I call the big 4. They have financial backing and relative stability and trade at premium multiples.

Wild Cards

GROY and MTA have both in the past expressed a desire to get big and re-rate. Metalla bought they releated party company Nova. Who knows what they'll do in 2024, but expect it to be active.

Potential Acquirees

EMX - Timok dispute is now settled. Franco already has a position and partnership with EMX and Franco been quietly acquiring some of the Caserones royalty that EMX owns a big chunk of so they clearly approve of one of EMX's biggest assets.

OR - Sean Roosen is off the board and they sold their equity stake in one of the other Osisko companies. There's an interim CEO and some are whispering that they haven't hired a new permanant CEO because why hire someone if you are selling the company?

SAND - Speculation was the horizon copper spinoff was to move the non-royalty assets into a seperate vehicle to make them a better acquisition target. It could also be to line up the next gig for Nolan. Sandbox could serve the same purpose. Any acquirer would also get an immediate synergy by simply retiring the debt or replacing it with lower cost debt.

ELE.V - They've quietly put together a good team and good assets, but haven't even uplisted to the Toronto main board. They fought off an unsolicited acquistion offer before, but if a higher quality company offered shares they might accept.

VOXR - Despite my not liking a couple of things they've done Vox Royalty has built up a decent portfolio that could tuck in very nicely to a larger player.

Non-Precious Royalty Gets Traction

Renewable Energy Royalties, Carbon Offset Royalties, Iron Ore Royalties, Lithium Royalties, Copper Royalties. There's a lot of stuff out there that isn't silver or gold. This year I think some of those companies with royalty models that aren't silver and gold are going to put some points on the board.

$LIRC.TO - Lithium Royalty has been beat up by lithium prices falling more than 80% this year, but they have some great assets and I think a lot of their assets will advance in 2024.

$TRR.L - It's a singular bet on Thacker Pass that probably won't pay off until 2026. Maybe early to the party on this one.

$RHI.AX - After the cash payment at the start of production what's left is an exploration company and a world class iron ore royalty.

$ALS.TO - I love the minerals side of the business and am re-visiting the renewable energy royalties now that they've started to mature that model.

Critital Metals Flow Through + IRA = Project Generators

Project generators were also one of the 3 proven ways to make money investing in mining.

In 2023 most of the project generators spent some time with their market cap about the same as their shares and cash. The mining net-net with an enterprise value of $0.

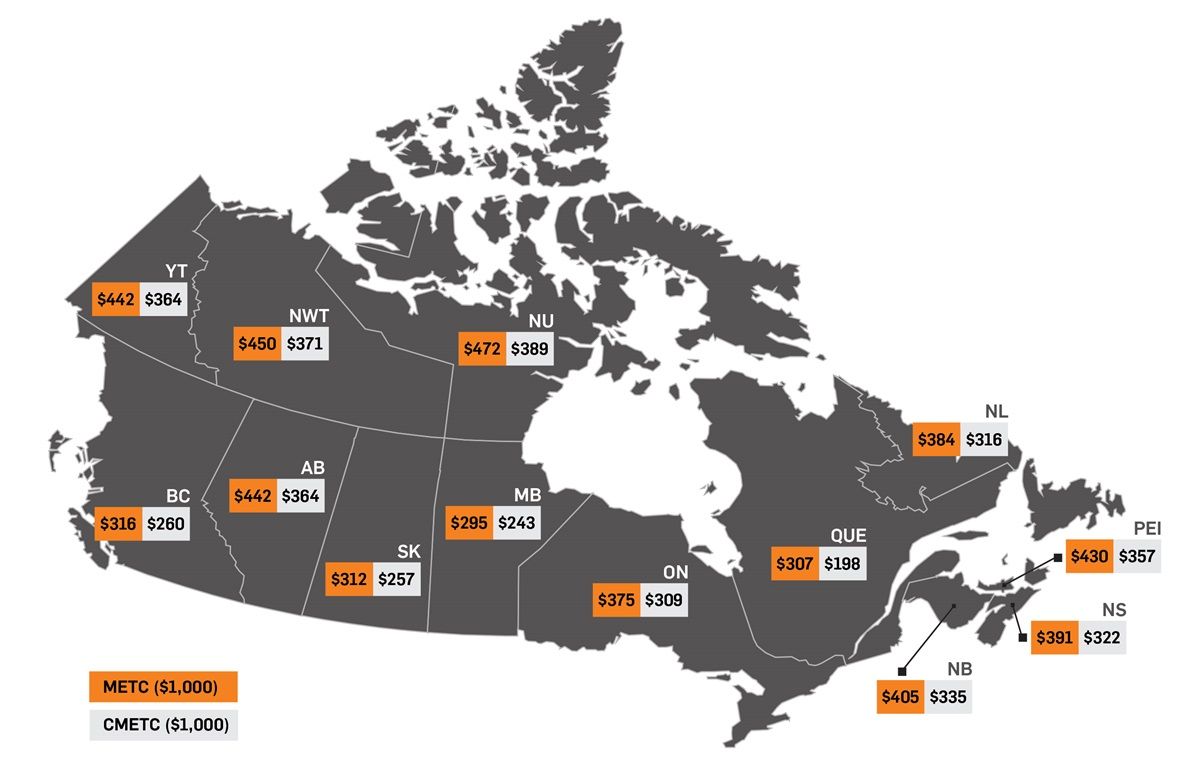

Below is a chart I think about every day. It's an estimate of the after tax benefit of exploration flow through financing in Canada, the grey is the new critical metal flow through.

If you invest in a junior explorer this means they can likely raise money above the price their stock currently trade at, and those investors can turn around and sell at a price below what the stock currently trades at and still come out ahead.

If you combine this with the incentives for US manufacturing to buy from free trade partners in the recent IRA laws, especially around battery materials, you have the perfect setup. Canadian government is subsidising exploring for and building mines for the metals and the US is subsidising buying Canadian metals.

The nice part about project generators, besides how the market is completely ignoring them, is benefit weighted spending. The partner foots the bill for drilling and other exploration expenses but the project generator benefits from that spending through a retained stake (either through a royalty or a carried joint venture position).

$KLD.V, $SMD.V, $GMX.TO - These three have a proven track record and are cashed up to not have to raise and dilute shareholders, while benefiting from the companies that are raising and diluting shareholders. Project generators in other countries don't have the tax tailwind behind them.

More non-gold Pre Production Sweet Spot

Pre-production sweet spot, moving from start of construction to first pour or declaration of commercial production, was one of the 3 proven strategies.

Gold was the ideal pre-production sweet spot because a junior could finance and build a single asset project without needing a billion dollars in capex. It turns out that there are some other reasonable capex mines that aren't gold.

In particular I'm looking at spodumene mines with Dense Media Separation (DMS) and no flotation. Sigma Lithium proved it could be done quickly and with minimal startup pain.

Expanding Production Graduates

In the required reading section of this blog Paul Gait makes a strong case that the market doesn't value new mines being added to existing producers. He shows the correlation of 2 month trailed basket revenues to market cap with MMG Las Bambas mine.

This year I plan to do a study of several names to see if this holds up in a larger data set. If it does the strategy gets added as a 4th proven strategy.

$HCC Warrior Met Coal is building Blue Creek. They'll start to get a little production from continuous miner units starting in 3Q2024 and the first longwall goes in 2Q2026. So this one may be early, but is also cashflowing in the meantime.

$ERO - Caraíba expanding plant capacity from 5.5 Mpta to 6.8Mtpa estimated this year. Tucumã should have first production come online in 2024.

Good Management = Better Sleep

I've looked at management as one of the criteria for investment, but this year I'm going to invest in some companies just based on the management team alone. Part of what a great management team does is make good decisions, and that's nice. But the real thing that great management teams bring is that other great people want to work with them. So they get to hire the best people, the get offered the best projects, they get more access to investors.

Here's some CEOs I'm super impressed with:

Zach Flood at Kenorland. Matter of fact honesty. Great strategic thinking. Amazing attention to detail. In the first 5 minutes of my first conversation with him I realized that he was in a different league than most junior mining CEOs I have talked to, and that I needed to up my own game to not look like a fool when I encountered people on this level.

Francis MacDonald at Li-FT. It's not a cooincidence that Zach and Francis co-founded Kenorland together. Talent recognizes talent. This is a man who is very data driven and will get down in the weeds. He has a rare combination to sell the vision, execute on it steadily, and constantly be a sponge of learning.

Doug Ramshaw at Minera Alamos. One of the most likeable guys in mining. But don't let that likeability fool you, he's super competent, espeically at markets and financing. If the AMLO government decides it will permit mines again Minera Alamos is in good hands.

Vincent Metcalfe at Comet Lithium. Founder and CEO of Nomad Royalties, who sold to Sandstorm after two and a half years for over half a billion US dollars.

Ruben Padilla at Sable. It's again not a cooincidence that Ruben is a director at Minera Alamos where Doug Ramshaw is president. Ruben oozes competence. He's clearly a great geologist but understdands the business side of exploration well.

Brian Dalton at Altius. Co-founded the company 25 years ago with next to no capital as an explorer, quickly pivoted to a project generator and then scaled into being a royalty company. Really long term strategic thinker with patience.

There are more great management teams, but that's some that spring to mind lately.

It's such a given that good management and good teams go together that it's shocking when you see someone good paired with questionable teams.

Boris Kamstra at Premium Nickel is so widely respected that it is puzzling he'd pair up with the team that constantly has us invsetors shaking our heads. I guess he's a mine builder and I guess there aren't that many opportunities to build a mine in that part of the world that he was attracted to the project rather than the team.

Marc-Andre Pelletier earned a reputation as a great operator and developer at Wesdome. It was surprising when he joined the floundering Bonterra without changing over the Wexford capital team with his own team. I guess there aren't that many CEO jobs in the Abitibi.

True Tier 1 Discoveries Getting More Rare

My best return in 2023 was WA1, a true Tier 1 niobioum discovery I bought into post-discovery. I got cute and traded around the position and completely exited twice. It's gone up since my second exit. What I should have done instead is sized up more faster and just never sold.

I owned some Great Bear, a tier 1 gold discovery, and made a tidy profit. But if I had just never sold and waited for the acquisition my returns would have been higher.

I watched Patriot's Corvette go by while I worried about lakes. I should have invested, it's clearly Tier 1.

I believe NGEX's Lunahuasi to be a Tier 1 copper discovery (Los Helados is likely Tier 2 but more likely to be built as it could feed into Caserones mill). I have sized up and plan to just not sell.

I'm on the hunt for Tier 1 assets that aren't already owned by majors this year.

Full Disclosure

I own stock in many of the companies mentioned, though not all. I have received no compensation from any of them. If you invest in some of these companies you might lose money, maybe all of it.