Lithium Hard Rock Market Forces

Or why I learned to stop worrying and buy spodumene projects.

I'm not an expert in this area. But this blog is free, so you get to read things as I'm figuring them out.

How Markets Work

In free markets the price is set by the marginal producer matched with the marginal buyer.

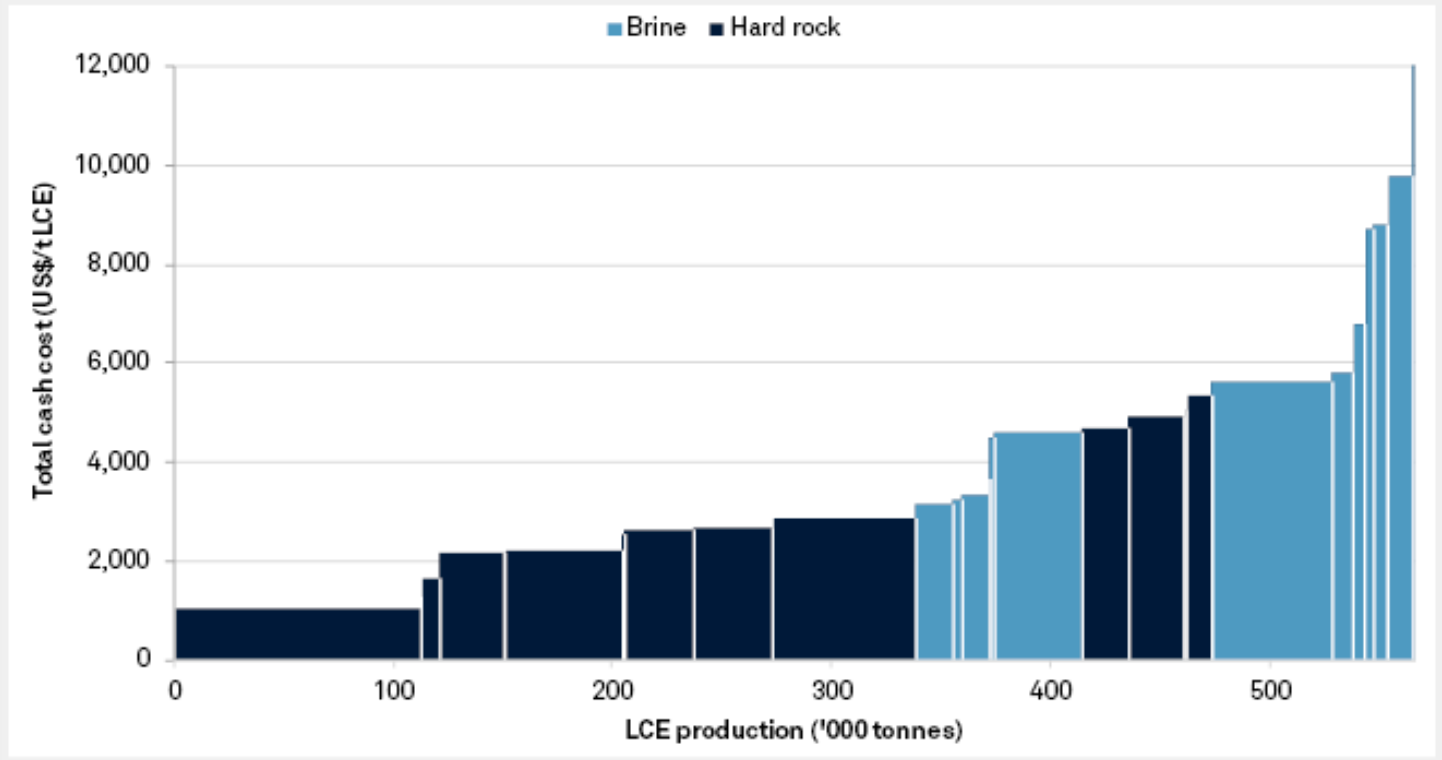

In the case of lithium if there are too many lithium miners and not enough demand for batteries then the higher cost miners will lose money. They will eventually get tired of losing money, or run out of money, and will stop mining for a loss. Thus when prices drop it's the miners at the higher side of the cost curve that reduce production. Balance is restored and prices can rise.

We haven't cared about production costs lately in lithium because there was more demand than supply and the price was way above the entire cost curve. All miners made money. The problem (or solution depending on your point of view) with all miners making money is that more mines keep getting opened.

There are of course delays in opening new mines. You have to go find new deposits, permit them, raise capital to fund them, etc. But we all know there is enough lithium for all the batteries we need. The question is how much lithium is available to be mined economically at each price level? If the price is $100,000/tLCE we'll just keep opening new mines forever. If the price is $3,000/tLCE we'll keep closing mines until basically Greenbushes and the Atacama are left.

What we want to do is identify projects that will be in the lower half of the cost curve so they can make profits through cycle.

Let's look at some project characteristics that affect where things settle in the cost curve.

Red Flags (No Go)

Lepidolite

Confession time. I used to own shares in Lepidico, the only non-China publicly traded Lepidolite project company. It was a mistake. Their current study shows an ASIC of $8,730/tLCE. But that's on an unproven technology and on a by-product basis, it's worse on a co-product basis. If you add in some inflation and the fact that studies seem to always come in lower than actual production numbers their costs are going to be high.

In China 44% of their domestic lithium is from Lepidolite, with an average concentrate grade of less than 2% Li2O.

If you look at Lepidico their Lepidolite resource is 11.9Mt @ 0.45% Li20. That's a half or a third as much lithium per ton of ore as a typical spodumene resource.

Cornish Lithium is 51.7Mt @ 0.24% Li2O. That is just abysmal.

Nobody really knows the numbers in China, but when prices dropped to $45,000/tLCE a lot of Chinese lepidolite processors started losing money and shutting down.

Underground

If you look at gold/silver/lead/zinc/copper mining the cutoff grade underground is 10x the cutoff grade of open pit. There are no current underground spodumene mines in the world, which is saying something. The costs of underground mining are just too high.

Allkem Mt Cattlin is looking to go underground as their open pit strip ratio keeps increasing. Other people are talking about it. I'm just not convinced it will be anything other than the upper end of the cost curve.

DLE with <200mg/L

I'm just going to say it, Alberta brines are not going to work economically. E3 has 75mg/L approximately. I've looked at their demo plant results and it's not good enough. Almost 75% impurities (Na+K+Ca+Mg+Mn+Sr+B) vs Li in the lithium stream and 722mg/L in that stream being below what most brine projects pump out of the ground to begin with. Rough going.

Salton sea brines similarly look rough, though there at least some argument can be made that geothermal heat can produce electricity as a byproduct, improving economics.

Direct Ship Ore (DSO)

In a high commodity price environment you might start direct shipping ore to move into production faster, but if your plan isn't to build a concentrator on-site right away your project is going to be the first to shut down in any commodity price dips.

Yellow Flags

Floatation (Small Spodumene Crystal Size)

Does your project have a lot of the spodumene in small crystals? You'll have to use floatation to recover that lithium. Floatation of spodumene is a huge pain to get right and many projects have way underperformed while starting up, sometimes for years.

Expect high costs, long and expensive ramp up times, and generally pain.

Ultimately Dense Media Separation (DMS) is cheaper both in capital expenditure (Capex) and operating expenditure (Opex). Floatation is expensive and tricky.

Typical DMS grind sizes are 5-9mm as the upper accepted size and 0.5-1.0mm as the lower accepted size. If you do a course grind you'll get less fines under your low end. If the crystal size is large enough and other factors line up you'll end up with a lot of crystals inbetween the acceptable sizes and few small crystals attached to impurities or smaller bits from the grinding process that are too small.

Ultimately even those with good DMS recoveries may want to add a floatation circuit. For example Sigma's 1.3% Li2O fine tailings are being shipped and sold to someone who is likely doing flotation on them. In the long run it makes more economic sense to save shipping costs and do that flotation locally. Even then, having better DMS recoveries mean lower processing costs on what's recovered there and a smaller amount of volume going through the flotation circuit.

Sedimentary (Clays)

Thacker pass is the only sedimentary (Clay) project under construction that I can name. Sorry Ganfeng Sonora, Mexico's AMLO governmentis stealing your project.

Thacker pass operating costs for the first 25 years in their feasability study average $6,743/tLCE. AISC will obviously be higher as processing is capital intensive. It will be interesting to see where this settles out. Government incentives (IRA etc) may also let Thacker pass have cheaper cost of capital and sell their product at higher than global average prices.

It's a guessing game at this point, but I think the project will come in with costs above Tier 1/2 spodumene, above Tier 1/2 evaporation brine, below Lepidolite, and below DLE brine.

DLE

There are two operating projects that people point to when thinking about currently operating Direct Lithium Extration, neither is truly DLE. That leaves 0 currently producing DLE projects worldwide.

I'm generally optimistic on the Smackover brines that Standard Lithium is developing in partnership with Koch & LAXNESS. Exxon is also making an entry into the region.

However, the technology is notoriously tricky. Standard build a large scale demonstration plant for their in-house developed technology before abandoning that technology. They are now going forward with a Koch developed process.

People are looking at DLE for projects around the world. Sometimes it's to fix impurities, sometimes it's because there is too much rain for evaporation ponds. DLE is not a magic wand that you waive to turn a bad project into a good project. The vast majority of DLE projects I've seen just won't work and are likely to never enter production.

<100Mt Spodumene Resource

You want to have future expansion possibilities, economics of scale, potential for vertical integration, long mine life. If you are under 100Mt of ore you are a marginal producer. Maybe it works anyway if there are other lithium resources in the district to combine with, easy access to ports, cheap power, low strip costs, etc. But if you aren't at 100Mt you need a lot of other favorable factors.

<1.0% Li2O Ore Grade

Is it an oversimplification to say grade = margin? Yes. Is it directionaly true, yes.

Floatation

Green Flags

High DMS Recoveries (Large Spodumene Crystal Size)

OK, there are other factors than just crystal size in DMS recoveries. But DMS is fast and cheap, so if you can get most of your lithium with this method your project is going to be much cheaper.

Sigma is a good example of this strategy. They use a DMS circuit and no floatation to produce a 5.5% Li2O spodumene concentrate. They then use their coarse tailings as road base and sell their 1.3% Li2O fine tailings (filter pressed, aka dry stacked) to either battery or ceramics markets. They get 61.5% recovery from DMS alone, and plan to up that to 65% recovery. They are planning to add a magnetic separator as well.

Open Pit Spodumene

Open pit mining costs are lower than underground. Spodumene is superior to petalite or lepidolite.

>100Mt Spodumene Ore

There are massive economies of scale in mining, and having more years of mine life to absorb the capital investment also really matters to IRR.

>1.1% Li2O Ore Grade

You want to be Tier 1/2, then you gotta have the grade to drive the margins.

Wide Vein Width

Wide vein width lowers strip ratios, lowers dilution, and generally makes life easier.

Anything 3m or wider can be mined without too much dilution, but the vein width will limit how deep you can mine before the strip ratio gets excessive. Vein orientation matters too.

Greenbushes has a strike length of 3km and a vein width of ~300m. Patriot Battery Metals CV5 pegmatite pinches and swells between 8m and 130m true width. Sigma thicknesses range from a few meters to 40m with an average of 12-13m. Li-Ft has a lot of double digit m widths (true width tbd).

Vertical Integration

If a project or district is large enough a company can move up the value chain. Instead of producing a spondume concentrate they might produce Lithium sulphate monohydrate (Li2SO4· H2O) that is easier to transport and store than lithium hydroxide LiOH, but can be used to make lithium hydroxide in the form of Li2SO4 + 2 NaOH → Na2SO4 + 2 LiOH.

Companies could go further and produce lithium hydroxide directly, but that makes more sense if they are near a lithium battery factory that would consume the hydroxide.

Why vertical integration makes sense is that you save on shipping costs for your 6% Li2O spodumene concentrate.

Disclosure

As of the time of this writing...

I am long Trident Royalties $TRR.L, who have a royalty on Thacker Pass.

I am long Li-FT $LIFT.V who are drilling out and exploring spodumene in Canada.

I am long Sigma Lithium $SGML who have recently started production and are looking to sell themselves.

I am long Comet Lithium $CLIC.V who are pre-discovery but recently added some notworthy team members.

I am looking for other good lithium investments.