Money For Nothing

Monish Pabrai has a quote in his book Dhando Investor I really like: "Heads I win; tails I don't lose much." The idea here is to think about your upside potential and compare it to the downside risk. Realize that these are often not related. Sure, investments with more upside potential also often have more downside risk, but not always.

Today we are going to look closer at some specific prospect generators. Specifically, what inspired this post is that I noticed a lot of prospect generators have gone down over the last 3/6/12 months despite their businesses being fine. After a personal review of my own portfolio I'm increasing weighting to this sector. Despite the cash/securities balances there is still some downside in these companies, but probably way less than most explorers. Meanwhile, the upside potential is huge.

Money for nothing and discovery upside for free would be great song lyrics.

What follows are a list of project generators I think are investible that have big portions of their market cap covered by cash and publicly traded securities. I have positions in the first 4 and don't in the last 3, but if you didn't want to track individual companies you could probably put a small amount of money in each of the 7 and wait 12 months for the market to become more sane and figure the basket has good odds (this is not investment advice and is for entertainment purposes only, I regularly lose money on my investments, talk to your financial advisor, etc).

Kenorland $KLD.V

This is my largest position among prospect generators in my own portfolio, and I've been slowly adding on dips. I've had a conversation with Zach Flood, the CEO, and was very impressed by him. Every investor I know who has talked to Zach was equally impressed. Their strategy is good and their execution is good.

If you net out my estimation of their cash (do your own dilligence) and shares you get the business and other assets for roughly CAD$15 million.

One of those larger assets is Frotet. Kenorland is a 20% JV partner, meaning they contribute 20% of the costs and get 20% of the eventual profits. But they are also the operator and get a 10% management fee. It's unclear if they get a management fee on their own contributions, but net they contribute 10-12% after management fees for their 20% stake, which is a pretty good deal. There is no maiden resource on Frotet so it's hard to estimate it's value. One potential illustration of value: 5Moz Au * 20% * CAD$25/oz = CAD$25 million. If you use that value then the rest of the business and assets are trading at negative CAD$10m.

Meanwhile they have several majors doing exploration programs where Kenorland retains a stake and collects management fees. They benefit from discovery but don't pay the costs.

Strategic Metals $SMD.V

When people ask me what Zinc investments I like I say Strategic Metals, which I have a position in. The 1 year price chart for Zinc looks like a double black diamond at a ski resort. But the cure for low prices is low prices as they say. Zinc will have its day again. When it does Broden will likely IPO and get built. Seems like a good project to me. Strategic metals owns a big stake in Broden having contributed some of the properties.

If Broden IPOs what price will the shares IPO at, who knows. Talk before Zinc price fell off was $6, which would put Strategic Metals stake as worth more than it's current market cap. Strategic has a history of special dividending larger stakes to it's shareholders, but who knows what it would do in this specific instance. To me the Broden stake is all upside with no downside.

Holding costs in the Yukon, where Strategic focuses, are incredibly low. They have 111 wholly owned properties, 5 JVs, 8 properties under option. Their overhead is pretty low.

More interesting is that my estimate of cash and shares in other publicly traded companies is worth more than the market cap of Strategic Metals. Before Broden. Before the existing assets or ability to continue to generate new projects.

Globex $GMX.TO

I plan to write more about Globex in the future, as it is a unique company. I own some shares. I will briefly point out what drew me to the company.

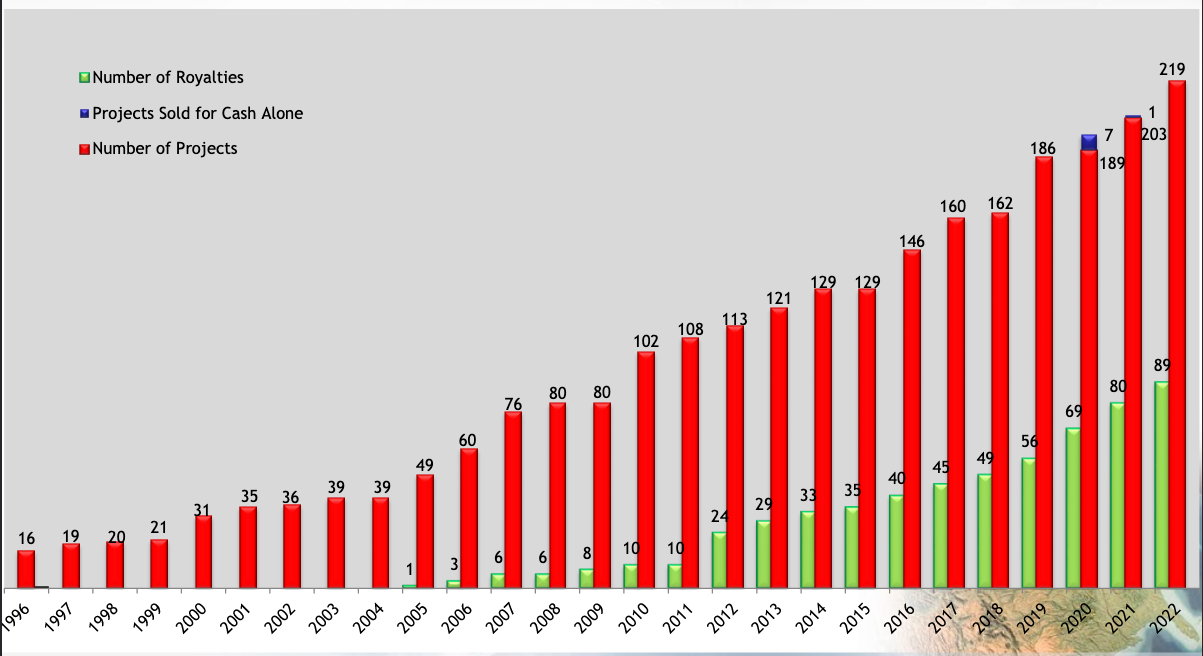

If we break that down into roughly 3 decades:

1996-2005 - Went from 16 projects to 49 projects. That's a 12% annual compounding. 2005 was also the first royalty.

2005-2014 - Went from 49 to 129 properties. That's a 10% annual compounding. Royalties went from 1 to 33.

2014 - 2022 - This third decade isn't finished yet with only 8 years in. Still, Globex went from 129 to 219 projects, rounded that's a 7% compounding rate on number of properties. Royalties went from 33 to 89. That's around a 13% compounding rate.

Along the way every year the number of projects and royalties increases. What's fascinating to me is that the growth in royalties lags the growth in projects as it takes time to convert projects into royalties. It's my theory that the growth in share price lags the growth in royalties as it takes time for the royalties to advance to later stages of development where they start to have more easily estimated value. I think we are starting to get to that point.

Here in Texas we have Pecan orchards. It's an interesting business because when you plant a pecan tree you don't see any pecans for the first 7 years. Then every year after for many more years the harvest per tree keeps increasing. Imagine a graph with trees planted, trees producing, and total pecan production. It might look a lot like a Globex graph of number of properties, number of royalties, and revenue.

Sable Resources $SAE.V

Market cap CAD$15.7m, cash CAD$14.7m. Three royalties they plan to sell. Let's say that the three roylaties together are worth CAD$1m, what does your enterprise value of $0 get you?

A CEO that is widely respected. South32 funding the Don Julio exploration, which Sable retains a stake in and collect an 8% fee for. Potential to bring in another partner to fund exploration on other Argentinian porphyry project like El Fiero or La Pancha. A couple great prospects in Mexico should that jurisdiction improve.

Personally, I'm pretty excited about this district that Sable has targeted and their approach to targeting it.

Riverside Resources $RRI.V

Market cap CAD$9.5m. Cash last financial statement CAD$7.3m. They have 4 royalties. They have a bunch of stuff in Mexico, though given how AMLO has messed up Mexico mining they are rightly shifting more of their focus to Canada. So net CAD$2.2m gets you a bunch of projects, a handful of royalties, and a good geologic team.

I don't have a position, but I like this setup better than most explorers.

Almadex $DEX.V

Their cash plus marketable securities at their last financial statement is more than their current market cap. Their website is down as I write this. But their business is active. They have 100% owned properties, are staking new properties, have optioned properties, and have royalties. They even own their own drill rigs and bring in a little extra cash doing contract drilling for other companies. I don't have a position, but I'm paying attention.

Silver Range Resource $SNG.V

Market cap CAD$9.3m. Cash CAD$7.6m. Enterprise value CAD$1.7m. This is a company related to Strategic Metals and also has shares in Broden and Silver47. By my count they have 13 royalties, 15 properties under option. It's not a hard stretch to put a value on all that north of CAD$1.7m. I don't have a position.