Option Agreements Equity vs Royalty

Royalty companies, prospect generators, exploration companies, and even established mining companies all are likely to participate in option agreements at some point.

I'm going to argue that if you are optioning off your project to another company that the 100% earn in with a retained royalty is almost always going to be better than a 70%/30% JV earn in.

Theoretical Framework

I'll walk through building a formula to convert between NSR and Equity percetage at option execution time.

If you have a 30% stake in a joint venture you are entitled to 30% of the profits from a mine. If you have a 2.5% Net Smelter Royalty (NSR) you are entitled to 2.5% of revenue.

To convert between percentages of revenue and percentages of profit we need to know how profitable the average mine is.

If we take the net profit margins for the top 40 miners over the 19 year period from 2002-2020 (because that's the data I found) you get an average profit margin of 13.1%. So in my view on average a 100% equity stake is equal to a 13.1% NSR.

Successful Mine Profit Equivalent = NSR / Mine Net Profit Margin

| NSR% | % of Profit |

|---|---|

| 0.5% | 3.8% |

| 1% | 7.6% |

| 2% | 15.2% |

| 2.5% | 19% |

| 3.93% | 30% |

| 4% | 30.5% |

In our table a 2.5% share of the revenue is on average equivalent to a 19% share of the profits of the mine once it is in production.

That last part "of a mine once it is in production" is important. It's tempting to look at 19% share of the profits of the mine and say that is less than 30% of a joint venture of the company that is developing the mine. But there are several things we haven't accounted for.

Bankruptcy

In this section I'll use the term bankruptcy loosely to refer to any equity restructuring that wipes out or severly dilutes the junior equity parter in a joint venture.

In almost all jurisdictions royalties are attached to the property and not to the company. So in most jurisdictions they survive bankruptcy. There is risk that an exploration company goes under, but the project later gets picked up and becomes a mine. Note we only care about bankruptcy risk on projects that go on to become mines, because projects that don't go on to become mines the royalty never cashflows anyway.

Successful Mine Profit Equivalent = NSR / Mine Net Profit Margin

Mine Profit Equivalent = (NSR / Mine Net Profit Margin) / ((1 - chance of bankruptcy) )

I don't have good data on this. To gather it we'd need to look at a representative sample of mines, filter out those that hadn't had an option agreement executed on the project in their history, and then look at the percentage of the original JV companies that went through bankruptcy or some kind of equity restructuring. Lacking such data let's pencil in 10% of JVs as not making it through to acquisition or production without some kind of equity restructuring.

Cashflow Profile

Imagine it's the end of year 1 of production of a mine. The royalty holder got their check for the 2.5% NSR they had on that year's production, cash is in the bank already. The equity holders however are lucky if they had positive cashflow at all, and if they did all of that cash went to pay debt.

Let's imagine $1.5m of cashflow to a each of a royalty holder and to an equity holder over a 15 year mine life. The royalty holder is more or less going to get a check for $100,000 every year with some variability for production rates and metal prices. But the equity holder might see nothing for the first 5 years and then see $150,000 each of the last 10 years.

Royalty holders get more of their cashflow earlier than equity holders for the same amount of cashflow. I don't have good data on the average discounted cash flow here. But if you assume an 8% discount rate and 3.3 years average delay in the cashflow profile that's a 25% advantage to the royalty holder.

Mine Profit Equivalent = (NSR / Mine Net Profit Margin) / ((1 - chance of bankruptcy))

Mine Cashflow Equivalent = (NSR / Mine Net Profit Margin) / ((1 - chance of bankruptcy) * (1 - cashflow delay discount) )

Dilution

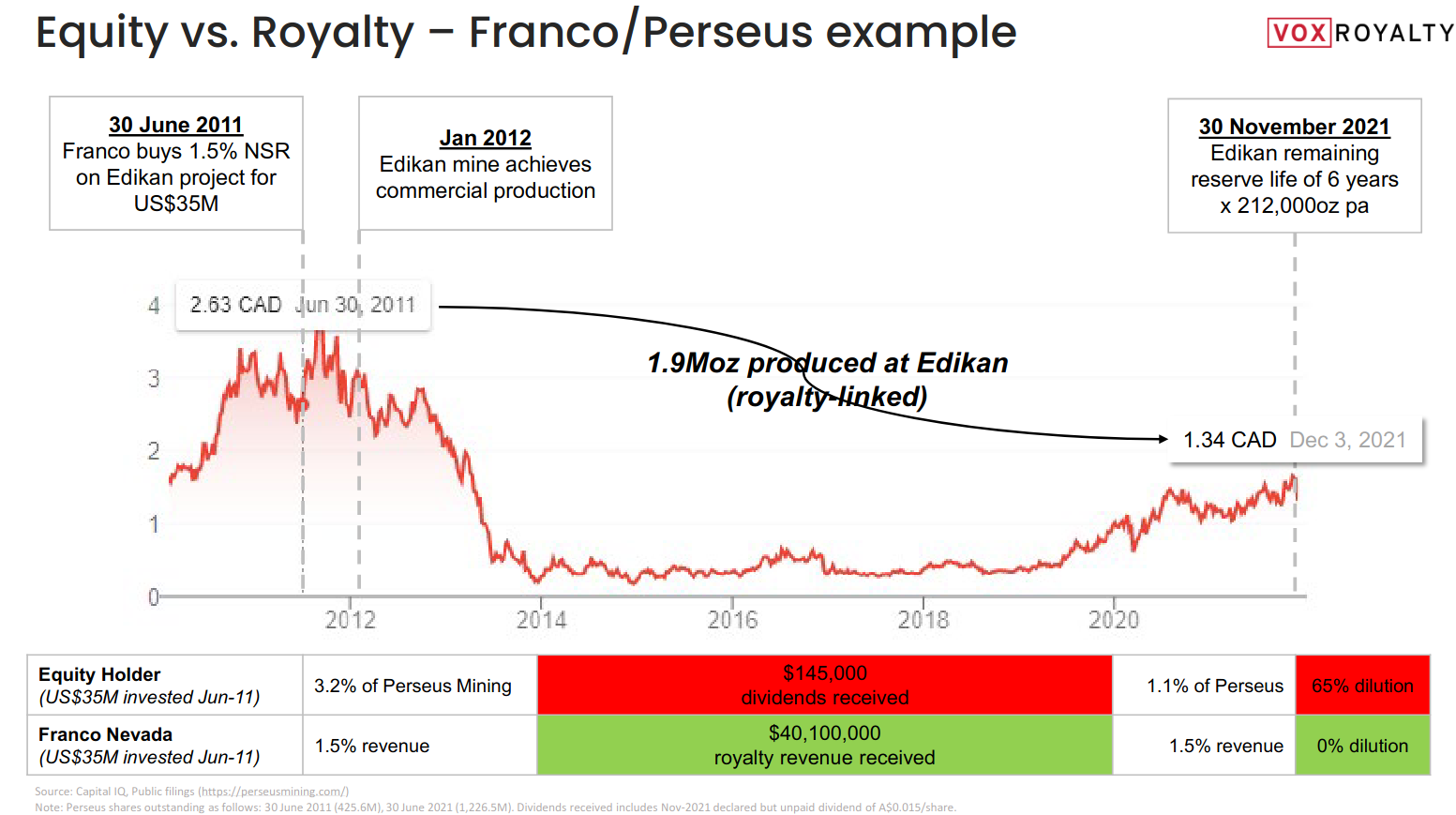

The example of Perseus that Vox Royalty uses is instructive. This is a mine that successfully went into production. There is 65% share dilution. And that doesn't include all the share dilution that happened earlier in Perseus exploration and project development phases, just the dilution during construction and production.

While there can be dilution after production start we are going to lump that into net profitability of the mine. So we care about equity dilution during exploration after the option is exercised, equity dilution during development (infill drilling, 43-101 studies, etc), and equity dilution during construction financing.

Mine Cashflow Equivalent = (NSR / Mine Net Profit Margin) / ((1 - chance of bankruptcy) * (1 - cashflow delay discount) )

Diluted Mine Cashflow Equivalent = (NSR / Mine Net Profit Margin) / ((1 - chance of bankruptcy) * (1 - cashflow delay discount) * (1 - exploration dilution) * (1 - development dilution) * (1 - construction dilution) )

I don't have good data on dilution, again only of companies that actually get acquired or go into production themselves. If we assume 25% diluition during exploration, 25% dilution during project development, and 50% dilution during mine construction the total dilution would be 71.825%.

Default Calculation

Let's plug in some default values and see what our final table looks like.

Equity at Option Exercise = (NSR% / 13.1%) / (0.9 * 0.75 * 0.75 * 0.75 * 0.5) = (NSR% / 13.1%) / 0.18984375

| NSR | Equity Equivalent at Option Exercise |

|---|---|

| 0.5% | 20% |

| 1% | 40% |

| 2% | 80% |

| 2.5% | 100% |

| 4% | 160% |

Discussion

It will be easy for people to pick apart this calculation and find minor flaws. But it's hard to argue that on average companies that own mines with a 2.5% NSR are going to send 19% of the mine profits to the royalty holder. Or that early stage exploration equity has a risk of failure and will almost certainly get diluted.

These calculations are my starting point. 2.5% NSR at option execution time should be default rule of thumb valued the same as 100% equity stake in the project as option exercise time.

Homework

Here are two recent project option announcements, one by EMX and one by Strategic Metals. I think they are both good for EMX and Strategic Metals and are good examples of their respective option types. EMX's is an example of a royalty option, Strategic's is an example of a 70/30 JV option. Having gotten this far in this article I hope you understand why of the two I clearly like the EMX one better.

EMX Options 4 Properties in Nevada and Idaho

Strategic Metals Options Mt Hinton

Full Disclosure

At the time of this writing I own stock purchased in the public market in both EMX and Strategic Metals. I have received no compensation from any companies mentioned.