Osisko Exit & Why This is Hard

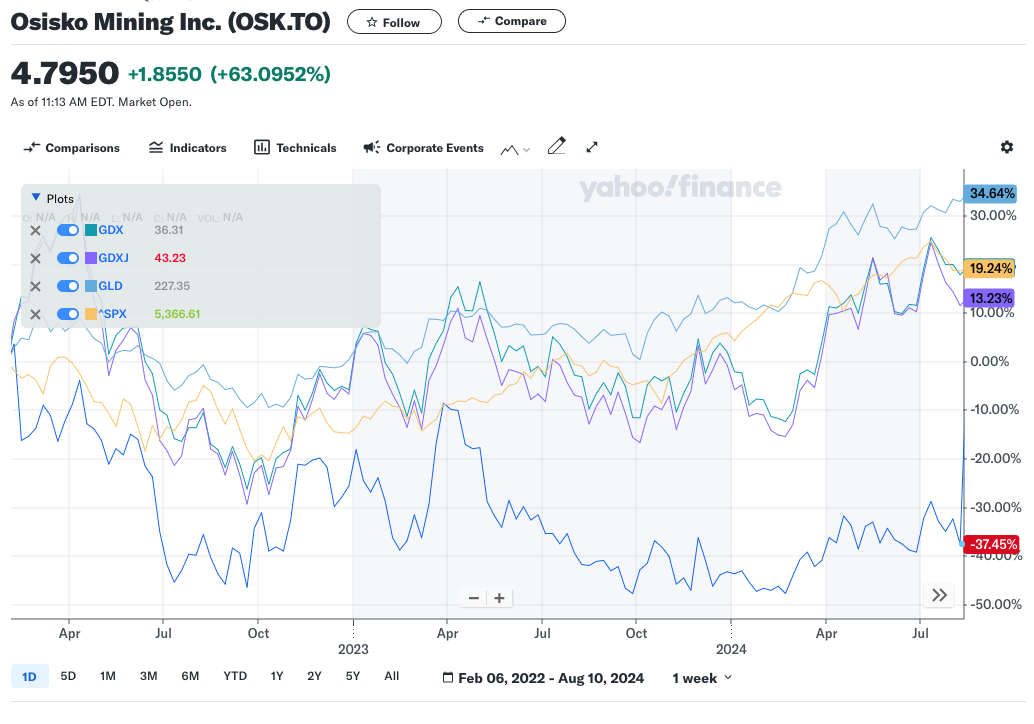

Osisko mining is living the dream today, they got taken out at C$4.90, which is a 55% premium to their 20 day average trading price, and a bigger premium to yesterday's close. Woohoo! Share price +63% today.

I didn't have a position in Osisko but this is good news for gold companies generally as an exit is a great way for undervalued companies to realize value for shareholders.

What an investor got a little less lucky with our timing and bought Feb 06, 2022 and sold a couple days ago holding for 2.5 years in-between? Well then they would be -37.45%

Fun bonus: 2.5 years is long enough for us to see our trend of physical gold (GDX) outperforming large gold minger (GDX) outperforming junior miners (GDXJ). A theme I repeat often on this blog.

You can zoom out to 5 years and 17% gains over that time (total not per year) until today. Including today the 5 year returns beat the S&P500, GLD, GDX, etc.

Development

Development stage, or Pre-Pre Production Sweet Spot as I like to call it, is usually the abandoned part of the Lassonde Curve where people go to lose money. What made this the exception to the rule? First, until yesterday it wasn't an exception, you were doing poorly as an investor. So the real question is what conditions set up for Gold Fields to make a takeover bid and turn this from a loser to a winner for investors?

Well, it starts with the gold price being +26% in the last 1 year while $OSK.TO was about +0% and gold was +46% in the last 2 years while $OSK.TO was about +4%. If we use post-JV formation May 2, 2023 as the starting point gold was +23% and Osisko was -23%. That's some amazing symmetry of a 46% divergence and ballpark of the takeout premium.

Hunting

What other development stage projects have had a big run up in their underlying commodity with flat or declining share price in the development company stock? Who is the next takeover candidate?