Prospect Generators as Venture Capital

You might wonder what do tech companies and mining have in common? It turns out the answer is that investments at early stages in both follow what is called a power law.

Power Laws vs Other Distributions

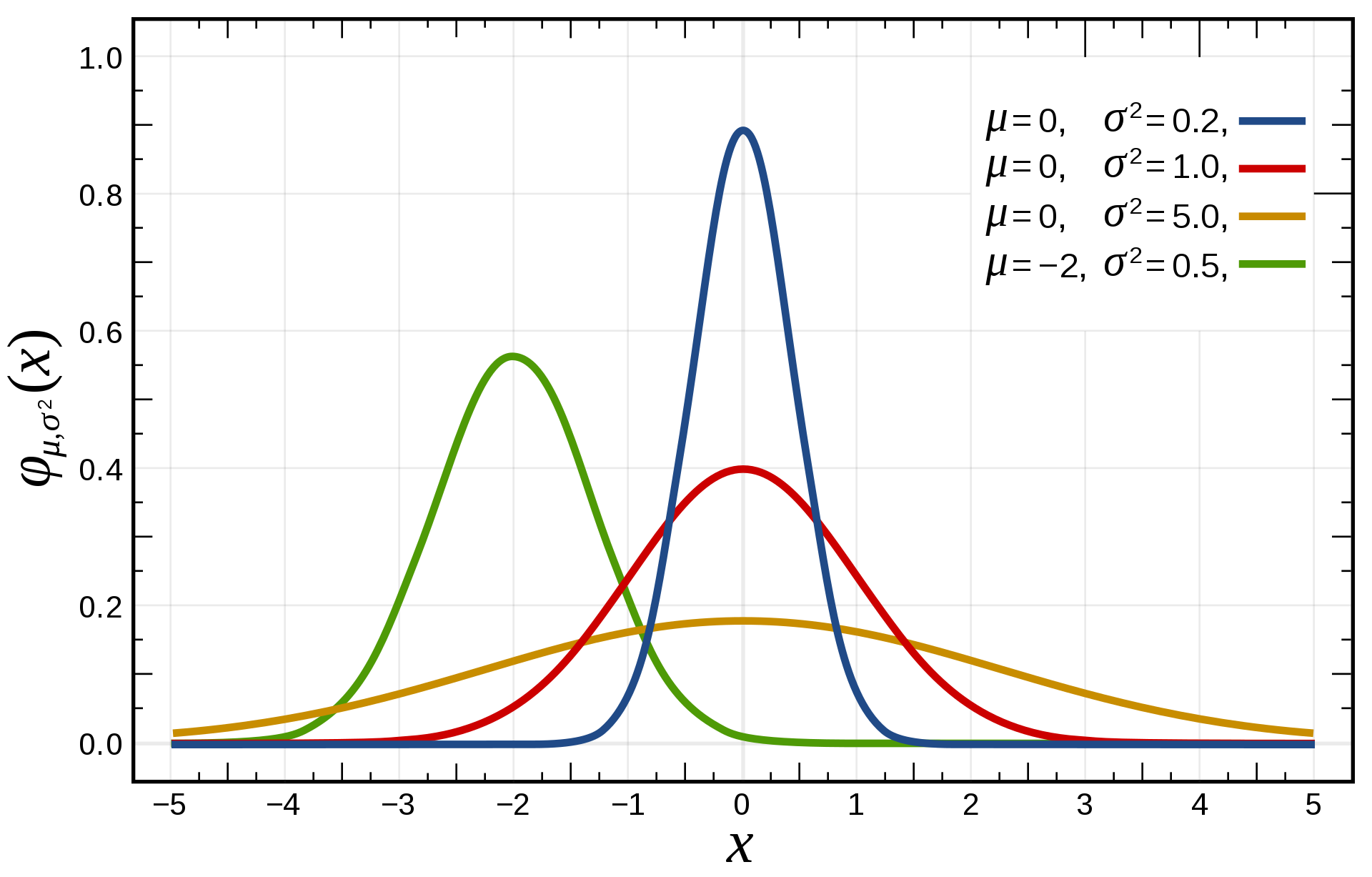

In a normal distribution, also known as a Gaussian distribution things tend to cluster around the average (mean).

If mining followed a Gaussian distribution most mining discoveries would be towards the middle in value. Mining doesn't follow this at all. Instead mining follows a power law distribution where a few very valuable mines completely dominate.

Venture Capital in Technology Companies

Famously Peter Thiel made about $1.1billion from his $500,000 investment in Facebook. That is a 220,000% return.

VCs pick winners only 2.5 percent of the time

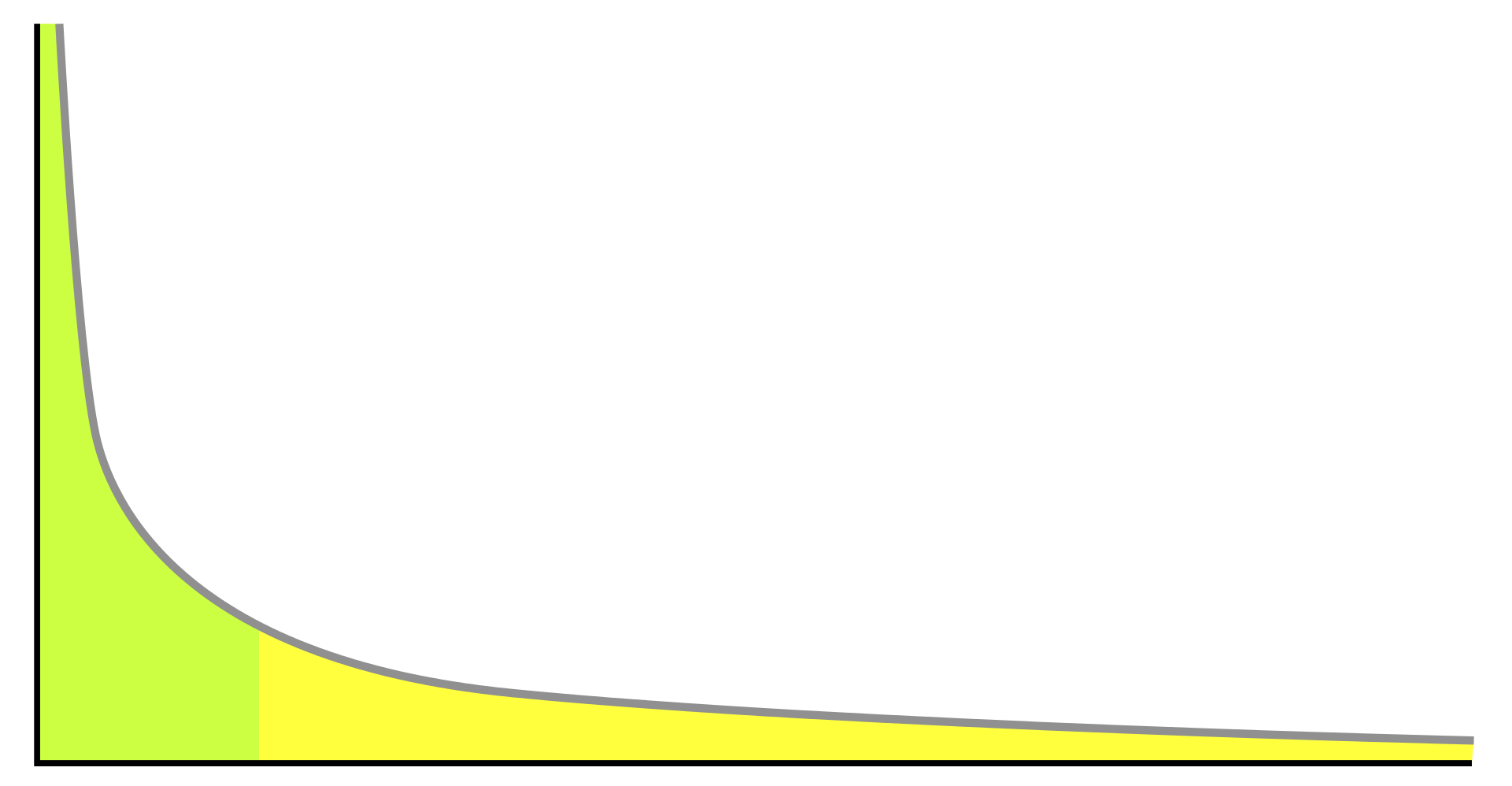

out of more than 4,000 VC investment rounds annually, the top 100 generate between 70 and 100 percent of industry profits

among the very top performing VCs, 4.5 percent of invested capital generates 60 percent of their funds’ returns

The way a power law works is that if 4.5% generate 60% of returns, then within that 4.5% generate 60% of those returns, so 0.2025% or two in a thousand would generate 36% of returns.

The exact numbers aren't important here, what is important are two principles.

- All of your returns will come down to a very small number of wins and a huge number of losers

- To get those huge wins you are going to have a lot of losers

Mining

Copper

In 2021 there was 21,000 ktons of copper mined. 9,344 ktons, about 45% of the total, came from just 20 mines. 6,604 ktons, about 29% came from the top 10 mines. Over 7% came from a single mine (Escondida).

Gold

In Kenorland's Discussing Exploration Risk Video we see that for Canadian gold deposits there is roughly half as many for each doubling in size, at least for the three largest sizes looked at. What I have informally observed is that the value per ounce of a deposit also increases as the deposit size increases, why that is I'll save for its own future post. I believe these combine for an exponential increase in the value of larger deposits compared to smaller ones.

Prospect Generators

If you are a prospect generator your value will eventually come down to a small number of projects, maybe even just one. Let's go through some project generators and see what that starts to look like.

- Azimut Exploration - Has 86 numbered projects on their website. They list 5 different partners. But in the end their corporate presentation only talks about their 100% owned Elmer project.

- Golden Valley / Abitibi Royalties (spinco) - Staked 10 claims and then optioned them to Osisko. Those claims became the Canadian Malartic mine.

- EMX - In my previous blog post on EMX I valued their Timok Cukaru Peki asset as worth a multiple of the companies market cap

- Canadian Royalties Inc - They had the royalty generation model, but their Nunavut Nickel project was what they got taken over for, the others were just rounding error.

- Cornerstone Capital Resources - It's pretty clear that their stake in Cascabel with JV partner Solgold is where the company's value is, and not their other 6 projects.

- Strategic Metals has 11 NSR royalties, 111 wholly-owned properties, 5 joint ventures, & 8 under option. But if Broden IPOs at $6 / share their stake would be around 80% of Strategic Metal's value.

- Salazar Resources has a lot of active expoloration projects and JV properties, but their stake is Curipamba / El Domo is where their stock valuation trades today.

I could go on. Every prospect generator and explorer is like this.