Sailfish Update

The Recent News

Back in February I did a pass through Sailfish Royalty assets. At the time their assets compared favorably to their market cap, and those assets had upside if they continued to move forward in development.

If they had good assets were they and are they a good investment? (full disclosure I have never had a long, short, any position of any kind in Sailfish) Well it's time for an update. If you didn't read the previous deep dive you can find it here:

There is an old saying: "you can drown crossing a river that is 6 inches deep on average."

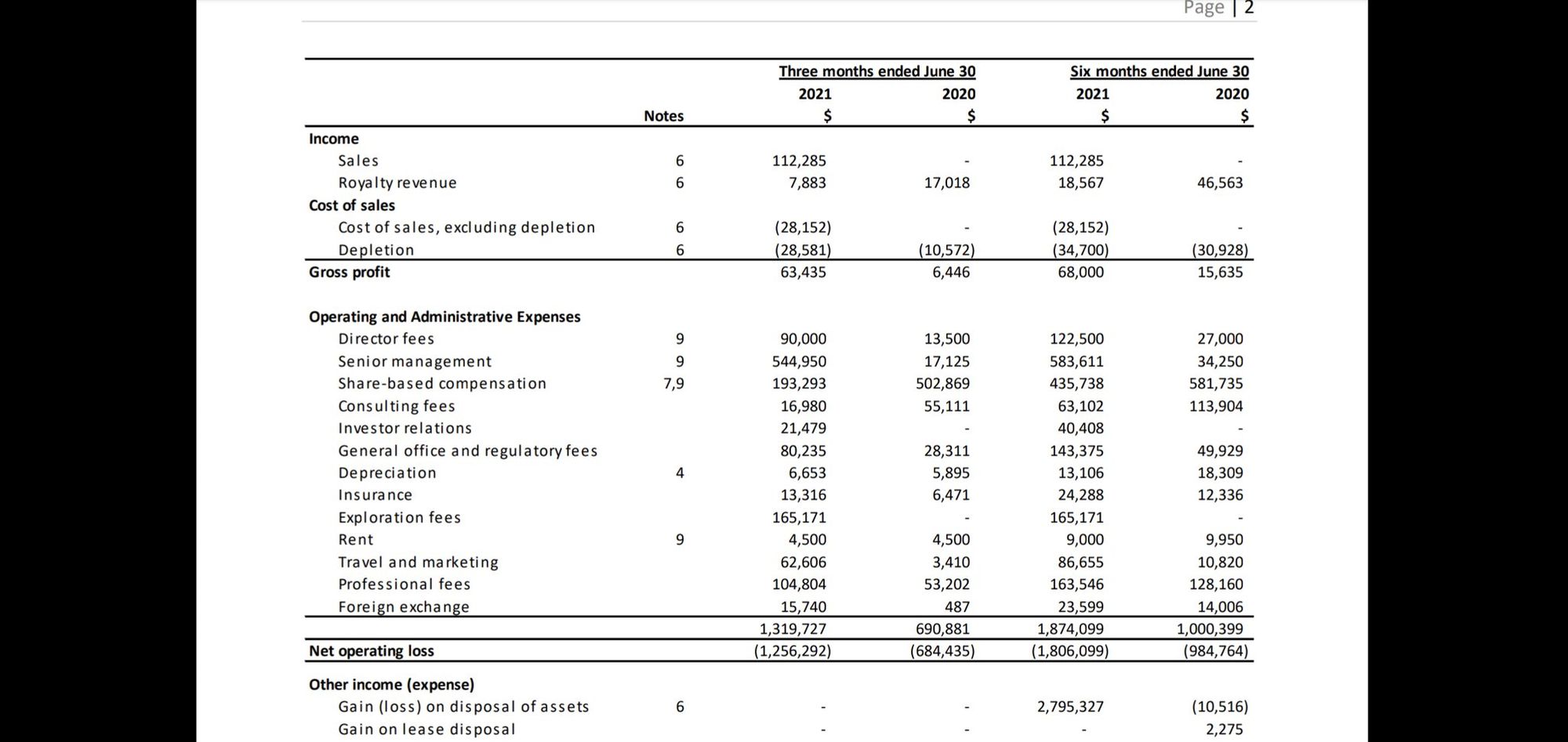

Sailfish doesn't have much cashflow from royalties, but they do have expenses associated with running a publicly traded company.

If you are running a public company with expenses going out and not much revenue coming in what do you do? Well, you could issue more shares to raise funds or you could sell assets and use cash to pay the bills. Sailfish sold their Tocantinzinho royalty for $19m.

Before the sale I had valued the royalty at $110m if it was in production and had discounted that to $70m because it was still a late stage development asset. Immediately I thought that Osisko and Metalla, each of which bought half of the royalty, got a good deal and Sailfish was selling the goose that lays the golden egg.

Well, then it gets worse for Sailfish. Gmining Ventures ($GMIN.V) acquired the project. Gmining Ventures is the team behind Gmining Services, who build some successful mines for other companies with 100% on budget and 66% under budget and 100% delivered on schedule or earlier. I guess they got tired of the companies they were building the mines for get most of the results of their hard labor and decided it might just be easier to build mines for themselves.

This is a reminder that Tocantinzinho is fully permitted and shovel ready. Gmining is going to update the feasability study for how they want to build the mine and then get to building it right away. It's a straightforward open pit project. Exploration is open at depth and there is 688km2 land package.

Anyway, back to Sailfish. With this royalty sale my quick valuation of their assets drops from $176m to $106m. Their balance sheet improves by $19m minus any continued cash outlays exceeding revenue.

Before this transaction an asset based valuation made Sailfish interesting as an investment. A cashflow valuation required some faith that management could bridge the current lack of cashflow until the assets produced adequate cashflow. Now there is more cash in the bank to help form part of that bridge, but the asset based valuation is lower.

Lessons For Royalty Companies

Royalty companies need royalty/streaming cashflow

For royalty companies a lot of the value they create in royalties comes from exploration and development stage assets. But you can't eat future profits. Cashflow gives companies a low cost source of capital for reinvestment and returning cash to shareholders. A reliable source of cashflow also covers operating costs and lowers borrowing costs. Wheaton Precious has an average interest rate on their debt of 1.24%. Meanwhile, Elemental Royalty borrowed $25m for two years at variable rate with 10% minimum rate and had to issue 2.75% upfront in company shares as a kicker.

Royalty companies need to reach a certain scale

They need to be large enough that their operating, administritive, and other costs are small relative to their revenue. If they don't have that in place already you have to believe they have a plan to get there through future revenue growth. When they are still sub-scale they will have to sell assets, issue shares, and/or be extra clever just to continue to survive. Or if revenue just covers those expenses there isn't a lot leftover for reinvestment or returning to shareholders.

Royalties Are Better Than Project Assets

The 1.5% royalty on this project sold for $19m when there was no active advancement of the project, with the Gmining project purchase it would already sell for more than that today. I had valued it at $70m at the time and said it was worth $110m once it was in production. It costs nothing to maintain. Any exploration is free and adds ounces and future cashflow.

Meanwhile, Eldorado paid $120m for the project, then invested another $90m in development. Gmining paid $50m upfront ($20m cash, $30m shares) and will pay $60m one year after the start of commercial production. $110m total. So assuming this goes well and becomes a mine Eldorado would have lost $100m on the project. I think it would be difficult to name a royalty anywhere in the world that has lost $100m.

For Gmining they got to pay $110m for the project ($50m upfront, $60m later). The statup-up Capex is $442m, the sustaining capex is $151m. The NPV5 of the project is $409m of the 10 year mine life. So Gmining fronts $552m in order to earn a potential profit of $409m over probably the next 13 years. They take all the risk of any schedule slips, budget overruns, etc. They pay for any future plant expansions, exploration, or other unanticipated costs. They do have some upside potential with underground development below the current planned pit, exploration of potential satellite deposits, plant expansions, etc. But all that upside also comes with additional capital requirements.