Physical Copper vs Miners

One of the things I've gone into in several ways in great detail on this blog is that on average within a given commodity the royalty companies outperform the physical metal which outperforms the large miners which outperform the junior miners. See for example these couple entries:

It's pretty easy to show this in gold as there are lots of gold royalty companies, good physical metal ETFs, and indexes of large and junior gold miners. Silver there aren't really pure-play silver royalty companies (Wheaton has both silver and gold exposure) but there are good physical metal ETFs and indexes of large and small junior silver miners.

Well, what about other metals?

Copper

So, what about copper? Does the royalty vs physical vs large miner vs small miner hierarchy hold?

On the royalty side there aren't as many copper royalties and those few that exist tend to be held by royalty companies that get a small percentage of their revenue from copper. For example Franco Nevada owns some royalty on Lundin Mining's Caserones mine but Franco Nevada gets most revenue from gold on other royalties.

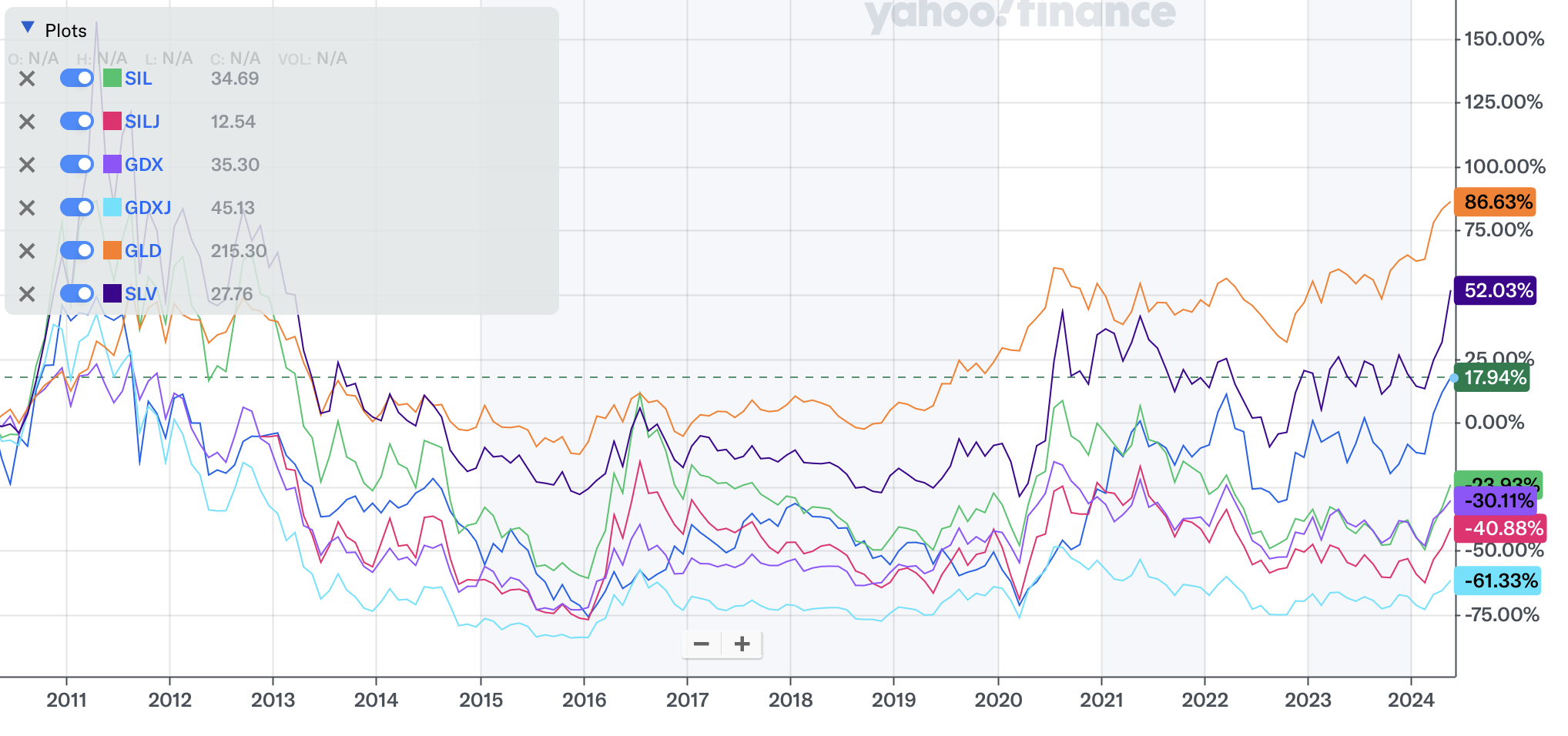

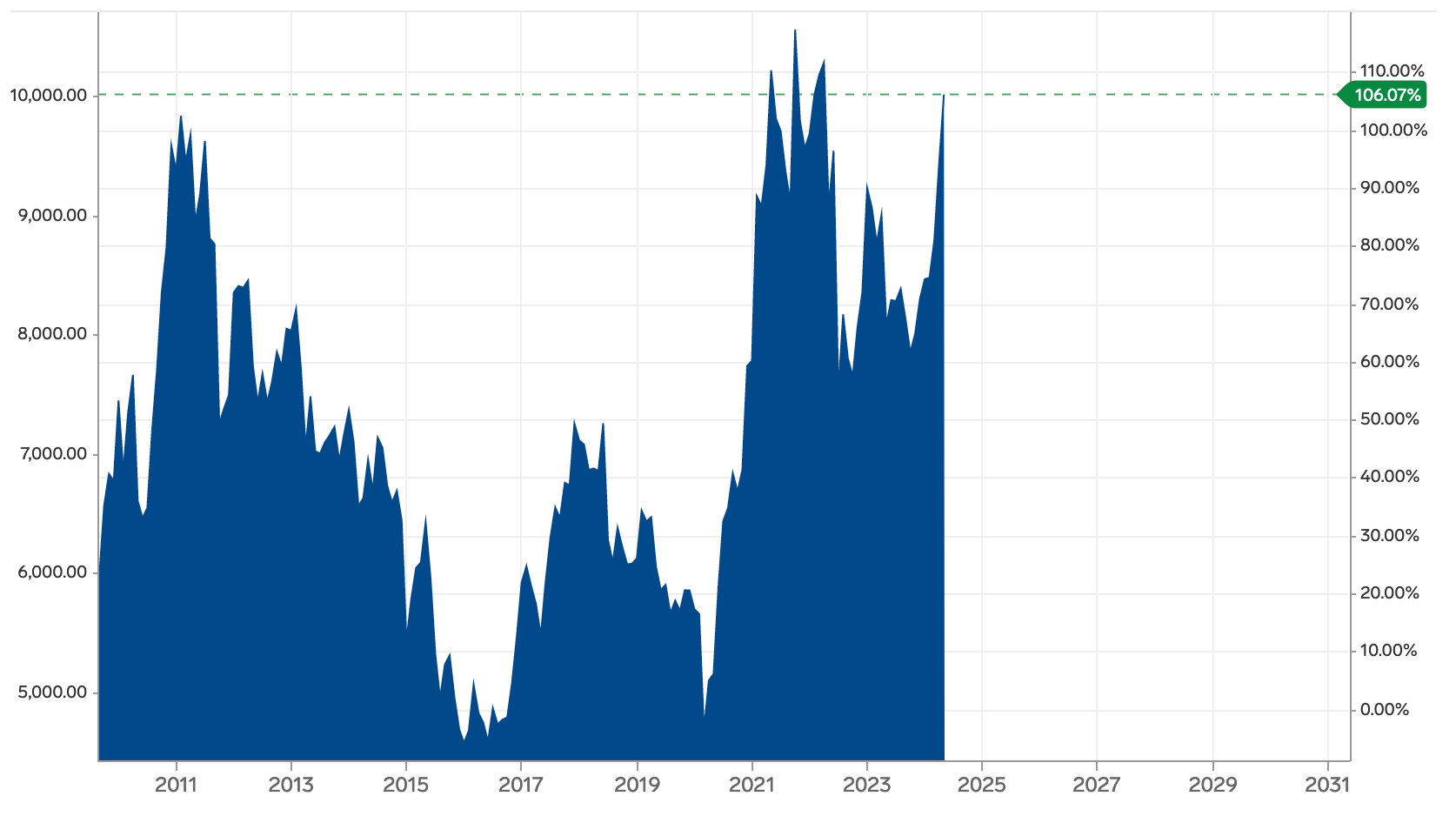

I made a quick chart of $COPX the main copper miners ETF. It started in April 2010 and today is +17.94% above where it started over 14 years ago. If we made it an even 14 years back a couple month ago it would have been +0%, which is pretty awful as 14 years of inflation would have made the purchasing power very negative. Well, it's pretty awful unless you compare it to the gold and silver mining indexes which were strongly negative over the same timeframes.

What happened to physical copper over that timeframe? It was +66% moving from roughly $6,000/t to roughly $10,000/t (with some brutal drawdowns in-between). The physical metal outperformed the miners again in this commodity. The miners also had way worse drawdowns (though the metals was bad too) going from +48% to -75% over 5 years at the worst.

The pattern that starts to emerge is that over the 14 years physical copper +66% would have come in right between physical gold and physical silver. It outperformed the copper miners index. Of note is that the copper miners index while basically breaking even way outperformed the gold or silver miners indexes of all sizes.

This is limited evidence that supports the pattern in other commodities holding for copper. What we do see here is that copper mining while still a terrible business on average is less terrible than gold or silver mining. We can speculate about why that is, but on the top of my list would be the average long mine life of copper mines and the relatively large market size leading to less violent swings in supply.

New Copper Vehicles

Up until now you either had to trade the copper miners index $COPX or try to trade copper futures; trading futures is quite daunting for retail and even professional investors.

New Mining Funds Including Junior Copper Miners

Sprott is busy launching a bunch of new ETFs with commodity specific miners and physical metals. See for example this round that adds a copper miners ETF $COPP to their copper junior miners $COPJ.

https://sprottetfs.com/media/6992/press-release-sprott-launches-copper-miners-etf-03-6-2024.pdf

While there are some reasonable companies in some of these ETFs, the junior copper miner ETF has ERO and Amerigo for example, by and large I am looking at these to follow the long term pattern of miners underperforming the commodity. This makes shorting these indices like $COPJ a good hedge for being long particular names.

Unfortunately I don't expect shorting $COPJ to be as helpful to an overall portfolio as shorting $GDXJ and $SILJ. There just aren't enough terrible copper companies that get funded so the indices have to include some profitable companies in their junior index.

Physical Copper ETF

I haven't read the prospectus on the physical metal trust yet, but assuming reasonable management fees it is likely a better vehicle to express long copper views than the large miners indices or junior miners indices.

If backtesting is any guide, and who knows because the future is unpredictable, this physical copper trust will likey outperform $COPX, $COPP, & $COPJ. That doesn't mean it's a good long term investment. Holding metal just incurrs management fees and doesn't produce any cashflow. In order to make money here you have to time your entry and exits and be right.

Copper Royalty

Unfortunately there isn't a great copper royalty company. However, if you already are interested in holding gold royalty companies you can slant your gold royalty portfolio towards copper.

$EMX currently has 34% of revenue from copper, 37% of royalty revenue.

Horizon Copper $HCU.V is a bit messy. It's three big assets are at best complicated. Antimina is a profit interest not a royalty, and it has an artificial silver stream to Sandstorm on it. Hod Madan is also a 30% equity interest and also has an artificial gold stream to Sandstorm on it. Oyu Tolgoi is a 25% profit interest in part of the mine. They also have a huge debt to Sandstorm that is multiples of their current market cap.

$ELE.V - They have some royalty on the producing Caserones copper mine and the Arizona Conoran Cactus development project.

Altius has some copper royalties but doesn't break them out separte from other battery metals.

Ecora has 33% copper according to analyst NAV.

$MLZAM.PA also known as $ZCCM.IH was discussed in some depth in the hidden royalties section. If you like being a minority shareholder to a recently bankrupt state and don't mind if financials are filed on time the napkin math is pretty good. As much as investing in junior mining is unsafe this is way more unsafe. Unsafe but interesting.

Summary

Sprott brining out three new copper ETF vehicles and several royalty companies increasing their exposure to copper is good for investors.