Tax Loss Selling & Commodity Cycles

Most tax loss advice goes like sell stuff you are down on to offset your gains. It's pretty straightforward and there's lots of people who write about it. That's not this article.

This article is going to look at the overlap of commodities that are down resulting in stocks that are down that set up end of year tax loss selling, which I may want to buy.

So let's look at catching some double falling knives and being someone else's exit liquidity. Caveat Emptor, buyer beware. This is proper degen stuff that on average will lose you money.

Iron Ore

Despite iron ore being -22% year to date this has the subjective feel of being early. Slowing China demand and Simandou expected to start production in 2025 doesn't paint a bullish picture. Still, it's maybe the case that the pessimism has already worked it's way through the stock prices and it's worth looking at. While not jumping in with both feet at least dipping some toes in the water and starting some starter positions so you are ready to move when the market goes fullly despondant.

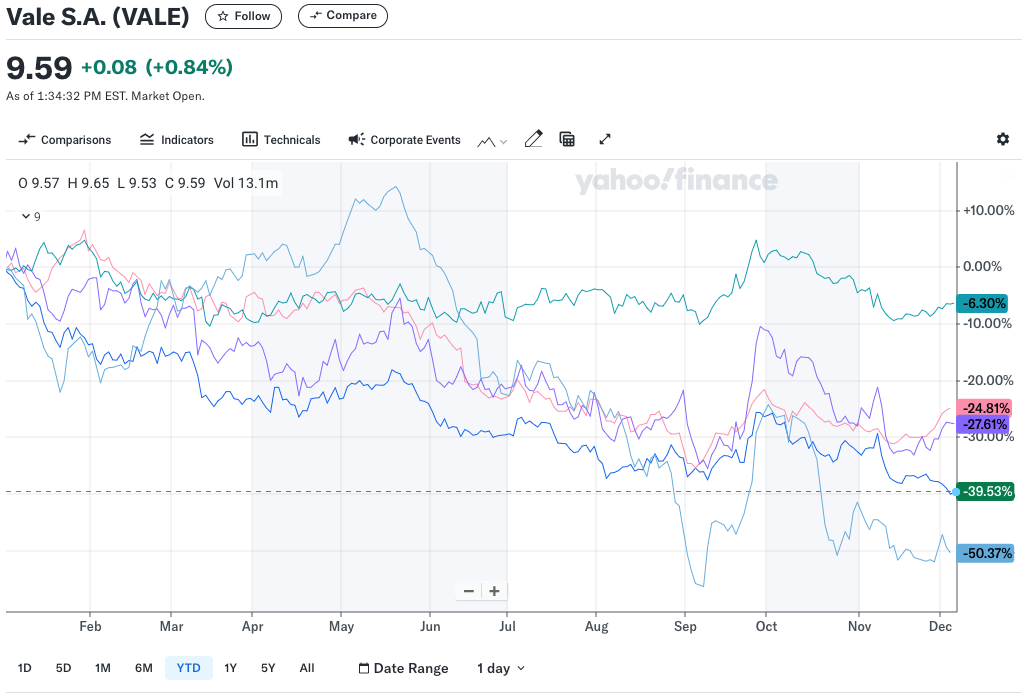

$DRR.AX Deterra Royalties is 24.81% year to date. They have a royalty on Mining Area C, a long life low cost mine run by a major. They also got beat up when they acquired Trident Royalties, a company we've written about previously who among other things have a royalty on the in construction Thacker Pass lithium mine. I've dipped my toe in the water and established a half position here.

$VALE has been absolutely killed here at -39.56% year to date. I really like their high grade low cost assets in Brazil and their potential in Vale Base Metals to expand into more copper, likely spinning those assets out into a seperate company at some point. I've owned the stock before at higher prices than this and am seriously consdering adding them to my portfolio again.

$CIA.TO Champion Iron are one of the best run non-majors. Being -27.61% year to date has put them back on the radar. $LIF.TO Labrador Iron seems to have not noticed there is a rout on in iron, but I continue to monitor them as one of the quality names I'd like to buy if it ever does go on sale. $MIN.AX Minres is -50.37% year to date having gotten killed in lithium, having high cost iron assets, having some scandals, and being highly financially leveraged. Minres is one I'm not interested in as a long term hold, but that kind of price drop gets your attention.

Lithium

OK, I was early to lithium after a lot of commodity price drop, but before the pain was nearly as deep as it is now. But now we have a lot of mines closing and a lot of companies delaying construction on new capacity. It feels like if you can survive at these spot prices you will survive.

Atlas Lithium $ATLX got their permits and built a plant in South Africa, but never released a study so they are -71.23%. I held for part of that loss.

$PMET.TO Patriot Battery Metals just got crushed (-61.71% YTD) by low lithium prices making development projects less attractive. On my shortlist to watch and given the massive drop on a lot of people's end of year tax loss sell lists. One of the largest spodumene resources in the world and with good DMS recoveries, good access to cheap electricity nearby, on the downside pretty remote for transportation.

$SGML Sigma Lithium -53.15%. Profitable at these prices and got subsidized government debt for expansion, but poor corporate communication and low prices have hurt this one. I held for part of that loss.

$LAAC Lithium Americas Argentina -50.24%. First quartile cost evaporation brine in Argentina JV with Ganfeng. Some slower startup than planned. I've traded around a full core position.

$PLS.AX Pilbara has in my opinion the second best operating spodumene mine in the world. -33.24% year to date. They also bought a decent development project in Brazil. I don't have a position but good asset plus good management often works out well for shareholders.

$LIRC.TO Lithium Royalty. -29.69% year to date. This is currently my largest position in my portfolio.

Copper

Copper is actually up for the year and down only slightly for the last 6 months. But I'm still bullish on copper.

I started a half position in $ERO ERO Copper. They reported a sub-par operational quarter but the issues seem like delays and not permanant shifts. I had sold at higher prices after their new copper project hit first production. The stock is -22.48% in the last 6 months, and more than that from my exit price in September.

$HCH.AX $HCH.V Hot Chile is also one of the rare copper companies significantly down at present. It seems like a project with legs and the market for acquiring development projects seems to be heating up.

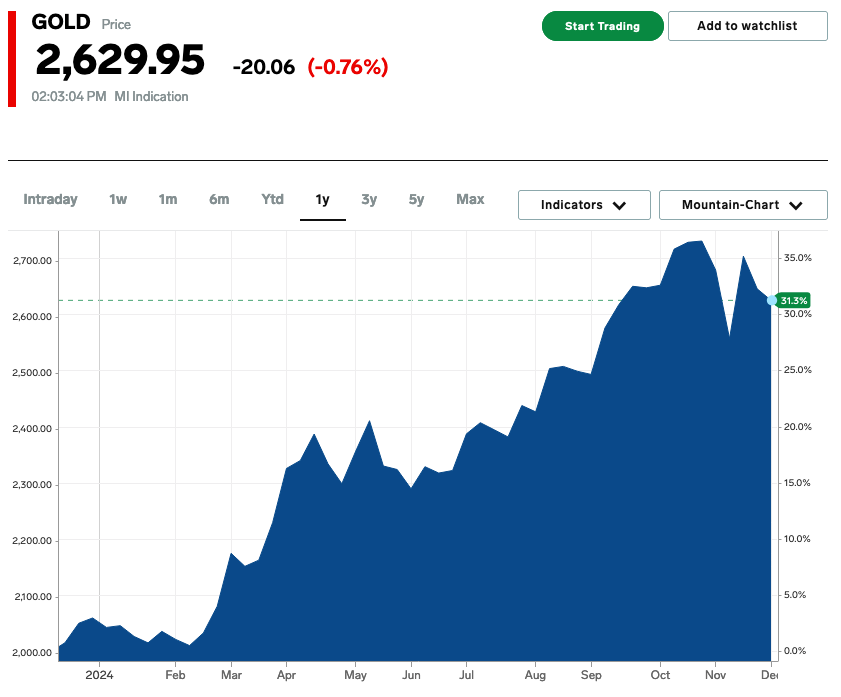

Gold

Sorry guys, if your gold stock it down its company specific and not commodity cycle related. Maybe it's still worth a buy with tax loss selling, but probably not my game.

Share Yours

What are your stock ideas to buy cheap during tax loss season? Post on X and tag @latinmines with your idea and your reasoning.