The Adina District

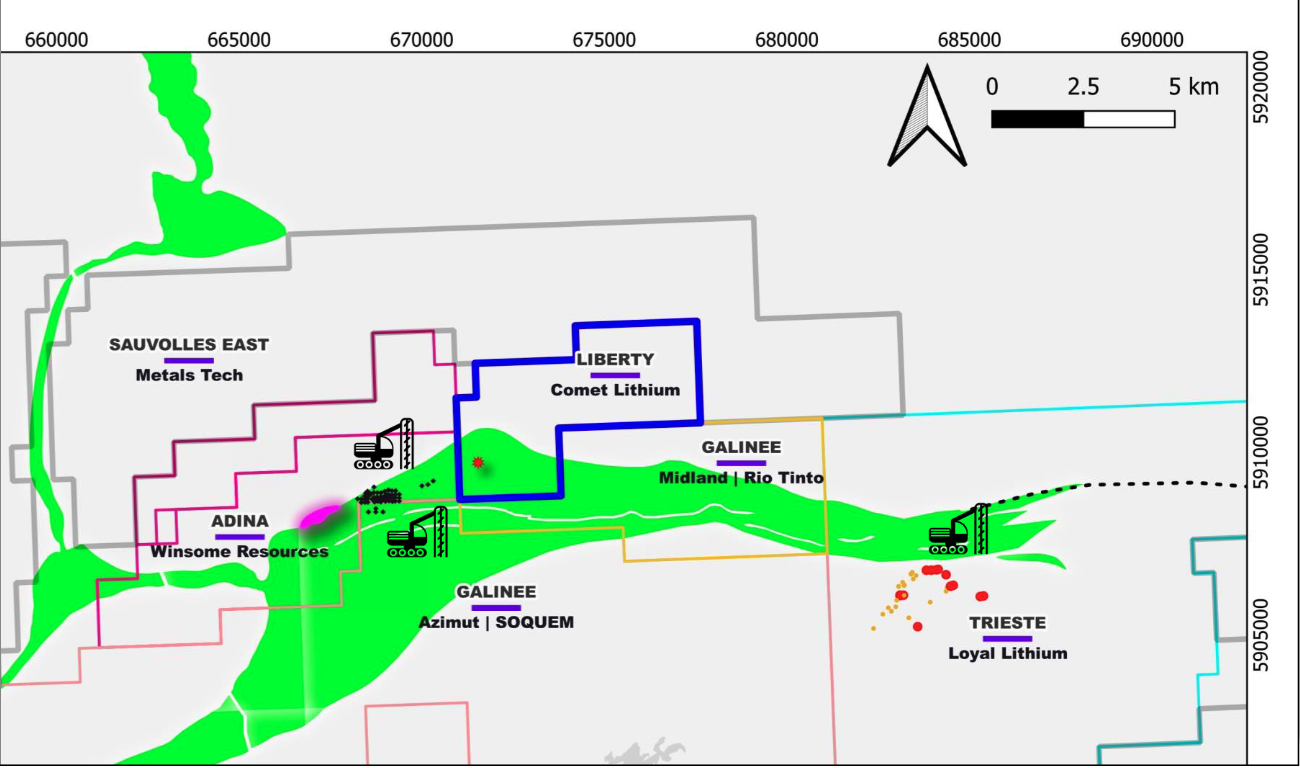

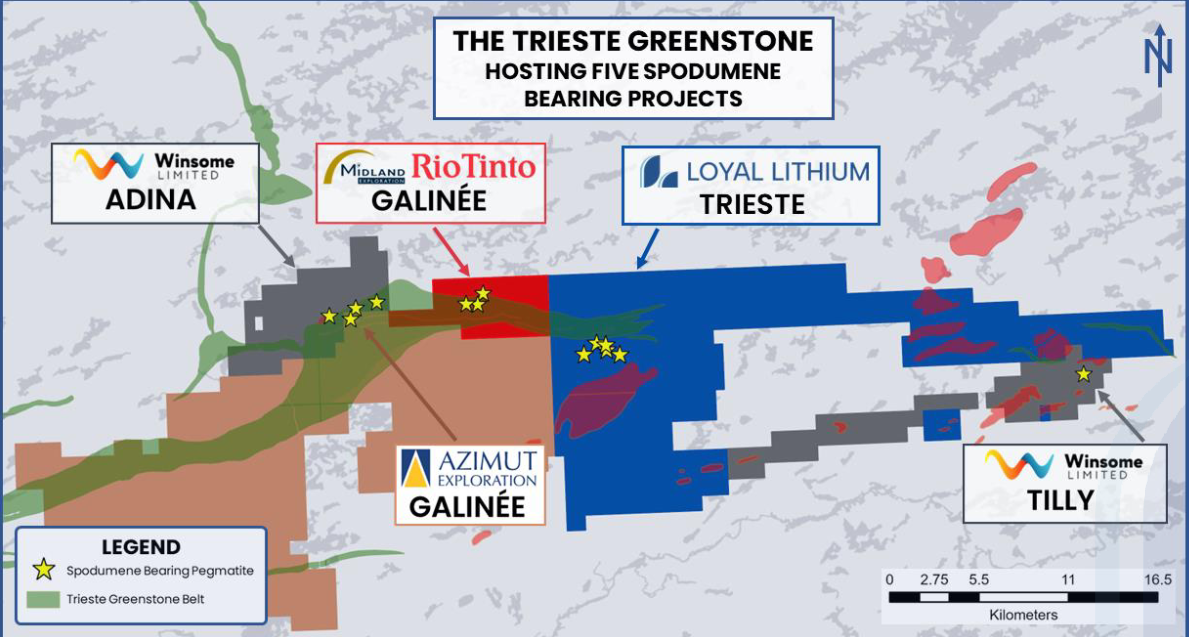

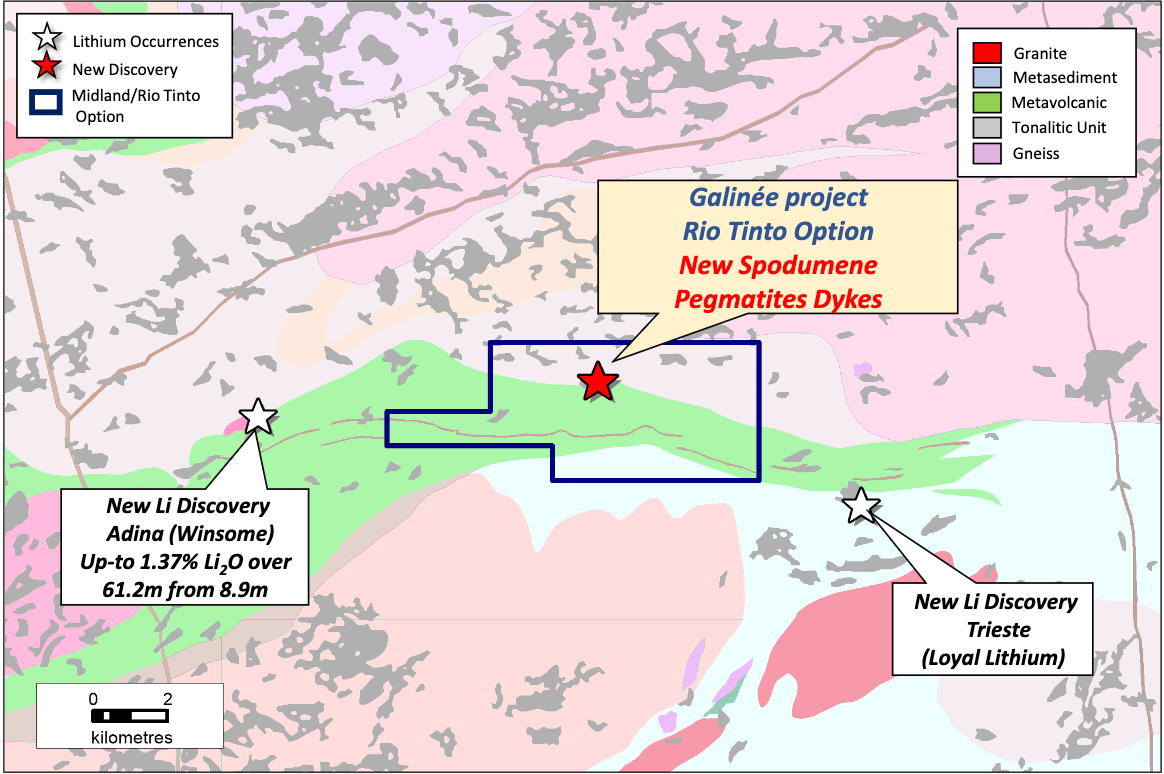

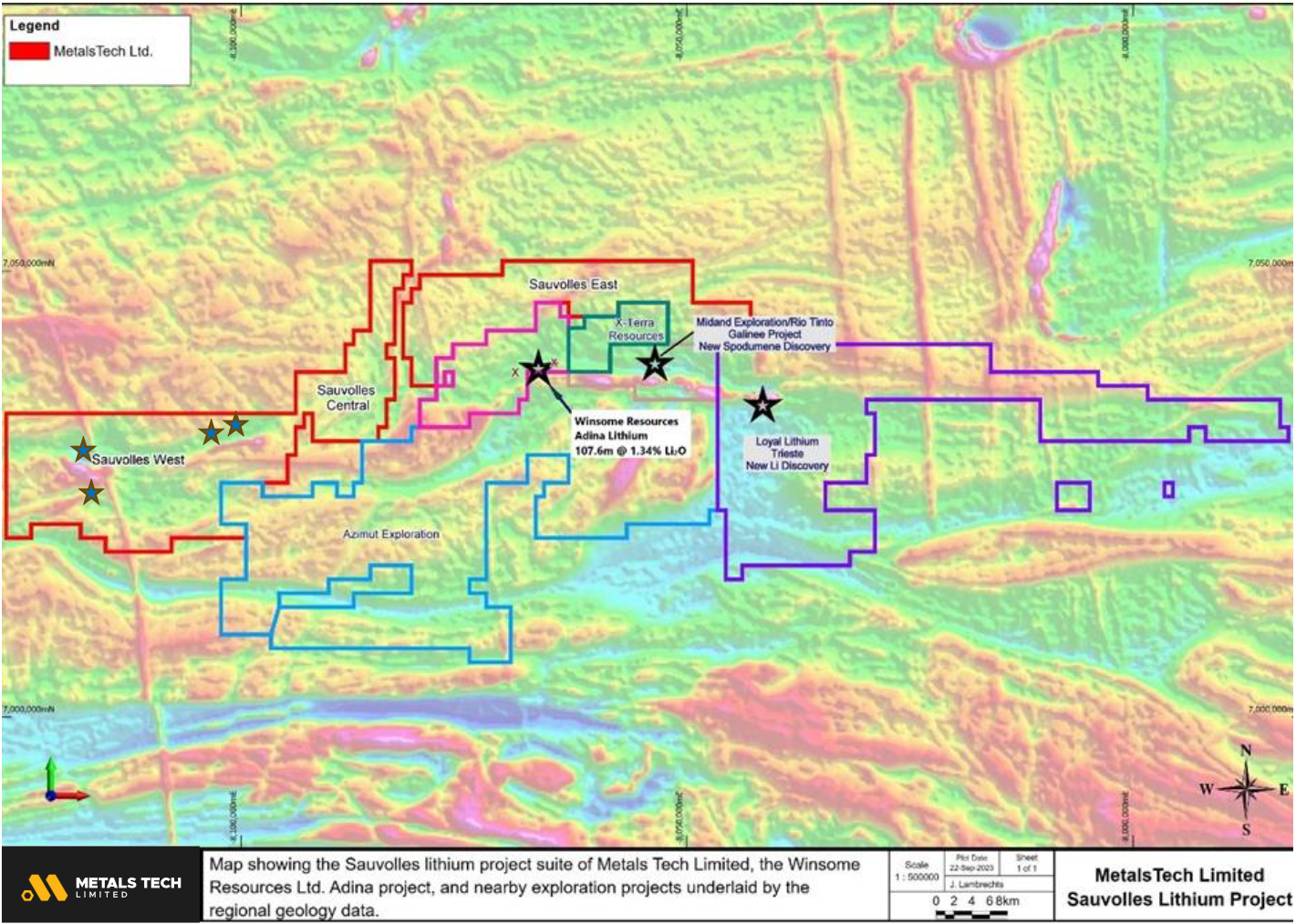

James Bay is quickly becoming a lithium spodumene region. I'm going to zoom in on some of the emerging districts, starting with what I'm calling the Adina district. It's basically the Adina project and surrounding projects.

Pros

- Early met work from Wnsome indicate circa 75% DMS recoveries. DMS much less capex and faster build than flotation.

- Permittable

- Arcadium (Allkem) permitted James Bay, it's a resonable well understood process.

- Critical Metals Flow through and other tax advantages.

- Access to US IRA market through free trade agreement could mean premium price versus China spot.

- Stable rule of law

Cons

- Poor infrastructure

- 50km from any road.

- farther to power

- 400km from rail

- Non-consolidated

- The district is owned by several companies, making coordination hard for things like road/power infrastructure.

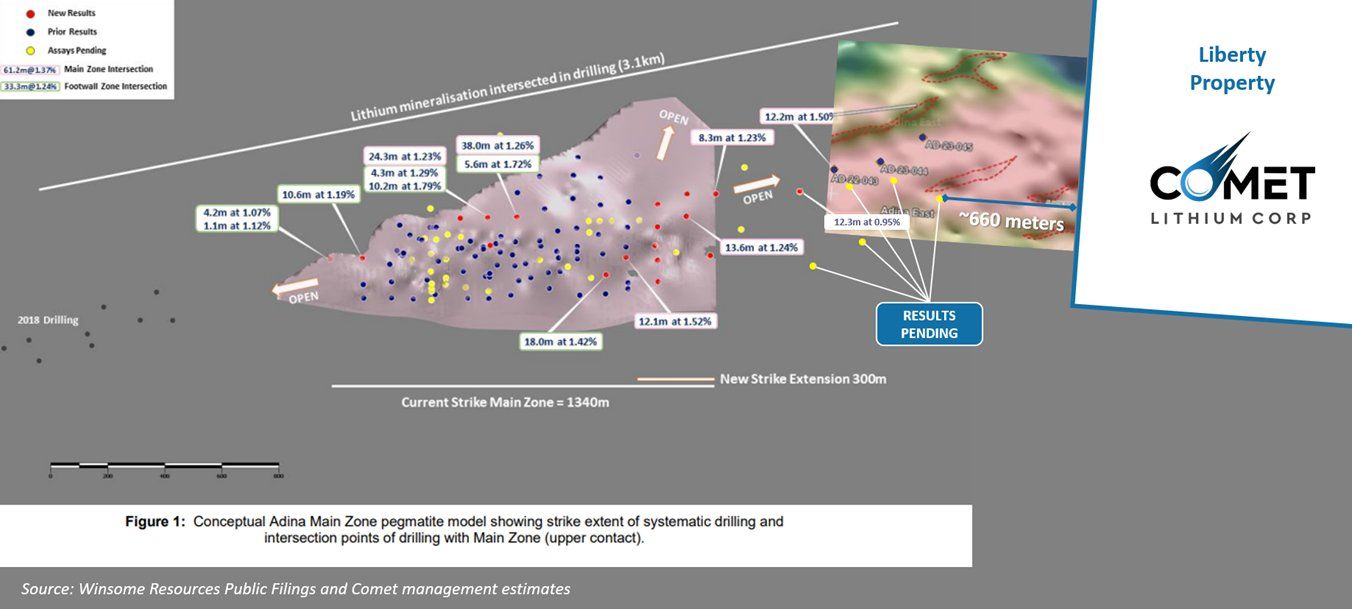

Winsome Adina

Market cap circa AUD$124m

This is the anchor to the district with 59Mt 1.12% Li2O and expanding with several drill rigs turning. Also circa 75% DMS recoveries in early met work.

Can they get to 100Mt without consolidating one of their neighbors?

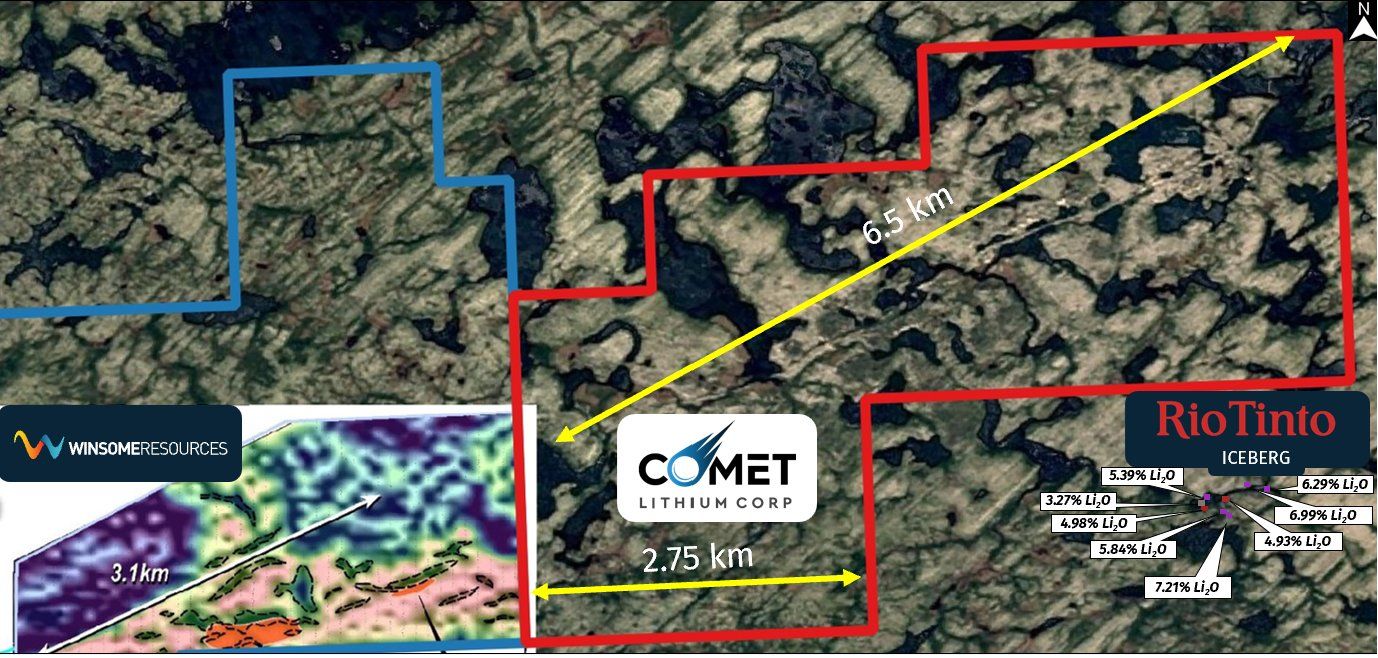

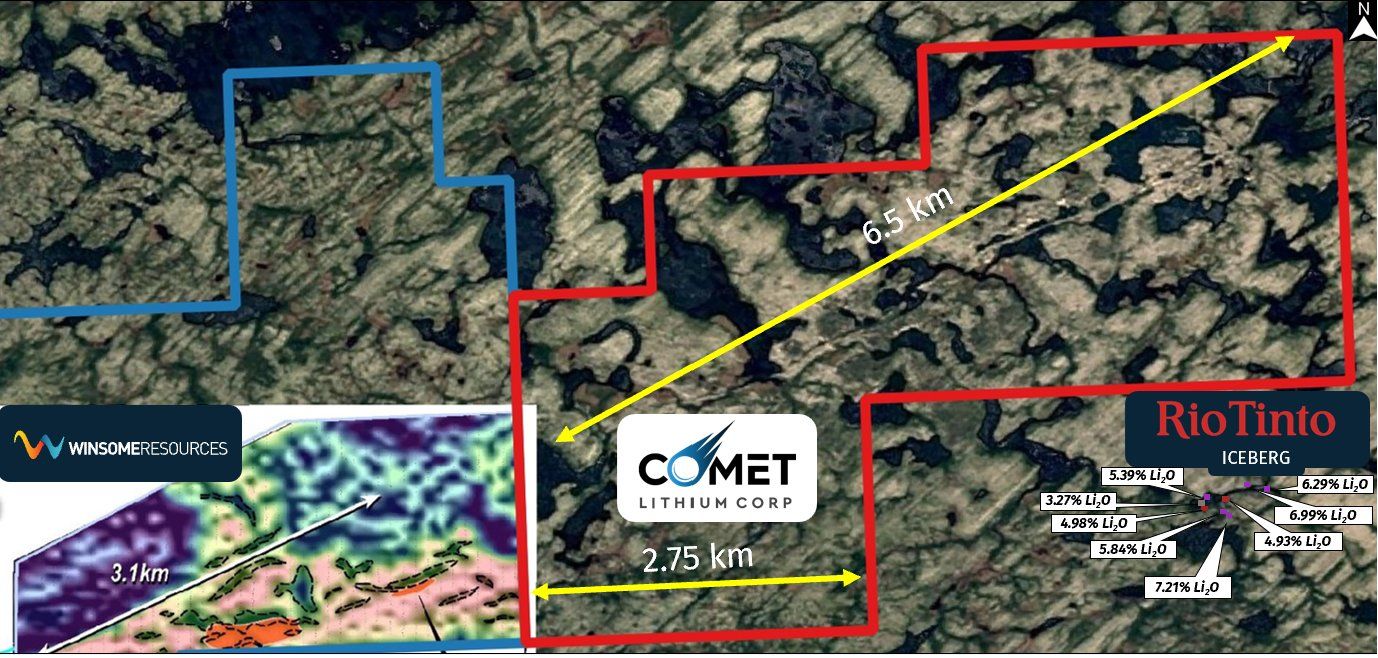

Comet Liberty

Market cap circa CAD$11m

Immediately to the East of Adina

Vincent Metcalfe was a founder and CEO of Nomad Royalty and sold the company to Sandstorm for approximately half a billion dollars. He's now the chairman of the board and CEO of Comet Lithium. Vincent Cardin-Tremblay also joined as VP of exploration. Both participated in the recent private placement.

Upcoming drill program.

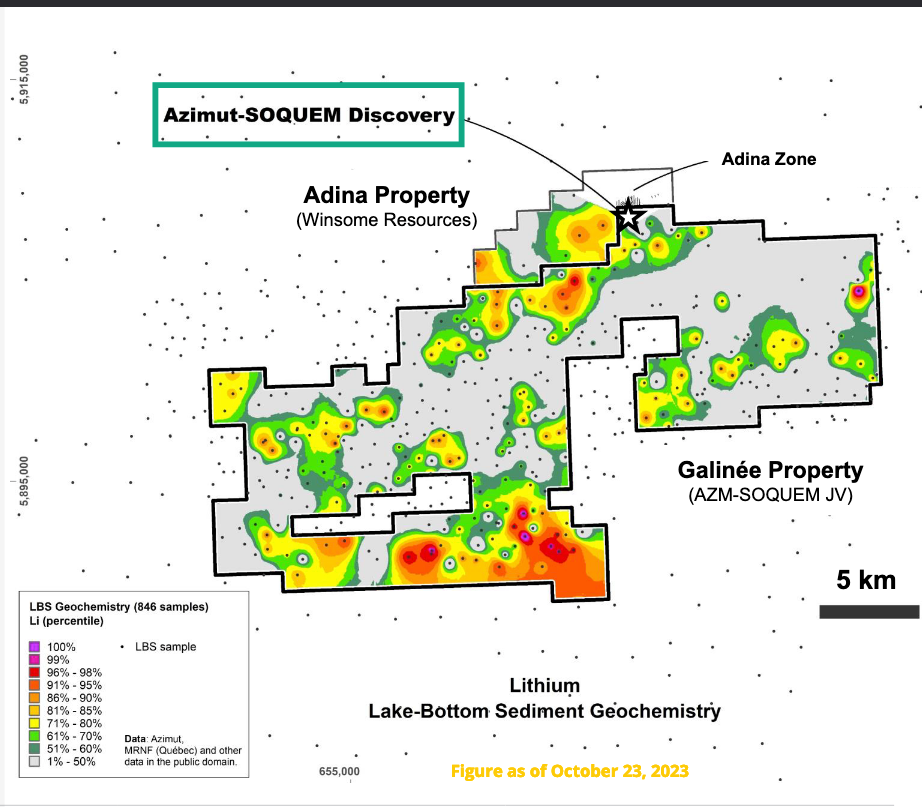

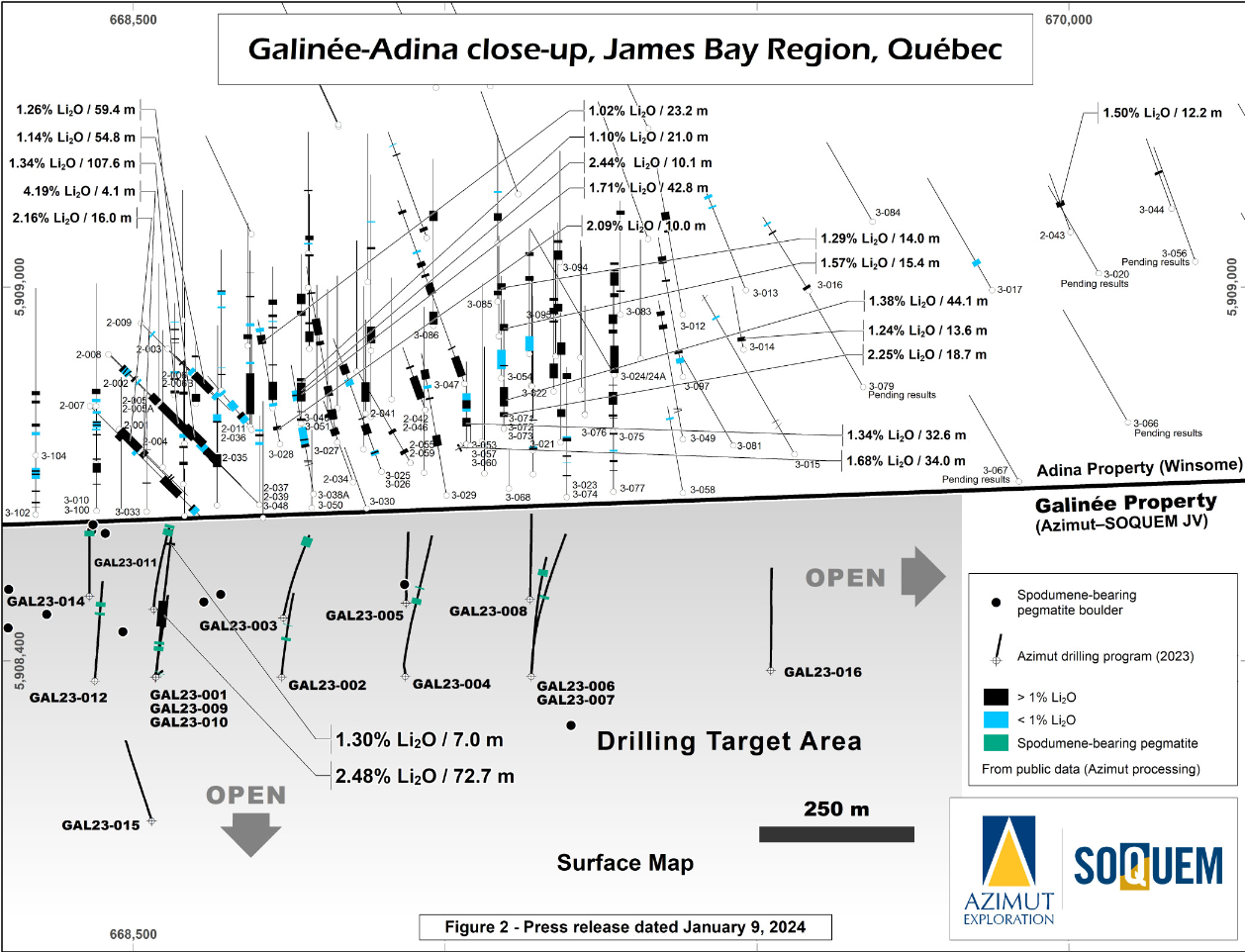

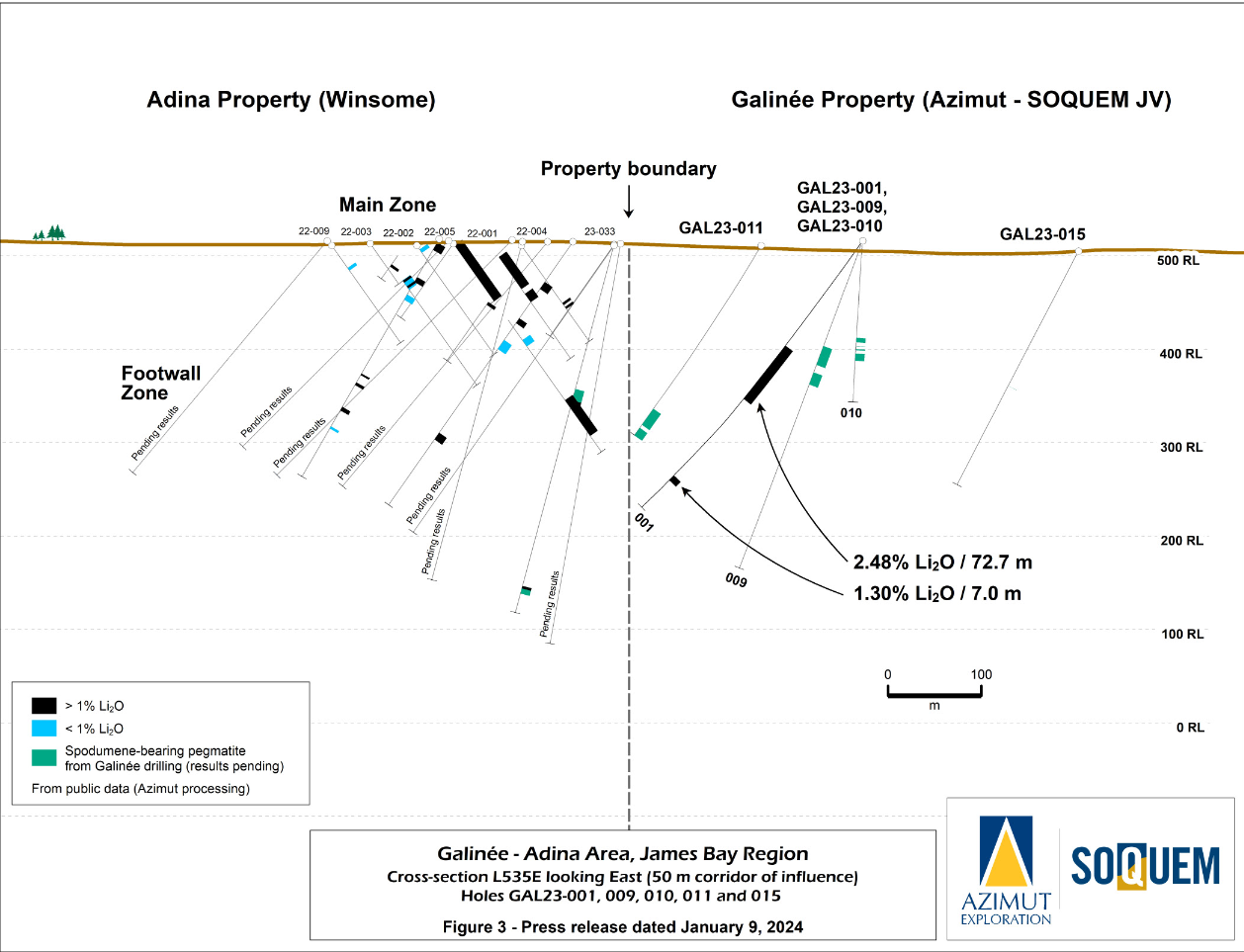

Azimut/SOQUEM Galinée

Azimut Market cap circa CAD$54m

Immediately to the South of Adina. Like you could stand on the edge of the Adina resource and throw a rock and hit Azimut's drill rig immediately south.

Right before I hit publish Azimut published their first assay:

Hole GAL23-001: 2.48% Li2O over 72.7 m (from 139.5 m to 212.2 m) including:

3.38% Li2O over 18.0 m (from 174.0 m to 192.0 m)

3.27% Li2O over 12.7 m (from 199.5 m to 212.2 m)

1.30% Li2O over 7.0 m (from 323.4 m to 330.4 m

Other visuals show:

Hole GAL23-006: 11.6 metres (from 216.8 m to 228.4 m, incl. a 0.8 m fault gouge from 222.2 m to

223.0 m): 5% to 30%-40% coarse spodumene crystals.

Hole GAL23-007: 12.3 metres (from 228.7 m to 241.0 m): generally less than 5% spodumene but

including a spodumene-rich interval (20%) from 234.45 m to 235.0 m.

Hole GAL23-009: 21.5 metres (from 120.3 m to 141.8 m): 10% to 15% coarse spodumene crystals

14.0 metres (from 150.4 m to 164.4 m): 15% to 20% coarse spodumene crystals

13.8 metres (from 345.0 m to 358.8 m): 5% to 30% spodumene.

Hole GAL23-010: 4.85 metres (from 104.15 m to 109.0 m): less than 5% spodumene

1.10 metre (from 116.4 m to 117.5 m): less than 5% spodumene

7.65 metres (from 121.2 m to 128.85 m): up to 7% spodumene.

Hole GAL23-011: 31.6 metres (from 203.6 m to 220.1 m, incl. 3.95 m of amphibolite from 231.95 m to

235.9 m): 15% to 25% (locally up to 60%-65%) coarse spodumene crystals.

Hole GAL23-012: 7.4 metres (from 186.6 m to 194.0 m): 15% to 20% coarse spodumene crystals

12.7 metres (from 210.5 m to 223.2 m): 25% to 30% coarse spodumene crystals.

Pure spodumene is 8.03% Li2O, so 20% pure spodumene would be 1.6% Li2O, so it's entirely possible some of these intersections are >1% Li2O. Better to wait on assays as visual percentages are not super accurate and spodume in the wild is not pure.

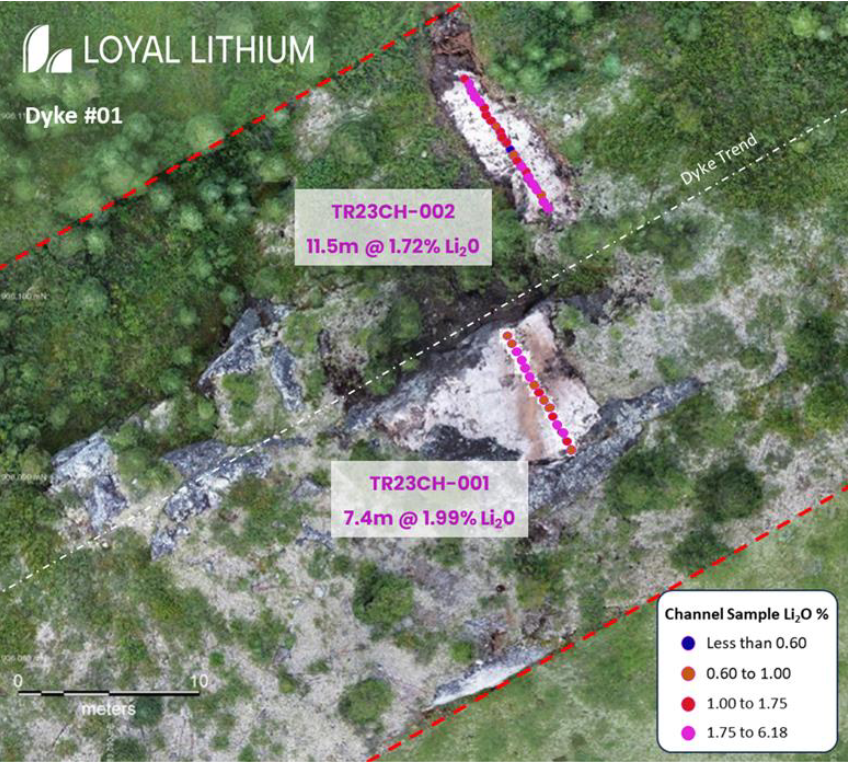

Loyal Trieste

Market cap approx AUD$24m

Trench assays are in

11.5m at 1.72% Li2O at Dyke #01: TR23CH-002 a partial cross section of dyke

▪ Incl. 2.5m at 2.31% Li2O

▪ and 3.6m at 2.03% Li2O

7.4m at 1.99% Li2O at Dyke #01: TR23CH-001 a partial cross section of dyke

▪ Incl. 1.9m at 3.63% Li2O

▪ and 2.0m at 2.25% Li2O

5.0m at 2.39% Li2O at Dyke #01: TR23CH-003 a partial cross section of dyke

▪ Incl. 3.5m at 3.16% Li2O

21.0m at 1.01% Li2O at Dyke #04: TR23CH-004

▪ Incl. 1.0m at 5.44% Li2O

▪ and 1.0m at 4.82% Li2O

12.0m at 0.62% Li2O at Dyke #05: TR23CH-005 a partial cross section of dyke

▪ Incl. 2.0m at 2.16% Li2O

Drill assays are still pending, but hit wide intervals on Dyke #01. Not true widths, but combined with the channel samples there's a good chance true width is 20m+.

o 74.77m of spodumene bearing pegmatite - DIS23-014

o 30.44m of spodumene bearing pegmatite - DIS23-011

o 27.96m of spodumene bearing pegmatite - DIS23-004

o 26.74m of spodumene bearing pegmatite - DIS23-006

o 24.22m of spodumene bearing pegmatite - DIS23-005

Core photos are pretty great. Combined with the trench samples this could be a banger.

Midland / Rio Tinto Galinée

Midland circa CAD$24m market cap

Rio funded grab samples identifying the Icerberg Pegmatite. Drill program planned.

Outcrop photos show large crystal sizes. When combined with the DMS met work from Winsome Adina and the proximity of the discovery it's quite possible that it will be processable with DMS.

Assay results have been received for the 26 samples collected at the Iceberg lithium discovery. High-grade grab samples returned up to 7.2 % Li2O, including 6 samples grading between 5.0 % Li2O and 7.2 % Li2O, 6 samples grading between 3.0 % Li2O and 5.0 % Li2O, and 3 other samples grading between 1 % Li2O and 3 % Li2O. The other samples returned anomalous lithium values below 1% Li2O.

Metals Tech Sauvolles

The old geological survey of Canada has anomolous lithium assays from grab samples that trend towards their project. Lots of pegmatites, though unknown if any of them contain lithium. Needless to say it's really early days here. The stars aren't even lithium occurances, just targets.

Full Disclosure

As of the time of this writing I have a small position in Comet Lithium for the management team and the small market cap. I also have a small position in Midland because I like the project generator model and think both their Galinée and Elrond projects have real potential and somebody else gets to foot the bill to drill them out.