Cheap Electrons - First Solar $FSLR

Introduction

I'm want to be long cheap electrons. I think First Solar is the cheapest source of cheap electrons.

First Solar is a technologically differentiated company with decades of growth ahead of it. It is also the only non-Chinese solar panel manufacturer still standing, which allows it to price its panels at a premium due to lower risk of supply disruption.

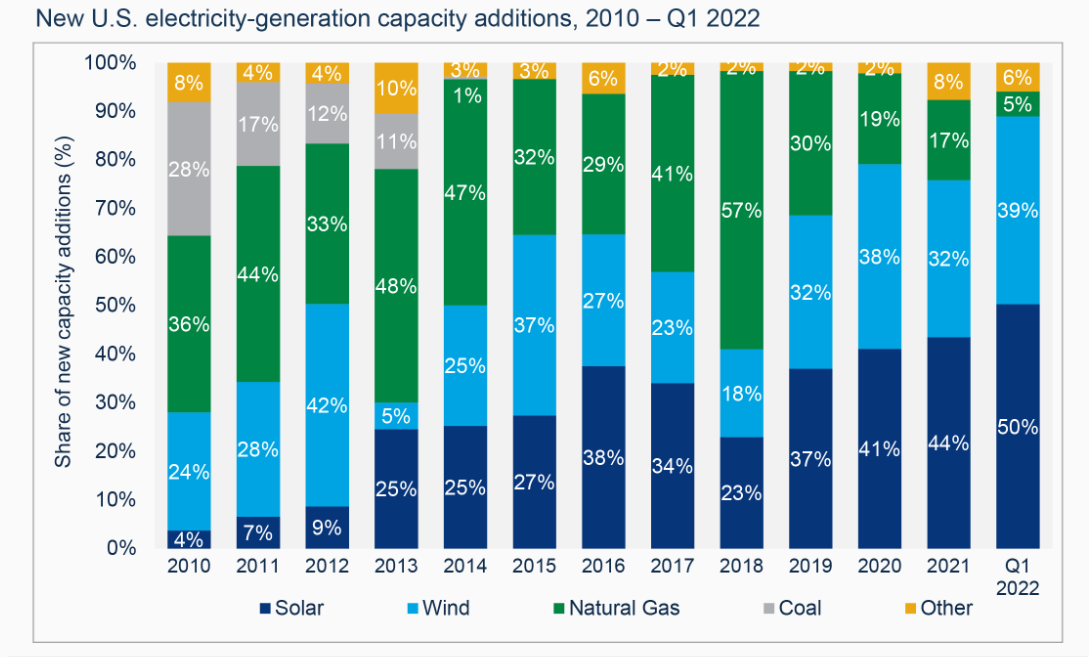

We have reached a tipping point with solar where the cost is below all other sources of electricity and the industry is only constrained by production capacity. If you ask one of the credit card companies who their competition is they don't say American Express, Visa, Mastercard. They say cash. Similarly solar competition is coal & natural gas. I think we are in an energy crisis and that benefits cheap electrons.

Instacart & HEB

There is a concept of path dependence. I think this concept is laid out well with two companies, Instacart and HEB. It's super convenient to not have to go to the grocery store and wander the isles looking for everything you need. It's much nicer if you can use your laptop or your smartphone that remembers all the things you like to eat and have them show up on your doorstep. Grocery delivery.

What's the best way to build such a grocery delivery service? You leverage existing infrastructure with as little investment as possible. Instacart did this. They didn't buy delivery vans or build warehouses, they just offered some college students a few bucks if they'd run around existing grocery stores and grab the stuff and go drop it on your doorstep.

Silicon solar is the Instacart of solar panel manufacturing. They leveraged all the infrastructure of silicon semiconductors from computer chips. There were already companies making silicon ingots and wafers for computers so they started out re-using those. It gave them the ability to start quickly and cheaply. Over time they were able to get cheaper "solar grade" silicon ingots and make other improvements as their industry grew. Despite the improvements, silicon is not where you would start for solar power if you were starting with a blank sheet of paper. It's where you happen to start because it is easy to start there. But it sets you on a path that runs into a ceiling later on.

Instacart is running into a ceiling in grocery delivery. They don't know what is actually in stock at your grocery store. It's not very efficient to have a single driver drive to a grocery store, pick up the items for one person at a time, and drive to one person's house.

HEB, the regional grocery store chain, on the other hand can have someone walk around their store picking up items for a dozen people's orders at once, so instead of 12 different trips through the bread isle they make one trip through the bread isle and grab bread for 12 different people. They also know what they have in stock because they manage the inventory system. They can send delivery drivers out with multiple orders all destined for the same neighborhood. They have inherent advantages at scale that Instacart simply cannot replicate.

First Solar is the HEB of solar. They had to build all this manufacturing knowledge and technology research from scratch without leveraging existing infrastructure from an unrelated industry. Importantly, they started out with the end state in mind. They chose CdTe because it has better physics to produce electricity from the sun, not because anybody was already manufacturing it for another purpose. They chose thin film depositing because it was faster and used less material and thus was cheaper, not because it had a higher purity and lower defect rate for miniturized transistors in desktop CPUs.

The Instacarts and Silicon solars of the world are faster out of the gate, but if the HEB's and First Solar's can stick around long enough they have a much higher ceiling and a lot more staying power due to defensible advantages that build over time. They have a rougher go of it early until they get to scale and their bigger upfront investment starts to pay off.

Technology Differentiation

First Solar Panels have energy payback time of 4 months, a roughly 90x energy payback over the warrantied 30 year lifetime. Energy payback is about 2x better than silicon panels. Lower water and carbon footprints as well.

30 year warrantied power output degradation rate of 2% in the first year and 0.3% per year for the next 29 years. That is 89.3% of original power output at 30 years. Plans to improve further to 0.2% per year by replacing copper (Cu) with semiconductor doping in the copper removal (CuRe) program. That would be 92.2% of original power output at 30 years.

Better production in hot and/or humid climates means a better real-world energy yield advantage in central latitudes.

Thin film depositing means high yield scalable low cost manufacturing using 2% of the semiconductor material compared to silicon solar panels.

Recycling of panels recovers 90% of the glass and 90% of the semiconductor material. Only solar module manufacturer with in-house recycling capabilities.

Current technology best module area efficiency of 19.7%. Targeting mid-term multi-junction efficiency of 25%. History of executing on technology roadmap and of developing new technologies on commercial scale equipment to transfer research to production quickly.

Financial Strength

First Solar's low cost manufacturing position has allowed them to maintain a very good financial position, $1.8 billion in cash as of this writing. This allows them a lower cost of capital than other manufacturers. It also lets them sign long term supply contracts with large companies that other manufacturers cannot.

Non-China manufacturing in Vietnam, Malaysia, Ohio USA, and soon India. This gives advantages to access markets with reduced shipping costs and avoiding tarrifs compared to China based manufacturers.

Growing Market

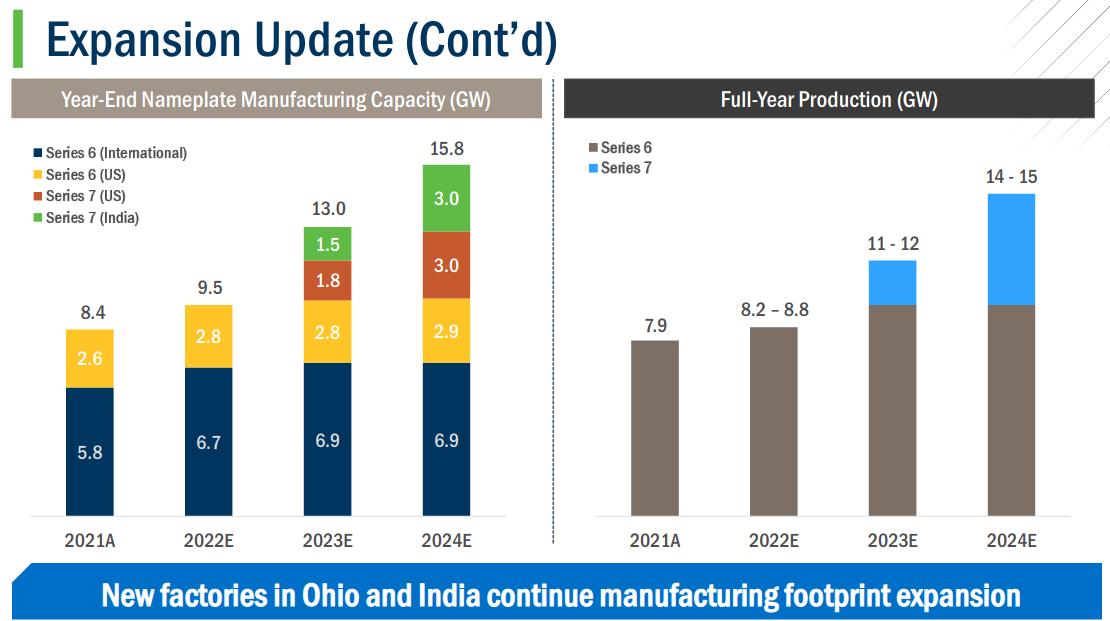

First Solar is set to double manufacturing capacity and production in 4 years.

Solar Cost Learning Curve

This NREL government report from early 2021 sums up what has been happening in solar systems. The costs have gone from $4.75/Wdc in 2010 to $0.94/Wdc in 2020. That is an 80% cost decline, or about 15% per year compounded. That's why solar has become popular.

Other sources put the 2020 Levelized Cost of Electricity (LCOE) for solar at $0.034/kWh. You can see some estimates of the learning curve based on market size in this study.

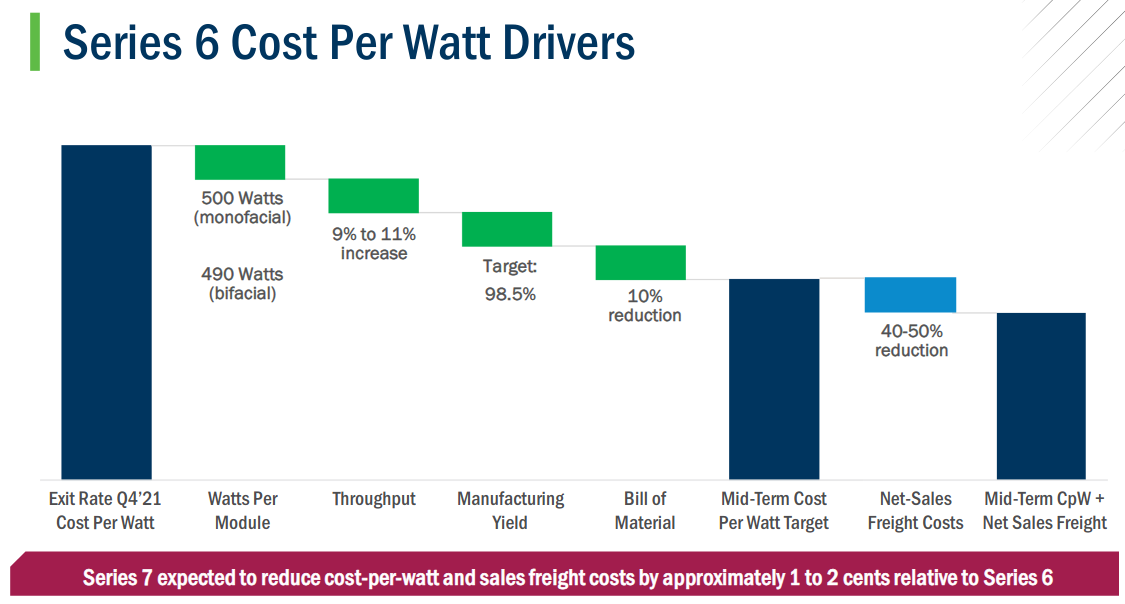

At the micro level you can start to see how First solar drives cost savings. Increasing watts per module from incremental technology improvements, throughput improvements in manufacturing equipment, yield improvements from manufacturing learnings, adding more manufacturing locations to ship modules closer to their end markets, etc.

The Competition

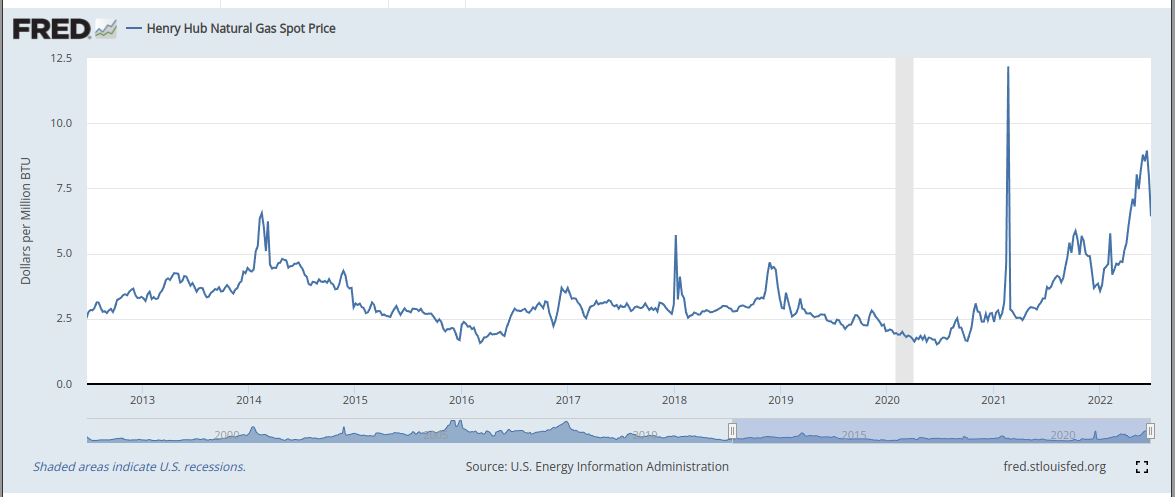

Ignoring environmental considerations when the cost of electricity from competitive sources goes up solar becomes relatively more attractive. For none of the major sources of electricity has the price lower than it was a decade ago.

Newcastle Coal futures.

Henry Hub Natural Gas Spot Price

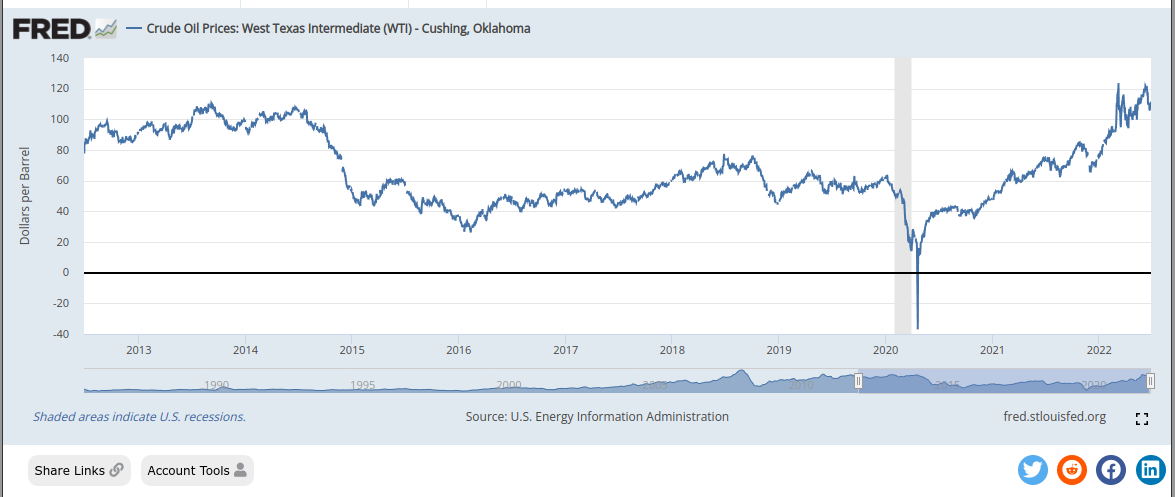

WTI Crude Oil

Imagine you own a natural gas power plant. If you pair that with a solar power plant the fuel savings by not running the natural gas power plant when it is sunny would pay for the solar plant. By owning both you just made your natural gas power plant more profitable. You also retain the option to run both at once if say it is sunny but not windy.

Coal becomes a little disadvantaged in this scenario because it takes a lot longer to turn a coal power plant on or off than a natural gas power plant. It also favors natural gas turbine plants over natural gas combined cycle plants because of lower capital costs and faster on/off cycling.

Valuation

First Solar's margins have been highly cyclical due to compeitive pricing in the industry. If we look at EBIT margins over the 4 year period 2017-2022 they averaged 7.7%. I calculate their return on capital as 7.7% over that 4 year period as well.

If you look at their production doubling in 4 years that is a 19% per year compounding growth. If you assume historical 15% per year price decline that is a net 5% revenue growth per year. There's no way to slice that slow growth and low margins against todays multiples and say it will be a great investment.

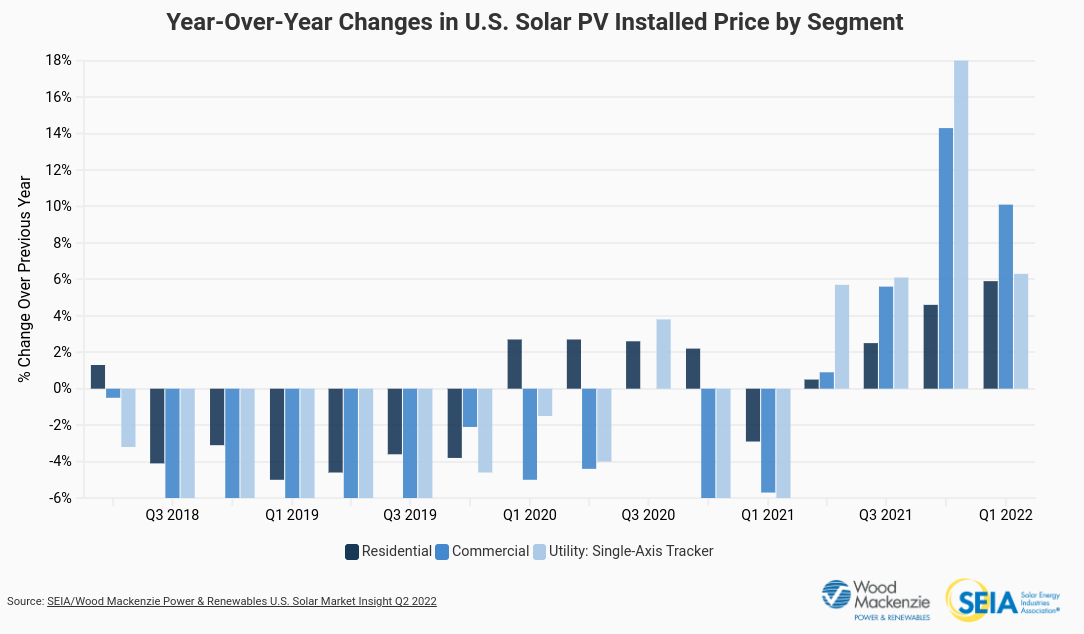

Let's look at the year over year price change for the last 4 years.

| year | percent change |

|---|---|

| Q122 | +6% |

| Q121 | -6% |

| Q120 | -1.7% |

| Q119 | -6% |

The geometric average is around -2% over those 4 years. We can also look at the 3 year period in the NREL data from 2017-2020. Price declined 13% over 3 years. that's just under 4% per year.

So, what happens if we increase on EBIT margins from 7.7% to 10% and put our sales price declines at -6% instead of -15%? If costs are still declining but solar has crossed the tipping point where utilities want as much as they can buy this seems reasonable.

Revenue per share last 12 months was $23.27. If capacity doubles in 4 years, 19% per year capacity growth, and prices go down 6% a year then

(1+0.19-.06)^4 * $23.27 = $37.94/share revenue

Assume a 10% EBIT margin.

$3.79/share earnings in 2026. 20x P/E multiple = $75.80. First Solar trades at $67.96 today.

To really get to a positive investment case you really have to project continued strong pricing (flat to increased prices would do) and declining costs leading to improved margins and return on capital.

Grid Storage

One of the main attacks against solar is that it doesn't produce power when it is cloudy or at night. I think this study should be required reading.

This chart show the decrease in cost of lithium batteries by year, by the size of the market, and by patent activity. These types of cost learning curves are driven by several factors. Over time we just get better at operations from experience and fine tuning. As we scale we get efficiencies. As the market grows the amount of research funding grows and the technology improvements can continue to drive down costs. Costs are declining at 13% per year, 20% per doubling of market size, or 40% per doubling of patent activity. Those cost declines compound so in 5 years you can expect a 50% cost decrease, if the market doubles 5 times (32x growth) you get a 68% cost decrease, if patent activity doubles 5 times (32x growth) you get a 93% cost decrease. Grid storage and automotive battery technology are sharing this cost decline from market size growth and research and together the total addressable market is absolutely huge.

The price declines in lithium batteries has continued on a predictable march downward. As the price of solar + storage is cheaper than other electric generation we stop needing baseload power and start needing backup power and regional transmission.

Grid Storage Raw Materials

One criticism I often hear is that there aren't enough raw materials. I think there are. Here's why.

The leading chemistry right now for grid storage is Lithium Iron Phosphate (LFP). Iron is cheap and abundant. So let's talk about Lithium.

There is a lot of lithium in the world. Currently hard rock lithium spodumene aka lithium aluminosilicate LiAl(SiO3)2 is mined from pegmatites. The other major source of lithium is from brines containing lithium chloride LiCl extracted via evaporation ponds in deserts, largely the Atacama desert. There are many new hard rock projects in development in places like Canada, and new brine evaporation projects in development in places like Argentina. However, beyond these two current sources of lithium there are multiple technologies proven to work at pilot scale that will be entering commercial operation in the near future.

Lithium Clays, also known as lithium sediments, are essentially lithium brines that have dried up. Thacker Pass in the US and Sonora in Mexico have shown extraction to be economic at pilot scale plants and are on their way to becoming commercial operations. These deposits tend to be very large, at or near surface, free digging requiring no blasting, and relatively uniform. However, because clays naturally compact in a way that makes it hard for water to move through them leaching lithium requires some extra processing.

Lepidolite is a lithium bearing hard rock that isn't mined today because it can't be processed. It is relatively abundant and even some current lithium hard rock mines move it as waste while mining pegmatites. Lepidico has demonstrated at a pilot scale plant that it can be economically exctracted. They are proceeding towards commercial production.

Lithium Brines that occur in places that aren't deserts and thus aren't suitable for evaporation ponds, or that occur at lower lithium concentrations still contain a lot of lithium. Direct Lithium Extraction (DLE) is any process that removes lithium from brines without evaporation ponds. Usually the water stripped of its lithium is then re-injected back into the aquifer, making it friendly to the environment. There are three main

Companies like Standard Lithium and E3 are pursuing Adsorption where a material that binds to lithium ions is mixed with lithium bearing brine and then physically separated. The material is then stripped of the lithium and recycled to be used again. Over several cycles the adsorption material breaks down and is replaced. The extracted Lithium Chloride is then processed into Lithium Carbonate or Lithium Hydroxide. Of the two companies Standard Lithium has a higher concentration resource, more proven partners, and is farther along in adapting their pilot plant for commercial scale.

Companies like Lilac Solutions are pursuing ion exchange. Much like Adsorption a material is mixed with the lithium containing water. How it differs is that an ion is swapped, so for example a hydrogen ion H+ might swap with a lithium ion Li+ leaving HCl in the brine instead of LiCl.

EnergyX is pursing an ion transport material that when electrically charged with a small voltage selectively transports lithium ions. They have demonstrated the technology at pilot scale.

Full Disclosure

I had held a position in First Solar $FSLR, but while writing this article I realized the investment case was not as good as some of the other things I'm seeing in the market. I liquidated my position and will follow First Solar. I'm now looking for either share price decline or improving margins or other catalysts before re-entering.