Valuing Royalty Companies - Triple Flag

One point is an anecdote, two points is a line, and three points is a series. This is my third article on valuing royalty companies, which makes this now a series on royalty investing. The format so far has been some discussion on valuing royalty companies and then a deeper dive on a particular company.

Part 1:

Part 2:

Why Royalty Companies

Here at Latin Mines I tend to take a barbell approach to investing in precious metals. On the small position size high risk side I'll invest in junior exploration companies. These are generally high risk companies with potential high reward. Sometimes I'll talk about ways to look for lower risk or increased reward in the exploration sector, but that's not the topic for today.

Today we are talking about the other end of the barbell. Precious metal royalty companies. Some other investors might say that the safer end of the barbell for precious metals is physical metal or the cashflowing major producers. I'll take royalty companies every time.

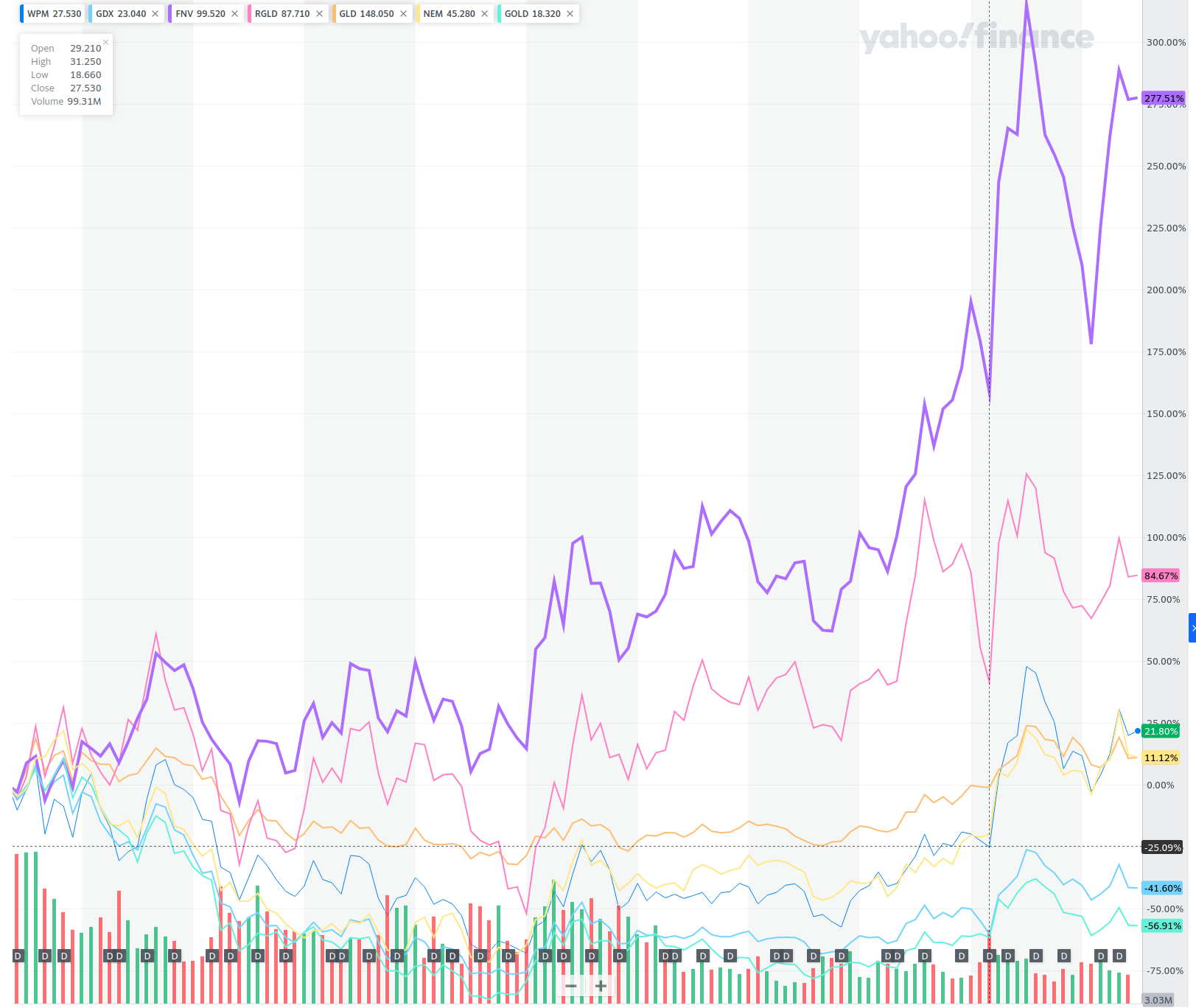

In the above chart I looked at several gold related investments for the last 10 years. There are three royalty/streaming companies that pioneered the industry. Franco Nevada ($FNV), which runs away with the return title over basically any timeframe, in the timeframe of the above chart they are +277.51%. In second and third are Royal Gold ($RGLD) at 84.67% and Wheaton Precious ($WPM) at 21.8%.

The $GDX etf, which is an index that tracks the larger gold miners was -41.6% over the time-frame. Gold itself as tracked by the $GLD etf was +11.12% during the period.

So what explains this data? Gold prices fluctuate depending on supply and demand. The price is pretty volatile as measured in US dollars but is also pretty volatile measured in things you would like to trade gold for like big mac burgers or lake houses.

The miners when gold prices are low have a lot of fixed costs and already spent money. As gold prices go lower mines often continue to operate even if they lose money on a long term accounting basis or even on a short term cashflow basis. As they lose enough money mines will eventually get shut down. This results in lower gold prices moving gold mining company stock much lower than the gold price declined.

Gold streaming/royalty companies can weather low gold prices much better. They do make less money, and their stock price generally goes down, but they have incredibly low fixed costs so they generally continue to have positive cash flow and no financial stress. In fact, in low gold price environments miners often turn to streaming/royalty companies for cash and deals are made on terms that are very favorable to the streaming/royalty companies.

The cash that royalty companies make in high commodity price environments is mostly made from deals struck in low commodity price environments.

In high gold price environments miners start making lots of money and their stock price goes up more than the price of gold went up. But royalty companies also benefit in two ways. The first way they benefit is that their revenue goes up proportional to the price of gold going up. The second way is that miners often increase production and exploration. Increased production increases royalty companies current revenue without any additional cost. Increased exploration increases future revenue without any additional cost.

Royalty Company Investment Strategy

A very sane strategy would be to invest 1/3 of your precious metals royalty portfolio in each of Franco Nevada ($FNV), Wheaton Precious ($WPM), and Royal Gold ($RGLD) and be done. You'd be well diversified across a huge number of assets with good management teams, low overhead, and low cost of capital for reinvestment.

I am not invested in any of the big 3. Why? Simply put they are not cheap. I'm not the only one that has figured out that they are well run great companies. Looking at a stock price to net asset value or stock price to cash flow they just aren't the kind of bargain I'm looking for in a portfolio that I'm trying to set up to outperform.

I'm willing to take a little more risk to buy assets cheaper or assets with more growth potential. Instead of looking to buy Franco Nevada after they've had an amazing run and have become boring and stable I'm looking to buy the next Franco Nevada while they are still cheap with tremendous upside.

Triple Flag

Triple flag was a private company that did an IPO on the Toronto Stock Exchange May 26th. One month later they are trading below their IPO price with a market cap of $2.3B CAD, probably more to do with the price of gold than anything company specific.

Looking at the assets (below) I think Triple Flag trades at about half the valuation of its peers in the streaming/royalty space. I also think the quality of those assets are higher overall than many peers. If the valuation simply re-rates to be inline with peers the stock would be a double. This is the primary reason I have, at the time of this writing, personally invested in a long position purchased in the open market (said for full disclosure, please do your own research and don't blindly follow me into trades).

Looking ahead there are likely to be three non-business events that investors should be aware of the potential impact on the stock price.

One potential future event is that Triple Flag will likely do a secondary US listing to give access to US based retail traders. Most companies of a certain size on the TSX exchange do a NYSE American aka AMEX listing. Prior to this US based investors can only trade on the over the counter (OTC) stock exchange, which is less regulated and for many accounts less available. I can't even find triple flag on the OTC exchange. Investors at Robinhood or E*Trade can't buy $TFPM.TO. E*Trade investors can buy OTC stocks (whenever Triple flag trades on OTC) but Robinhood investors can't.

Another potential future event is index inclusion in the $GDX or $GDXJ. Despite having a diversified portfolio and a $2.3B CAD market cap. It's unclear if there is enough trading volume or float for inclusion, so this may happen after the lock-up period expires.

The other potential future event is the lock-up period expiration 180 days after IPO. By my math that is towards the end of November 2021. Lots of investors and employees may want to lock in some profits, buy a house, buy a car, fund their kids college accounts, etc. Traders may affect the stock price leading up to this as they look at shorting or trading options ahead of the lock-up expiration.

The Assets

| Project | Value |

|---|---|

| Northparkes | $1722m |

| Cerro Lindo | $227m |

| RBPLAT PGM Operations | $575m |

| Fosterville | $161m |

| Burticá | $173m |

| Young-Davidson | $96m |

| Altan Tsagaan Ovoo | $22m |

| Pumpkin Hollow | $544m |

| Gunnison | $25m |

| Eagle River | $5m |

| Dargues | $25m |

| Hemlo | $9m |

| Stawell | $5m |

| Renard | $17m |

| Tamarack | $2m |

| Kemess | $14m |

| Henty | $17m |

| GJ | $1m |

| Polo Sur | $50m |

| Buffalo Valley | $4m |

| Eastern Borosi | $4m |

| Hosco-Heva | $1m |

| --- | --- |

| Total | $3695m |

Asset Discussion

I analysed their top 22 assets. The company had about 15 producing and 60 in development or exploration. There are a lot of good jurisdictions and high quality assets with exploration upside. If you take their current market cap of $2.3B CAD that's around $1.86B USD, which puts them as trading at about half of my back of the napkin level analysis of their top 20 assets.

The only downside I'd say is that their non-producing exploration portfolio is a little thin. In my view this is more than made up for by their exploration potential on several producing assets that is likely to result in resource replacement going forward.

Northparkes

Lowest quartile cash costs, tier 1 jurisdiction of Australia, huge 1060 km2 stream area, right of first refusal on new streams, limited drilling below 200m, 18% plant capacity upgrade in progress. I'd rather it was a royalty than a stream, but there is a lot to like about this cornerstone asset.

M&I of AuEq stream oz = $1,722m

Cerro Lindo

Peru is generally considered a tier 2 jurisdiction with lots of active producing mines. But there has been some instability with the new president during the campaign promising to impose an excessive mining tax. The congress is still right leaning but we'll call is a tier 2b jurisdiction with a negative outlook.

The project itself had 107km of diamond drilling in 2019, but Triple Flag's 69 km2 stream license covers approximately half the mining license, though their stream does include the entire current mine resource.

$227m value on current M&I stream oz.

RBPLAT PGM Operations

South Africa has a long history of mining, so I'd call it a tier 2a type jurisdiction, some might even call it tier 1, but I'd rather have a mine in Australia, Canada, or Nevada.

There's limited exploration upside on this one. The stream area doesn't even cover several existing or proposed shafts. But despite that resources and reserves are being replaced faster than they are being mined. Currently in this rule of thumb level asset valuation we aren't upgrading or downgrading producting assets valuation on exploration upside, cost curve location, jurisdiction, acreage, etc.

$575m m&i stream ounces.

Fosterville

Lowest quartile cost mine, tier 1 jurisdiction of Victoria Australia, great operator in Kirland Lake Gold, straightfoward 2% NSR royalty, 152km drilling in 2019, etc. Lot of inferred and exploration replacement of resource and reserve.

$161m on M&I royalty oz.

Burticá

Triple Flag paid $100m. They have a silver stream covering 755 km2. Zijin is a major miner. I'd rather have a mine in Columbia than Peru or Chile right now. Lots of inferred, more than M&I.

$173m on M&I stream oz.

Young Davidson

Canada! It's a nice operating mine from a nice mid-tier operator. While they have replaced some ounces the resource is being depleted faster than it is being expanded. That may just be because they have plenty of resources for mine operations for the next several years, or it may be there is limited exploration upside. Straightfoward 1.5% NSR royalty.

$96m on M&I royalty oz.

Altan Tsagaan Ovoo

Mongolia isn't a super amazing jurisdiction, but it is improving. Steppe Gold is also a more Mongolian company with lots of Mongolian management and even a secondary listing on the Mongolian stock exchange and some local Mongolian ownership. They are transitioning from easy near surface oxide heap leach to processing sulfides, which is a big step up in complexity. That said, gold is gold.

$22m on M&I stream ounces.

Pumpkin Hollow

A stream on one area, a royalty on another. Production started but not fully ramped. Nevada is a great tier 1 jurisdiction and the timing is perfect for a copper project with high copper prices.

M&I stream/royalty ounces $544m

Gunnison

Arizona is a Tier 1 jurisdiction. But I just don't like this project. In-situ extraction of copper is very unproven. Crux wrote two articles covering this project, and they aren't very positive. Risks in Adopting New Mining Technologies: Excelsior Mining and Interpreting Drill Results: New Found Gold and Excelsior Mining Update . I'm discounting the project 75% and would discount it more except it might get bailed out by high copper prices.

M&I if successfully in production $274m

Value discounted to 25% chance $68m

Eagle River

Super old mine running on fumes and a small royalty. But it's in Canada and cash flowing.

$5m M&I royalty oz.

Dargues

Australia ramping up. Got sold during ramp up, so there's clearly some issues going on here though it may have just been the previous owner was strapped for cash. But the process plant is fully operational and lots of ore is being consistently mined every month. New extensional drilling defining good gold beyond current resource.

$25m M&I royalty oz counting ramp up as production now.

Hemlo

Hemlo is a tier 1 mine in a tier 1 jurisdiction (Canada). This is a small royalty on a small part of the mine. Not a lot of exploration upside, but also really really likely to get mined.

$9m on M&I royalty.

Stawell

Australia, small, producing. $5m

Renard

Canadian diamond mine stream. $34m, but I hate diamonds so I'm cutting it 50% arbitrarily to $17m.

Tamarack

Nickel, Copper, Cobalt, PGEs, Gold. Minnesota USA. Development project. Highway and rail run through it.

$19m if in production, but can you name another mine in Minnesota? I can't. Discounting to 10% odds, $2m.

Kemess

It's in Canada. A brownfield project with lots of infrastructure. The owning company successfully operates a mine about 250km away. There's a road but it's so far the camp is mostly fly-in fly out. Parent company is distracted by Kyrgz Republic taking over their Kumtor mine. Economics aren't great at lower metal prices but metal prices are higher now so maybe it will get built.

$286m if in production. Last study from 2016, no funding or construction started. Even at a 5% chance it is worth $14m

Henty

Small mine but in production and a 3% GRR royalty. $17m

GJ

Skeena sold it to Newcrest, who owns the nearby (30km) Red Chris mine. They sold a 30% stake to Imperial who are a joint venture partner in Red Chris. It's a big resource but it doesn't seem to be advancing very quickly at all.

Let's call it $1m.

Polo Sur

Antofagasta as the operator/explorer. Antofagasta Region of Chilie. M&I&I 1657 Mtons at 0.34% copper (Cu) = 5.63Mt Cu. 1% NSR. If it were in production it could be worth $500m at today's spot prices. A good argument could also be made that these types of projects with long life of mine should actually discount the time value of money more. I'll carry it at 10% since it will be a long lead project and may never happen. $50m

Buffalo Valley

418k oz Inferred, acquired by the adjacent active mine. 3% NSR. It's in Nevada. Would be worth $22m if that was all M&I and it was in production. We'll carry it at 20% of that for now. Because gold in Nevada next to operating mine tends to get mined. $4m.

Eastern Borosi

Calibre mining did some drilling on it in 2019, then acquired the outstanding 70% in Aug 2020, bringing their stake to 100% (minus royalty). Calibre is operating a hub and spoke mining operation in Nicaragua. The property is next to Rio Tinto. As of March 15, 2018 it had an Inferred resource of 700k oz Au & 11 Moz Ag. In April 2021 Calibre started a drill program to upgrade the inferred resource to indicated and to expand the resource. One to keep an eye on for sure. 2% NSR

The current resource might be worth $30m in production. The size of the resource could grow. But what are the chances it goes into production? We'll carry this one at 15%. $4m

Hosco-Heva

This property in Quebec hasn't really been drilled since 2013. The Nov 2013 resource had M&I&I of 2.1Moz Au. Helca may be doing a little more exploration drilling to see if they can turn this into a viable project, but it's pretty low key. 0.5% NSR. $18m if in production, we'll carry it at just under 10% of that, $1m.