Home Runs vs Getting On Base

Making it's rounds recently on Mintwit is the Warren Buffet quote.

If I was running $1 million today, or $10 million for that matter, I’d be fully invested. Anyone who says that size does not hurt investment performance is selling. The highest rates of return I’ve ever achieved were in the 1950s. I killed the Dow. You ought to see the numbers. But I was investing peanuts then. It’s a huge structural advantage not to have a lot of money. I think I could make you 50% a year on $1 million. No, I know I could. I guarantee that. - Warren Buffett.

Pythia Capital made a nice joke about it

I then added some joking / not joking commentary

I then got some comments defending that exact investing style that I was making fun of (chasing 10 baggers and instead losing money). So I thought I'd address it in some more depth and a little less flippant.

What Does Hall Of Fame Look Like?

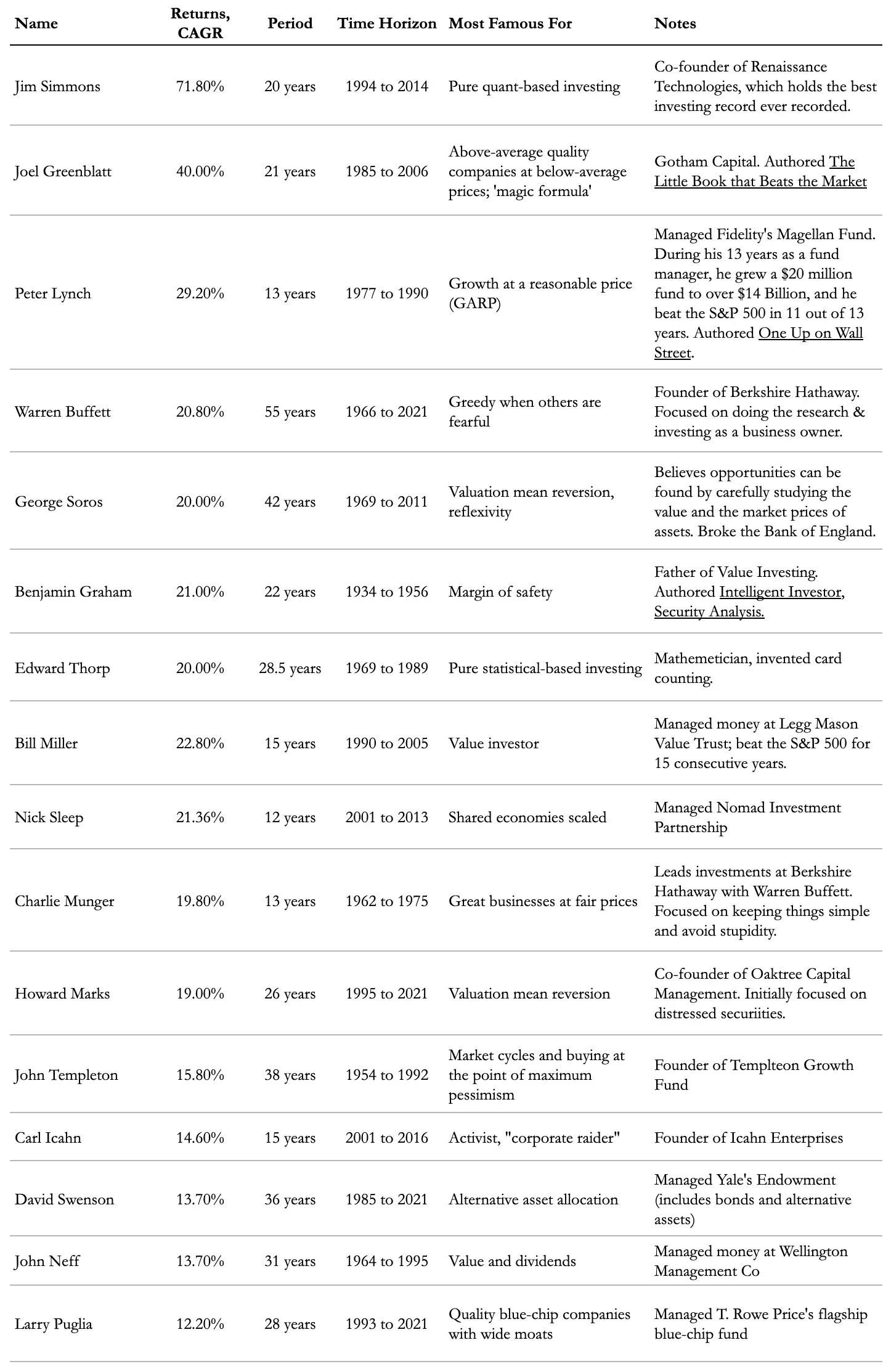

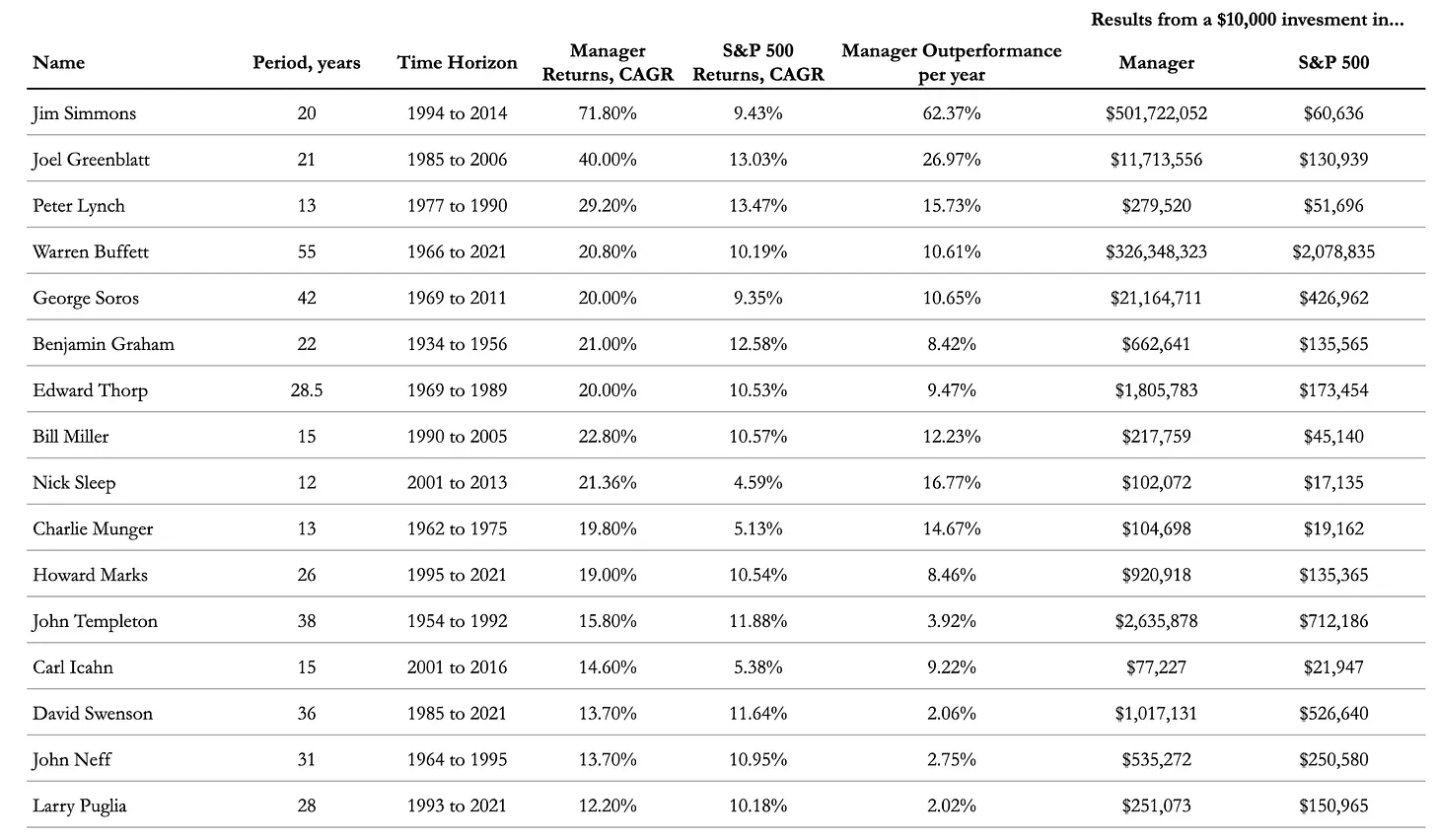

The goal is to grow your wealth as much as possible. The measurement is compound annual growth rate, also known as a geometric mean. Ideally this is net of things like taxes, inflation, fees and opportunity costs.

So, the greatest invsetors of all time not named Renaissance Technologies haven't earned Buffet's 50% number that started this conversion.

I'd be super happy if I could do 20% a year for 20 years and even remotely seriously be able to compare myself to anyone on that list. Heck, if I could outperform the S&P500 by 1% a year or return 10% a year I'd be happy.

But What About Great Bear?

Jan 17, 2017 Great Bear closed at $0.22 a share. Jan 18, 2022 they closed at $28.35. That's a 164% annualized return. It's not just a 10 bagger, it's a 100 bagger in 5 years.

Don’t gamble! Take all your savings and buy some good stock and hold it till it goes up, then sell it. If it don’t go up, don’t buy it. - Will Rogers

All I have to do is pick the winning lottery numbers and buying a lottery ticket is a great investment. -me

I talk about Francis' exploration risk video in this article:

Great Bear is a Tier 1 (>10Moz) discovery. From that article here's some statistics on Tier 1 discoveries in Canada.

63 >10Moz AuEq deposits in Canada. 61,000,000 hectares of mineral claims in Canada. 968,000 heacares of mineral claims per Tier 1 deposit.

Exploration cost estimates for a Tier 1 deposit:

Method 1 - $725m

Method 2 - $320m ($111m if you net out cash generated by divesting smaller deposits.)

Method 3 - $1.55b

Great Bear sold for around $1.4b, which is pretty close to the Method 3 estimation of discovering a Tier 1 deposit in Canada.

I've also noted in that article that in Francis' data set the number of deposits at a given size almost exactly gets cut in half for every doubling of the size. I wrote an article on how this is a power law relationship and looks a lot like the power law relationship in venture capital. I also show how it applies in copper and not just gold.

Moneyball

There's a great book written by one of my favorite non-fiction authors Michael Lewis that was turned into a movie with the dialog written by one of my favorite screenplay writers Aaron Sorkin. If you haven't seen it you should, it's a fun watch.

A big part of the Movie is how Billy Beane adopted a lot of the principles of Bill James' sabermetrics. It's a gross oversimplification but instead of valuing guys who hit home runs (and struck out more) you value guys who get on base.

We can win more games if we value consistency a little more and chase guys that might become stars a little less.

It's worth noting the Red Sox then hired Bill James and used these statistical methods to win the world series.

I think this philosophy sums up what I'm trying to do investment wise. I'm looking for more 10% or 50% annualized returns and less 164% annualized return investments. I'm trying to get on base, not hit home runs.

Great Bear Revisted

Great Bear released drill results from the hinge zone Aug 22, 2018. Two days later on Aug 24, 2018 it traded at $1.73. That was a huge run up from the $0.22 it traded at in Jan 17, 2017. All those pre-discovery shareholders were doing a happy dance.

2.5 years later it was $28.35. That's more than 200% annualized returns AFTER the hinge zone discovery hole and after the resulting runup from the hinge zone discovery hole. The returns AFTER were actually BETTER.

I personally bought too later (well after the discovery hole) and sold too early (well before the acqusition) and still made a very good annualized return on my investment. I also learned from my mistakes.

I bought $NGEX.TO (at the time $NGEX.V) and $AE.V well after the discovery holes and have averaged up buying at higher than initial prices I initiated my position at. I'm sitting on large unrealized gains in both.

I'm not going to 100x these investments. But I like my hit rate and annualized return on the hits on this Tier 1 discoveries in progress strategy.

Revisiting Some Get On Base Strategies

Royalty Companies, Project Generators, Pre-Production Sweet Spot

I've covered these a lot on this blog so I won't beat a dead horse. There are strategies I'm still actively using in my own portfolio.

For precious metals royalty I'm curently focused on potential acquirees in continued industry consolidation. Even if no consolidation happens it will probably still be the case that owning a basket of precious metal royalty companies is probably a decent idea.

I'm increasingly interested in royalty companies outside precious metals.

In project generators I'm increasingly focused on companies that benefit from critical metals flow through financing in Canada and on the quality of management teams.

In pre-production sweet spot I'm more active in looking outside gold projects to any permitted and financed project entering construction or already in construction.

Producers Expanding Capacity

I said earlier this strategy might graduate to the confidence I have in the don't lose your shirt strategies (royalty, project generators, ppss) this year. So far so good on that front. $ERO, $HCC, & $AFM.V are working out well with good unrealized gains and $SGML despite being negative so far is still an investment setup I like.

$LAAC is kind of a special case that is in initial production ramp and doesn't meet the criteria yet (Pastos Grande / Sal de la PUna and Caucharî-Olaroz aren't in construction yet) but the ability to transition to a producer expanding capacity was a big part of the investment case.

Hidden Royalty

$RHI.AX investment is doing fine sitting on 50%+ unrealized gains and $MLAM.PA sitting about flat.

$KLD.V turned their JV equity stake into a royalty and thus could be tracked in either the hidden royalty strategy or the project generator strategy.

Overlay Strategies

Sleep At Night Management

Good management alone isn't enough, but it's a lot. I violated that when I took a started position in Awale and I paid for it. Bad management is enough to overcome a good project. Not all of my good managment companies have been good investments, but they still let me sleep well at night and they have better odds of also being good investments. In reality most companies have just OK managment and if the setup is good that can be good enough.

Commodity Prices

Lithium carbonate at $15k/t isn't enough to bring on new supply needed. Tin at $18,000-$20,000 doesn't work long term either. When the price gets down far enough on the cost curve to mess up supply it's a good time to look at quality producers, royalty, etc. Conversely when lithium carbonate trades at $60,000/t and every project has triple digit IRR it's probably time to step back.

Right now I'm team #tinbaron #manganesemen #lithiumbull where I'm seeking investments in the commodiy because of the price.

Gold, silver, met coal, iron, crude oil, and copper all seem in the reasonable range where I'll opportunistically invest if the right opportunity arises, but am not looking specifically to increase my exposure to the commodity price changes.

I'm bearish nickel due to Indonesia destroying the market by flooding the supply in a way I don't see letting up. I'm also bearish on high-nickel NMC batteries versus other battery chemistries.

I'm vaugely permabearish on lead and zinc as there's just a lot of potential supply out there to respond to any price increases. I'm also bearish lead as automotive starter battery market doesn't have a bright future and other uses of lead are also shrinking due to lead toxcicity.

Summary

Every investor has to recongize their own strengths and weaknesses and invest accordingly. I look at somone like Nate Smith very early on American Eagle or Vukasin Pekovic very early on Awale and if I had their level of insight and conviction I would have a different investing strategy. Those kind of rock stars might be able to hit on 100x investments pre-discovery enough to make it a good strategy for them.

I however am not that guy. I'm more like Ichiro Suzuki with few home runs but a good on base percentage. I gotta play my strengths. More investors should probably play to their own strengths.