Lithium Rocks Hard

I'm going to start out by saying that I am not actually a lithium expert, I'm just a natural resource investor who has been trying to separate the wheat from the chaff in this lithium bubble market. So a lot of this will be a little wrong, do your own dilligence.

TLDR;

This is a followup to my last lithlium article. The key takeaway from that article was:

Less than 100Mt [hard rock] resource or less than 1% Li2O puts a project as a marginal producer. Tier 1 would be at least 200Mt and at least 1.1% Li2O.

Today I want to talk about the marginal producers that are hard rock but are under 1% Li2O, including Lepidolite and Petalite. At the end I'll comment on a few companies.

Battery End Market

Low-Medium End

The battery market is starting to break down into two large camps. The first camp is the low cost batteries. It's worth mentioning the low cost batteries have become good enough to use in the standard range Tesla Model 3, so they are eating quite a lot of the market now. The main chemistry for these is Lithium Iron Phosphate, sometimes abbreviated as LiFe for lithium iron. The grid storage market is also moving largely to Lithium Iron Phosphate to time shift energy from solar and wind.

For reasons I won't get into the lithium in these batteries is Lithium Carbonate. For other reasons I won't get into it is way cheaper to make Lithium Carbonate from lithium brine where the lithium starts as LiCl or sedimentary (clay) lithium which is basically brine without the water.

High End

The high end batteries typically use Nickel and/or Cobalt, which are expensive metals. For example Tesla's 4680 cells are believed to be NCM (Nickel, Cobalt, Manganese) 811 (ratio with 8 being Nickel, 1 being Cobalt, and 1 being Manganese). The lithium is lithium hydroxide.

While you can make lithium hydroxide from brine the processing adds a lot of cost. So most of the lithium carbonate comes from brine and most of the hydroxide comes from hard rock.

Hydroxide vs Carbonate Price

Generally the price for hydroxide has been higher than the price of carbonate there is no particular reason for that to remain true. Hydroxide prices are largely the balance between hard rock supply and high end battery demand. Carbonate prices are largely the balance between brine supply and low end battery demand. If the hydroxide and carbonate markets get too out of balance there can be crossover, but the conversion cost keeps the two markets only loosely coupled.

Spodumene

The chemical formula for pure spodumene is LiAlSi2O6. That gives it a molecular weight of 186.09gm, which is pretty light and makes the Li 3.73% and the Li2O 8.03%. Spodumene is the vast majority of hard rock lithium that makes its way into batteries.

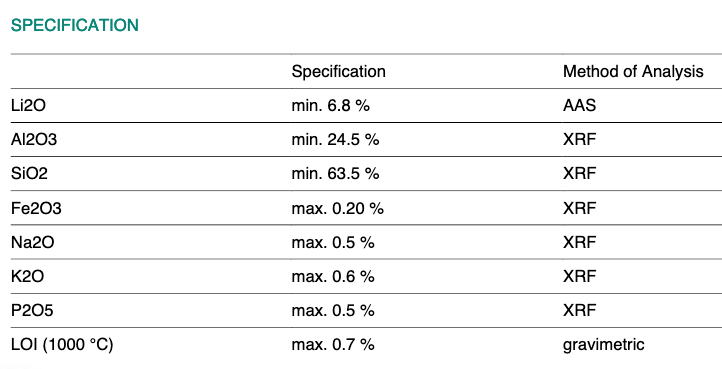

Run of mine ore is typically 1-2% Li2O, so some minimal processing is done at the mine site to separate out a lot of the non-spodumene minerals. This results in a spodumene concentrate that varies from processor to processor, but each will have a minimum of lithium and a max of some particular impurities. Typically the minimum Li2O will be 6-7%.

Here's a spec sheet from Albermarle for example.

https://www.albemarle.com/storage/components/T402209.PDF

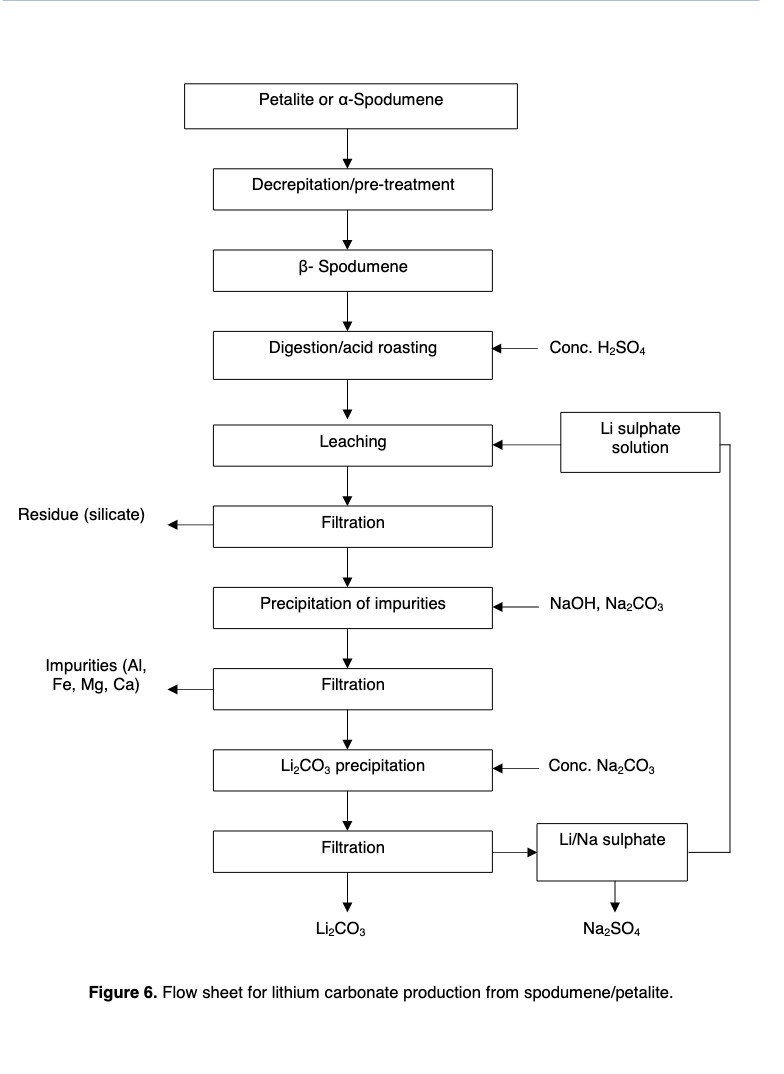

The general process for turning spodumene into lithium carbonate is roasting at high temperatures and then acid digestion with sulphuric acid.

Note that iron is the most hated impurity because the minerals containing iron tend to form clinker (lumps) when roasted. Note also that lepidolite is 12.13% K2O, which means that almost all of the lepidolite will have to be removed from the concentrate to hit spod con specs. Meanwhile, a fair amount of petalite can be mixed into the spodumene and still make specs.

Petalite

The chemical formula for pure petalite is LiAlSi4O10. This gives it a molecular weight of 305.15gm, which is pretty heavy and makes the Li 2.09% and the Li2O 4.5%. It has a little more Silicon and a little more oxygen, but is otherwise the same basic stuff as spodumene.

The flowsheet also looks basically the same.

https://repository.up.ac.za/bitstream/handle/2263/25842/dissertation.pdf?sequence=1

So why is petalite such a small part of the lithium market compared to Spodumene if the processing is nearly identical?

Ton per ton pure petalite has 43% less lithium than a ton of pure spodumene. This gets you at every step. A ton of unprocessed ore will have way less lithium, which means higher mining costs per dollar of revenue. The shipped concentrate will have less lithium, which means higher transportation costs per dollar of revenue. The processing costs per dollar of revenue will be higher because it takes more tons of petalite concentrate to produce the same amount of lithium hydroxide.

This would put petalite mines way at the high end of the cost curve for hard rock lithium mines.

This is why petalite has been very small business. Petalite today is often sold directly into the high temperature glass or ceramics market as they don't need as high of lithium content and there are many petalite deposits with low impurities allowing it to be used with minimal processing. See for example Avalon signing an offtake agreement with a glass-cermaics manufacturer.

The battery grade lithium hydroxide processors also aren't tuned for processing petalite. Thus, while they could theoretically process petalite, as a pratical matter they really can't just switch back and forth between spodumene and petalite. Heck, they can't even switch specs of spodumene supply without a lot of reconfiguration.

As the lithium market continues to grow and mature there are three cases to consider. Petalite as a by-product of spodumene mining, primary petalite mines, and petalite as a by-product of other mining.

Petalite as a by-product of spodumene mining isn't likely to become a distinct concentrate, because it usually occurs in low enough quantities to just be included in the spodumene concentrate.

However, some deposits have a lot of petalite and not a lot of spodumene. I'd expect at some point in the future some processors to use petalite concentrate for blending with spodumene concentrate. Much as different met coal producers blend coals from different mines today. For that to happen the petalite concentrate would need low impurities so that the decrease in Li2O grade is offset by the decrease in impurities and decrease in blended concentrate cost. Petalite concentrate will always cost less than spodumene concentrate due to lower Li2O values. I would never invest in a primary petalite mine as it will likely always be an inferor product to spodumene concentrate and always be a marginal cost producer that either shuts down or loses money in commodity down cycles. But some investors looking for high leverage plays might be interested.

Petalite as a by product of other mining is interesting. It reminds me of what Wheaton did with streaming where they went around to a bunch of base metal mines and said we'll pay for a silver recovery circuit if you agree to sell some of the silver to us below market price. We'll both make more money. The same type of thing could apply here, adding a petalite recovery circuit could produce a salable concentrate and likely the processing costs would be less than the revenue, thus it would improve the profitability of the mine. Today the market for it is immature and small, but as the overall lithium market grows the market for niche products within it could also grow.

Lepidolite

The chemical formula for lepitolite is K(Li,Al)3(Si,Al)4O10(F,OH)2. This gives it a molecular weight of 388gm, but despite the weight the lithium content is pretty high at 3.58% Li, 7.70% Li2O. That's almost as high as spodumene, and way higher than petalite.

In 2021 lepidolite-based lithium carbonate was about 23% of China's total lithium carbonate supply. Let that sink in. 1/4. There is to my knowledge no lepidolite sourced lithium carbonate outside of China.

Of course the grade of pure lepidolite is irrelevant, the real question is what is the grade of an easily produced concentrate? As you can imagine with no commerical lepidolite concentrates outside China information is scarce. Lepidico has 3.23% Li2O. A concentrate from China used in a study had 58.43% lepidolite, which would put its grade as 4.4% Li2O. Both of these numbers are similar to a petalite concentrate in terms of raw lithium, and way below spodumene concentrate.

As the lithium market continues to grow and mature there are three cases to consider. Lepidolite as a by-product of spodumene mining, primary lepidolite mines, and lepidolite as a by-product of other mining.

Lepidolite concentrate as a by-product of spodumene mining is likely to become a real thing. You can't include much lepidolite at all in the spodumene concentrate, which means the waste stream from the spodumene concentrator circuit is likely to have a lot of lepidolite in it. It seems like a no-brainer to recover it into a salable concentrate instead of throwing it away.

Primary lepidolite mines will likely be at a disadvantage to spodumene mines due to the lower lithium content in the concentrate. However, if the market remains in defecit primary lepidolite mines could come on as high cost swing producers.

I dont' know enough about what other non-spodumene ore deposits would have a high concentration of lepidolite to know if it could be a viable concentrate stream from other mines.

Individual Hard Rock Companies Not Spodumene

Let's get weird.

Afritin

Afritin's measured resource is at 0.139% Tin (Sn), which is in current production. For comparison Alphamin has a resource grade of 4.5% Tin (Sn). Afritin also has a lithium resource that is 71.545Mt of 0.63% Li2O, most of that is Petalite. They are not currently processing the petalite, instead is it going to the waste pile when mining tin.

The thought here is that instaed of throwing away the petalite they are already moving they could separate it and concentrate it and sell it. This would reeuce the stripping ratio of the mine and produce a secondary income stream without mining more material. There's still a lot of unanswered questions like how effective will the ore sorter part of the circuit be in practical use? Can they find a reliable offtake partner for the conentrate in this immature lithium market?

Does 1+1 = 3 in this case? Can a marginal tin mine produce a marginal lithium by-product and together turn a profit? It's not an insane thesis, but one I'm not placing any money on myself at the present time.

Lepidico

This is to my knowledge the only company outside China looking at Lepidolite processing. Their Karibib resource is 11.9Mt @ 0.45% Li20, which is underwhelming as a resource. Despite that underwhelming resource they have a 31% IRR at US$12,910/t lithium hydroxide, which is way way way below the current spot price.

Their lepidolite concentrate has a grade of 3.23% Li2O, which is way below the grade of spodumene concentrates and on par with petalite concentrates.

There is a lot of technical risk. The prize isn't the phase 1 plant or the Karibib mine. If the technology works it opens up Lepidico to either process lepidolite concentrate from other mines or to license the processing plant technology to other battery companies. Lepidolite is often found with other lithium minerals like spodumene in pegmatite bodies, thus spodumene mines could produce a secondary lepidolite concentration and convert some of their waste to a revenue stream.

Cornish Lithium

They've licensed Lepidico's technology royalty free and are building a demonstration plant using UK government grant money. Their resource is 51.7Mt @ 0.24% Li2O, mostly lepidolite.

I am mostly following Cornish lithium because of their technology licensed from Lepidico.

Spodumene Hard Rock

Sigma Lithium

82.5Mt resource (M&I+I inclusive of reserves) @ 1.43%. An updated Phase 4 resource is still in progress. They seem likely to eventualy hit the 100Mt hurdle that would put them as a Tier 2 project, though their 1.43% grade is world class.

My definition of supply deficit is that the spot price is above the entire supply cost curve, all producers are profitable. That's where the market is today. In that kind of market a Tier2 size project with Tier1 grade coming online in 2023 is likely to throw off a lot of cash very quickly.

Patriot Battery Metals

I don't know how big this will end up being. I think big is the correct answer. This has the potential to clear 100Mt. For example, Canacord estimated it at 110Mt back in October.

Full Disclosure

I have held positions in Lepidico in the past but do not at the time of this writing. I do have a long position in Sigma Lithium purchased in the public market.