Prospect Generators Part 2 - Net Nets

Thanks For Reading

This blog, and my twitter account is me learning in public. It's embarrassing. I've published 23 posts in just over a year. It's not a coherent theme.

I started out being really interested in Ecuador because I thought it presented a uniquely good investment opportunity. Ecuador still does but it got boring to write about. The federal government is very supportive of mining, there is some localized opposition to mining in places while other locations are very supportive of mining, the courts continue to be unpredictable, and the regulatory capacity of the government continues to be underdeveloped. But it's one of the last places you can find Tier 1 world class porphyries just outcropping at surface. And for most of them there seems to be a path to permit them and build a mine, even if it's a bumpy process. A few projects that sit in ecologically sensative areas that shouldn't have gotten exploration permits in the first place or that are in locations that don't have local support probably won't get built.

I've spent a lot of time talking about royalty companies and thoughts on valuing them. I expect I'll continue to do that because royalty companies are in my opinion the best way to invest in the mining sector.

I'll continue to have some random topics like Lithum (someday there will be a part 2 to follow up my part 1), particular regions, and more.

Prospect Generators

This is sneakily part 2 of Prospect generators because my discussion of option agreements equity vs royalty https://latinmines.com/option-agreements-equity-vs-royalty/ is really about prospect generators.

My hope in this series is to be able to find some tools that can be used to separate the good prospect generator investments from the medicore or poor ones. Prospect generators are the hardest to evaluate because most of the value is in the team and the prospects they will generate in the future. So I'll try to cover some ways to look at the team in future posts. But the assets are interesting as they run the range from newly staked moose pasture all the way through operational mines. So by learning how to value prospect generators assets I am really learning how to value all mining assets.

Quick Overview Of How Prospect Generation Works

The platonic ideal of a prospect generator is that they have a smart team of geologists that go around staking claims or buying claims on the cheap. They then do all the unsexy work that doesn't move markets but gets a project drill ready. This might include grab samples, grid soil samples, geophysics, surface geology mapping, geologic modeling, etc. They build a lot of relationships and expertise to know what ground to stake or buy on the cheap. They build relationships with people at exploration companies and exploration teams at mining companies.

They then sell those projects on to exploration companies or mining companies to drill but retain a stake in the project. The exploration company then pays for all the big exploration costs like drilling and 43-101 or JORC studies and get most of the upside, but the prospect generator still benefits if ultimately something big is found.

Source: Silver Range Resources company presentation

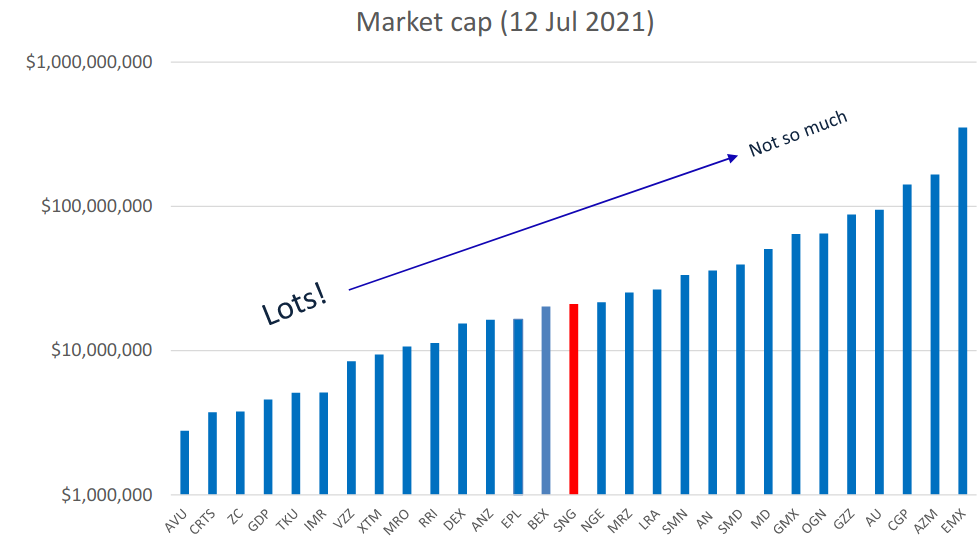

EMX is maturing into a mature royalty company with the larger share of their market cap value coming from producing or under construction royalties. Golden Valley and it's sibling ($GZZ/$VZZ) got taken out by Gold Royalty. But otherwise this chart from Silver Range Resources (itself a prospect generator) is a good summary of the universe of publicly traded royalty companies this article is talking about. By my count that's 26 companies.

I saw a chart once that showed the return of holding a basket of prospect generators vs holding a basket of junior explorers with starting market caps under $50m. The prospect generators clearly outperformed, and it wasn't close. Rick Rule is quoted as owning a large basket of project generators and that the return to that asset class has been far superior for him.

Rick Rule again is quoted as saying that when he was in school they were taught one in three thousand mineralized anomalies become a mine. So in his view a typical exploration company you take a 1:3000 chance for a 10:1 return, which isn't a great deal.

It's also important to understand this model as most exploration companies acquire projects from prospect generators. Other explorers will act like prospect generators for some of their projects when they don't have enough capital to do all the exploration drilling themselves.

Valuation

The intrinsic value of these projects ultimately comes from the cashflow from the mine, but the whole point is that at this stage nobody knows if the prospects will turn into a mine. So valuation is by definition impossible. But that doesn't stop us from trying.

My personal process is to try to value as many assets as I can, sum those all up. I'll call this the hard asset value. I then subtract my calculated hard asset value from the market cap of the company and what's left is the soft asset market cap. I then just have to make a call if I think the soft assets of the company are worth the soft market cap.

So let's dive in to valuing assets, starting with easiest and moving down harder to harder.

Debt

Pure prospect generators shouldn't carry debt. If a pure prospect generator has more debt than cash I would just stop and move on.

But since EMX isn't a pure prospect generator anymore and is part royalty generator and part royalty company they now have debt. I'll value the debt at it's face value, plus the cost of the debt, plus a penalty for the financial pressure it places on a company. So for EMX I might value the debt at -1.2x face value.

Cash

You could make arguments that the cash for prospect generators gets raised in the market and adjust for the cost of capital. You might adjust cash up based on the historic return on cash of the company, or down if you think the company. I'm old fashioned and lazy, a dollar is worth a dollar.

Public Company Stock

Prospect generators often get stock in the company they farm a project out to. I'll just use the current publicly traded price of that stock. This isn't without it's downsides as it's not always possible to sell these illiquid positions and the stock price at this end of the market is very volatile. But unless the stock is worth a huge portion of the prospect generator's value the public market price is good enough.

This sounds simple, but figuring out what stock a prospect generator owns is not a trivial task. In Canada for example they only have to disclose if their position is greater than 10% of the company they hold. Otherwise you are left to whatever the company voluntarily discloses.

Here's a spreadsheet example of Strategic Metal's holdings that I cobbled together as an example. All dollar amounts in the spreadsheet are CAD

Private Company Stock

I default to valuing private company stock at the per share value of the last funding round. If you look at the Strategic Metals spreadhsheet above you can see Terra CO2 and Broden mining valued this way.

However, since funding rounds in private companies are few and far between the value of the company may have dramatically changed since the last round. So you may want to make manual adjustments here. For example in the spreadsheet Broden mining has advanced since the last funding round and is moving towards IPO. Nobody knows what that IPO price will be, but $6 is a reasonable guess. If you plug $6 for the IPO price in instead of $1.50 at the last funding round the value changes from $7.5m to $30m.

Using the conservative last round valuation of Broden at $1.50 per share you end up $1.6m under their market cap. I personally would pay $1.6m for the hard assets we haven't valued yet, let alone the soft assets.

If you value Broden at $3 per share to account for the project advancement since the last funding round you end up around the fully diluted market cap, which would bring in more cash. If you value Broden at a potential $6 per share IPO price the hard assets we've valued so far are a lot more than the market cap basic or diluted of the company. For this company the best use of your time now is to stop valuing further hard assets of the company and go learn as much as you can about Broden mining and it's potential value.

Net-Nets

We haven't even gotten into any deep analysis yet on prospect generators and already we have gotten to interesting results. Ben Graham, the famed value investor, introduced the concept of the net-net where a company was trading below its liquidation value. Net-nets are often known as cigar butts because they might have one last puff as they re-rate or get bought out.

Here's another net-net in the mining sector that isn't a prospect generator. Eros Resources holds publicly traded securities worth, in my opinion, considerably more than its market cap.

Some other things to consider when looking at net-nets. Or why I'm currently holding shares of Strategic Metals and not Eros Resources, though Eros Resources might work out perfectly well.

- Capital Return

- Strategic Metals has had three different share distributions distributing shares in companies to its shareholders valued at around $20m. So it's likely that they will continue to return value to shareholders in a similar manner in the future.

- Eros's capital returns are uncertain

- The collection of other unvalued assets

- Strategic has 11 NSR royalties, 111 wholly-owned properties, 5 joint ventures, 8 under option. We haven't valued these in the blog yet, but they clearly have some value

- The residual value of Eros's other assets seems low to me

- Value of the ongoing business

- Strategic continues to have a good team and generate new projects, that's worth something beyond the value of the assets they already have.

- Eros does have an experienced team, but some of their transactions seem to be related party transactions where interests could be aligned more with the related party company than with minority shareholders.

Disclosure

I'm just a retail investor writing articles to force myself to think through different aspects of my own investing. Nobody pays me for this. My main conflict of interest is that I'd like my investments to do well. This isn't investment advice. I often lose money in investments. Do your own dilligence, consult your investment advisor, and consider that your life may be better if you stop reading this blog and instead invest in index funds and spend your time with friends and family instead of researching obscure investments.

At the time of this writing I own shares in EMX & SMN purchased in the public markets. I have never participated in any bought deals or private placements from any of the companies in this article. I have never received any compensation from any of the companies mentioned in this article. I do not have any warrants or options for any of the companies mentioned in this article.