Electrification Metals & Electric Royalties

Overview

I used to play soccer back in school and one of the first things they teach you is to pass the ball not to where the person is now, but to where they are going to be. Electric Royalties is in the bootstrapping stage. It would be easy to look at their current cashflow from producing royalties (below corporate expenses) or their current divided (no dividend) and be negative. I think that would be a mistake. They are in motion.

Electric mostly own exploration and development stage assets operated by junior companies. This puts it in the uncomfortable position of not having enough short term cashflow. However, they do have a lot of cash in the bank to either add some cashflowing royalties or tide them over until their development royalties start producing.

It's pretty easy to make a case that Electric's cash and the value of Authier, which is fully funded and planned to be in production a year from now, together are worth more than their current market cap (which swings pretty wildly in these turbulent markets), though you have to think that their current burn rate eats into that value a bit, which can be weighted against the value of the rest of their portfolio and their ability to find value creating transactions in the future.

Electrification Metals

The royalty model has been well proven in precious metals like gold and silver. I would also say at this point it has been proven in oil & gas. Both are competitive. The next generation of royalty companies are trying to apply the model to less competitive areas. Deterra and Labrador Iron are two single asset iron royalty companies for example. Trident, Anglo Pacific, Star, & Electric Royalties are among the new groups trying to carve out a path in less competitive areas. Altius has been blazing a path in unique commodities for awhile.

Electrification is appealing because it has good ESG credentials, it is a growth area, doesn't have a lot of competition, and sounds cool. Really, a lot of this is just about marketing royalties in commodities that are less competitive.

Let's discuss some of these metals that Electric Royalties is investing in.

Lithium

It wasn't too long ago that lithium was a specialty chemical. Then the lithium battery was born and the demand for lithium skyrocketed. Most of the early batteries went into portable consumer electronics like iPhones, laptops, or bluetooth speakers. Then Tesla soldered together a bunch of laptop cells and made a convertible electric car, the Tesla roadster. Fast forward a few years later and Elon Musk is one of the richest people in the world and the Tesla Model 3 is everywhere. All the other car manufacturers are scrambling to catch up and release electric car models of their own.

What happened? It turns out that Lithium batteries are following what is known as a cost learning curve. I highly suggest reading this paper which I've also added to the required reading section of this website. For every doubling of production the cost per amount of energy stored goes down 20% (more or less), and when accounting for energy density improvement the cost of a car battery goes down 27% for every doubling of production. You can also view it as a 40% cost decline for every doubling of patent activity. It doesn't take a lot of doublings to really drive costs down. As costs of batteries pass certain thresholds the demand for them skyrockets.

Electric Royalties timed this pretty well. Lithium Carbonate spot prices are up 400% from 2020 levels to around $71k/tonne. A bunch of Electric's Lithium royalties were purchased in 2020. This explains why Electric was able to sell 2/3 of a royalty they paid around $1m for in 2020 and get $4m for it, at a $6m value. 6x (600%) returns in two years are nice.

Typically, I use spot prices when valuing royalties, but I'm not going to when valuing Lithium royalties, why? Because there is lots of lithium in the world. Exponential growth caught the lithium industry flat footed, there simply weren't enough drilled and permitted projects ready to construct. There still aren't. But at some point enough lithium projects work at a $12,000/ton incentive price that projects will get explored, constructed, and come into production. I haven't seen a JORC or 43-101 study that doesn't work at $12,000/ton, leading me to believe that there's probably a lot of potential supply out there at that price eventually, even if there isn't enough of that supply in the next year or two.

Copper

If you've read much of my site you'll know I'm long term bullish on copper. Copper is the second best conductor of electricity behind silver. Nobody is making motor windings or home wiring out of silver, it's too expensive. Aluminum is much cheaper and conducts OK, which is why high voltage lines are made of aluminum wire supported by a steel cable. Most people that can substitute copper for aluminum already have. Historically, the use of copper has grown in line with growth in the economy (gdp). However, there's a lot more copper in an electric car than in a gasoline car. That's true of everything we electrify, there's more copper in the electric version of something than in the gas version.

The problem is most of the copper we get comes from old mines that are running low. There's been a real lack of new copper mines discovered. Short of technology like Jetty making heap-leaching of low grade coopper sulfides economic there is going to be a growing gap between supply and demand on copper that can only be resolved by increasing price.

Nickel/Cobalt

Historically Nickel and Cobalt have been used in steel alloys. However, higher density lithium batteries also use a bit of Nickel and/or Cobalt to help improve energy density. NMC is a current chemistry that uses both. Nickel is cheaper than Cobalt, so most batteries are looking to use less Cobalt and often do so by using more Nickel.

However, the demand for Nickel and Cobalt isn't infinite. Tesla switched their Model 3 standard range all to lithium iron phosphate (LFP), which isn't as energy dense but since iron is much cheaper than nickel or cobalt make it much cheaper.

Back in 2019 a typical price for Nickel might be $14k/ton. Today it is over $23k/ton and briefly peaked over $40k/ton. Back in 2019 a typical price for cobalt might be $30k/ton where today it might be over $70k/ton.

Substitution to LFP and the steel industry's price sensitivity put some downward pressure on Nickel & Cobalt prices.

I'm not investing in Nickel or Cobalt directly myself, but if battery use is the incremental buyer after steel both may remain above 2019 levels going forward, though I am dubious they can sustain early 2022 levels.

Tin

There are a lot of uses for tin, but one of the primary ones is for lead-free solder, which today is almost all solder. As the use of microprocessors grows solder connects components to electronic circuit boards. Tin is a small market but is vital to electrification. Tin is a complicated subject with much production coming from informal or illegal mining that is environmentally damaging in unstable jurisdictions. Much of that informal mining is oceanic alluvial deposits that besides being terrible to mine environmentally are also getting quickly depleted.

Zinc & Vanadium

Let's call a spade a spade. Zinc and Vanadium are not electric metals. They are base metals used primarily in the steel industry.

Zinc has traditionally been used mainly for galvinizing steel to prevent corrosion. That and other industrial uses will continue to be the primary use going forward. Talk of zinc-air batteries is just talk. Doesn't mean it isn't useful, or that it doesn't make a good investment, but it's not an electric metal. Sure, windmill towers need galvinized steel. Steel is a necessary building material, but what percentage of steel is really going to windmill towers?

Vanadium flow batteries also don't seem to be going anywhere, for one thing the round trip efficiency is poor compared to lithium. And while long battery life seems good really what matters is a cost per Wh of storage, and lithium still seems to be better on that metric, with better ability to deliver that power on demand. Vanadium will always be important in steel as an alloy.

Enter Electric Royalties

Year to date Electric royalties $ELEC.V share price is down. Some of that is that copper prices are off, driving the $COPX index down -21%. Freeport $FCX is -29%. Lithium Americas $LAC is -23%. So it's pretty brutal out there for battery metals. That said royalty companies aren't exposed to the price increases and are proportional to, not levered to, the the metal prices, so you'd expect royalty companies to be down less compared to producers and developers.

The CEO has also been out buying shares in the market.

So let's see what we find when we take a closer look.

Assets

| Project | Value USD |

|---|---|

| Authier | $13m |

| Graphmada | $8.9m |

| Cash | $8m |

| Battery Hill | $5m |

| Seymour Lake | $2m |

| MTM | $1.8m |

| Milennium | $1m |

| Cancet | $0.5m |

| Bisset Creek | $0.5m |

| Mont Sorcier | $0 |

| Rana Nickel | $0 |

| Chubb | $0 |

| Bouvier | $0 |

| Sayona East | $0 |

| Sayona West | $0 |

| Mount Dorthy | $0 |

| Cobalt Ridge | $0 |

| Zonia | $0 |

| Sleitat | -$0.5m |

| --- | --- |

| Total | $40.2m |

Cash

Between the pro-forma $4m cash balance and the recent asset sale for $4m they probably have around $8m in cash. Considering their recent market cap is around $23m that's a pretty significant amount.

Middle Tennessee Zinc Mine

Variable 1 to 1.4% GRR zinc royalty. I think it has an annual royalty revenue around $400,000 to Electric. Back in 2018 it had 10 years of resource, so until I see better data I'll assume 6 years of resource remain. NPV8 of that cashflow is $1.8m. If the actual mine life is much longer you could consider a 10x multiple on the cashflow and value it at $4m.

Graphmada

2.5% NSR on a graphite project in Madagascar operating by Greenwing Resources.

There's a large and growing resource of a formerly producing small scale mine that went on care and maintenance for covid and never reopened. They are up to 20.2Mt of resource that contains 890kt of graphite. It's mostly large flake graphite that has been growing about 50% per year. That resource doesn't include the latest round of 3268m of drilling the ended April 13, 2022.

Electric paid $2.9m for this and Yalbra graphite project in May 2021. But they called it a cash flowing royalty at the time, presumably thinking the mine would reopen.

If we assume 890kt of graphite at $800/ton, a 2.5% NSR and discount it 50% for some time value and some risk it won't reopen we get

890000 tons * $800/ton * 0.025 * 0.5 = $8.9m

Bissett Creek

Authier

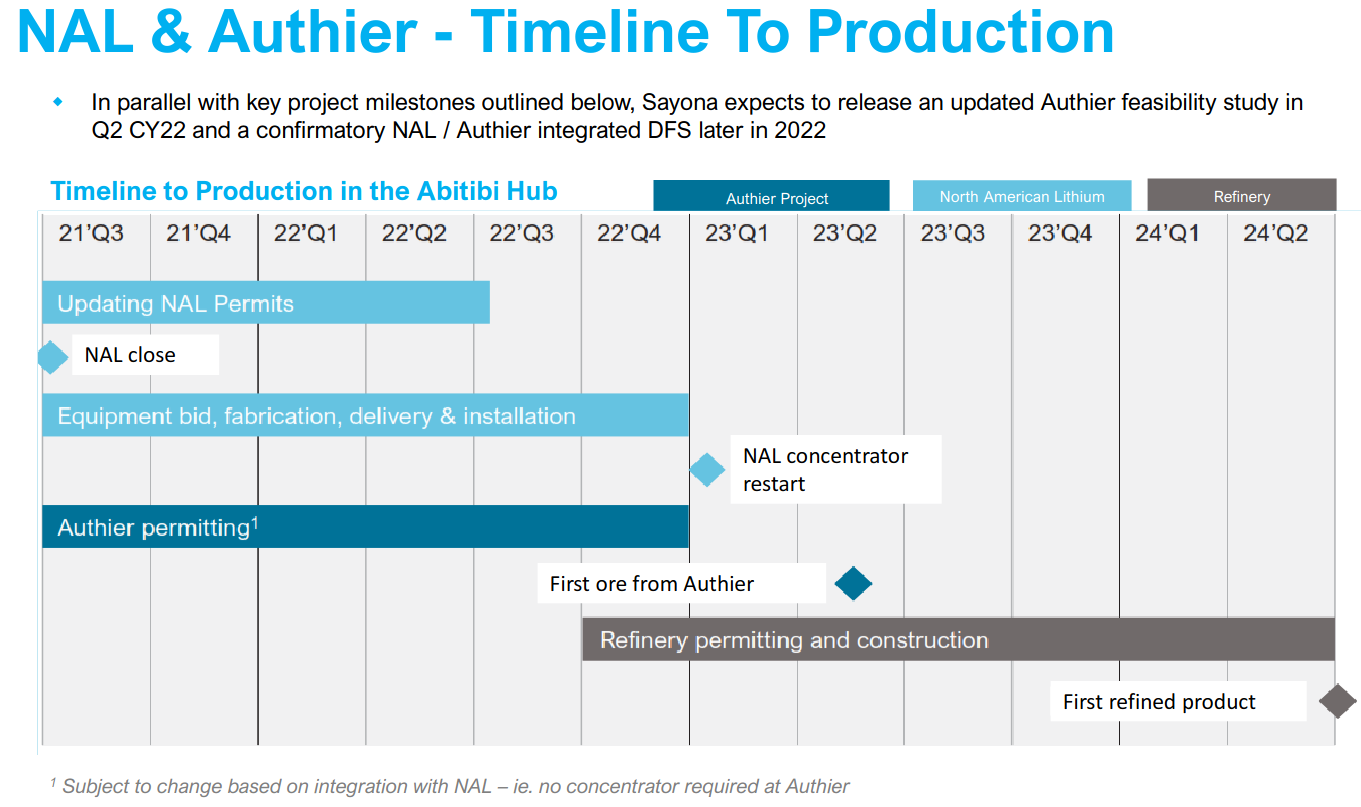

Sayona & Piedmont approved NAL restart targeting 1Q 2023 https://sayonamining.com.au/wp/wp-content/uploads/2022/06/SYA_NAL-restart_28-Jun-22.pdf

They plan to process lithium Authier at NAL, greatly accelerating the timeline and economics: https://sayonamining.com.au/authier-project/

Electric owns a 0.5% GRR on Authier. The DFS had a 33 year mine life, 31,300 TPA, $14,000/t. 31,300 tons * $14,000/t * 0.005 = $2.1m annual income for 33 years.

If you consider their product is spodume the revenue is lower. 114,116 * $2,500/t * 0.005 = $1.4m annual income for 33 years.

I think there's a 90% chance this goes into commercial production. I'll discount it a further 16% assuming the schedule slips and it takes 2 years. We'll use the midpoint of annual income on a 10x multiple.

$17.5m * 0.9 * 0.84 = $13.23m current value.

Battery Hill

25.14Mt manganese M&I, another 27.72 inferred. 2% GRR. Manganese X Energy Corp has a market cap of CAD$34.2m and is looking to build a processing plant to make high purity battery grade Manganese. June 27, 2022 they released a PEA. They have also started development of a pilot plant. The NPV10 is $486m compared to a capital costs of $438m and an after tax IRR of 25%. The price of HPMSM is assumed in the PEA to be $2,900/t.

Those are pretty marginal numbers, but they might be able to be improved in a PFS.

Being conservative we could say a 2% NSR is equivalent to 15% of equity in a producing mine. That would value the royalty at CAD$5m based on Manganese X Energy's market cap. Really with development and construction dilution that's at least CAD$10m.

From the resource side if we give an 80% discount since it's just a PEA stage project with marginal economics:

25,150,00 t HPMSM * $2,900/t HPMSM * 0.02 * 0.2 = $291m. In production that could be worth over $1b, without counting any of the inferred, which could double it.

Projects like this are really hard to value, because so much is tied up in do they go into production or not. It is worth $0 or $1 billion? There's really not a lot of middle ground.

I'll artibrarily call it $5m. That's 1/7th the market cap of Manganese X Energy Corp, which feels about right.

Mont Sorcier

This project is owned by an CAD$11m market cap company and would get 86% of its revenue in its market study from magnetite iron and only 14% from Vanadium.

I don't think this project has legs. $0.

Seymour Lake

They just sold 1% for $4m, implying a $2m value for the remaining 0.5%.

The project itself has a JORC resource of 9.9Mt at 1.04% Li). They are also still expanding the resource through drilling, targeting getting to 22-25Mt. Green Technology Metals has an 80% stake in this as their flagship project and a market cap of AUD$66.8m. If they decide to build this it will increase in value a lot.

Millenium Copper Cobalt

In June Metal Bank Limited did 1500m of RC drilling, with plans to do a phase 2 drilling program after that will be 1000m RC & 600m diamond drilling. It's a 0.5% GRR with option to add 1.5% NSR. A resource update and scoping study are planned for late 2022. The current resource has 5.9Mt @ 1.08CuEq and they have an exploration target of 8-10Mt.

0.005 * 5,900,000 * $10,000/t = $295m value if in production, up to double that if they hit their exploration target.

The problem of course is that it's not likely to get into production. This is the second best project for Metal Bank Limited, an AUD$10m market cap company. The grades are pretty poor and kind of deep for the grade, though some of it does have nice cobalt credits. There is an idled mill 19km away.

With the active drilling and the existing resource I'll carry it at $1m.

Cancet

This project has been passed around a bit. But June 14, 2022 Winsome Resources, the current owner of the project released assays from new drilling. The results were fine. The stock dropped on the assay results, so fine isn't amazing. Still, Winsome has an AUD$26.3m market cap and lists Cancet as their highest ranked project.

1% NSR

Between the equity and the benefit weighted spend of the current drill programs there is some value here, but I don't really know what it is. Call it $0.5m based on nothing in particular.

Rana Nickel Project

Purchased in January 20222 for 2,000,000 shares valued at the time around $750,000 and $100,000, so $850,000 in total.

It has a historic resource remaining of around 32kt of nickel. No real activity on this one. Carrying at $0. Global Energy Metals has a 10% interest and a 1% NSR, the other 90% is owned by a private company that is trying to do a deal with Metals One to IPO on the AIM. Who knows if that will advance.

$0 for now.

Chubb

Chubb is in Quebec, not Newfoundland. Newfoundland Discovery Corp drilled in 2021/2022. One of the upsides is that Sayona & Piedmont are advancing two projects in the district, making this a nearology play. The downside is that the trend for the deposit is lower grades in the shallower intersections and better grades as it dips lower. But even the better intersections are of the average grade of the other resources being developed in the district. The depths also mean a prohibitively high strip ratio.

$0.

Bouvier

The 3 diamond drill holes had either narrow widths (2.7% Li2O 1.5m) or poor grades (.336% Li2O over 16.1m and 0.75% Li2O over 10.1m). For comparison Arthier used a 0.55% cutoff grade, average grade of 1.01%, and a lot of resource in the 1.5-1.75% range.

$0.

Sayona East

Sayona is focused on restarting NAL and bringing Authier online, all other projects are on hold.

$0

Glassville

This is in close proximity to the Battery Hill project, but is not active at all (it's available for option from Globex, a prospect generator).

$0

Sleitat

It's on the map near Bristol Bay and Pebble mine, which means it will be hard to permit. There is no infrastructure, no road and no power. The owner, Cornish Metals, doesn't even mention it in their corporate presentation it's so far down on their list. The last drilling was 2006, the grades are low.

The transaction hasn't closed yet. It's for 1,000,000 shares and $100k. If you value the shares at $0.40 and add the cash it will cost $500k.

Value negative $500k

Yalbra

Buxton Resources is active on the project planning for an infill drill program as of May 2022. But they haven't done any activity on it in many years. It is claimed to be Australia's highest grade graphite project.That said, it's not exactly flying. The last update prior to that was October 2014, 8 years ago. At that time it had 650kt Inferred Graphite. Buxton resources is a AUD$10.5m market cap company with 11 projects, so the market doesn't think much of this project.

We'll give it $0.1m to credit that the company is planning to do some infill drilling.

Mt Dorthy & Cobalt Ridge

Collectively known as the Mount Isa Projects. These seem to be throw ins with Millenium and have no activity as far as I can tell.

$0

Sayona West

Sayona is focused on restarting NAL and bringing Authier online, all other projects are on hold.

$0

Bisset Creek

A 2013 PEA with a 2018 updated sensatitivy analysis. The company would like to finanance putting it into production, but can they? A 1% GRR on a 21 year mine life is great, if it gets into production.

If in production 33,000t * $1,800/t * 0.01 = $594k/yr. 10x multiple $5.9m.

Let's carry it at 10% between chance of getting into production and delay if it does. $500k

Zonia

Not closed yet. 0.5% GRR on a copper asset, with options to buy 0.5% more and up to 1% on a neighboring asset. 2m shares and $1.55m, so call it $2.3m total.

510,000,000 lb Cu * $3.50/lb Cu * 0.005 = $8.9m if in production. But it's PEA stage. That doesn't credit any inferred or the optionality on the adjacent property or the optionality on the additional 0.5% purchase. So maybe a good deal, time will tell.

I'm going to value it at $0 for now because I think it could be worth what they will pay for it, but it's not on the books yet.

Full Disclosure

I have owned shares in Electric royalties in the past, purchased and sold in the public markets. I am not currently a shareholder in Electric Royalties, though I may or may not purchase or sell shares in the future. I have not received compensation from anyone for writing this.